Wisconsin 1 Es Form 2020

What is the Wisconsin 1 Es Form

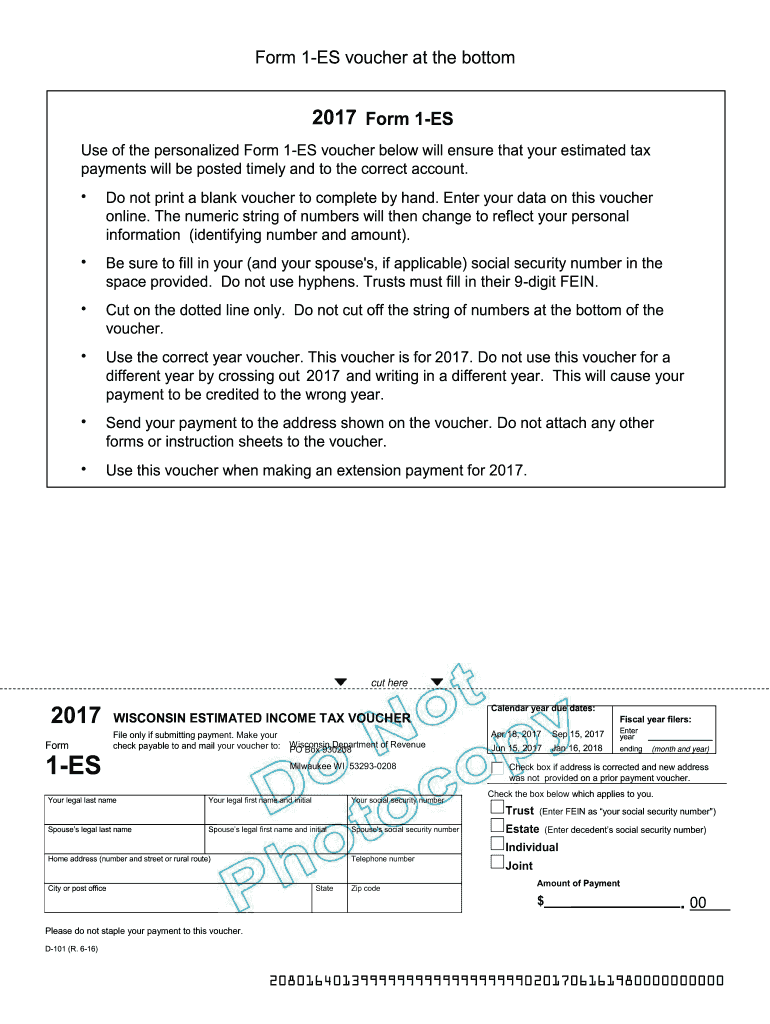

The Wisconsin 1 Es Form is a tax document used primarily for reporting estimated income taxes for individuals and businesses in Wisconsin. This form allows taxpayers to calculate and submit their estimated tax payments throughout the year, ensuring compliance with state tax obligations. It is essential for those who expect to owe tax of a certain amount when filing their annual returns. The form is designed to help taxpayers avoid penalties for underpayment by enabling them to make timely payments based on their projected income.

How to use the Wisconsin 1 Es Form

Using the Wisconsin 1 Es Form involves a few straightforward steps. First, gather all necessary financial information, including income sources, deductions, and credits that may apply. Next, complete the form by entering your estimated income and calculating the corresponding tax liability. It is crucial to ensure accuracy in your calculations to avoid any issues with the Wisconsin Department of Revenue. Once completed, submit the form along with your payment by the specified due dates to maintain compliance and avoid penalties.

Steps to complete the Wisconsin 1 Es Form

Completing the Wisconsin 1 Es Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather documentation: Collect all relevant financial records, including previous tax returns, income statements, and any applicable deductions.

- Estimate income: Calculate your expected income for the year, considering all sources such as wages, business income, and investments.

- Calculate tax liability: Use the Wisconsin tax tables or tax rate schedules to determine your estimated tax based on your projected income.

- Complete the form: Fill out the Wisconsin 1 Es Form accurately, ensuring all figures are correct and reflect your calculations.

- Submit the form: Send the completed form along with your estimated tax payment to the appropriate state office by the deadline.

Legal use of the Wisconsin 1 Es Form

The Wisconsin 1 Es Form is legally binding when completed and submitted according to state regulations. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or audits. The form must be filed by the deadlines set by the Wisconsin Department of Revenue to avoid interest and penalties on unpaid taxes. Understanding the legal implications of this form can help taxpayers navigate their responsibilities and maintain compliance with state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin 1 Es Form are critical to avoid penalties. Typically, estimated tax payments are due quarterly, with specific dates set by the Wisconsin Department of Revenue. These dates generally fall on the 15th of April, June, September, and January of the following year. It is essential to mark these dates on your calendar and ensure that your payments are submitted on time to avoid any unnecessary fees.

Who Issues the Form

The Wisconsin 1 Es Form is issued by the Wisconsin Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. They provide the necessary forms, instructions, and guidelines for completing and submitting the Wisconsin 1 Es Form. Taxpayers can access the form and additional resources directly from the Department of Revenue’s official website or by contacting their office for assistance.

Quick guide on how to complete 2017 wisconsin 1 es form

Complete Wisconsin 1 Es Form seamlessly on any device

Digital document administration has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Manage Wisconsin 1 Es Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to edit and electronically sign Wisconsin 1 Es Form without any hassle

- Locate Wisconsin 1 Es Form and click Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for these tasks.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your updates.

- Choose how you wish to send your form—via email, SMS, or invitation link—or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow efficiently meets your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Wisconsin 1 Es Form and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 wisconsin 1 es form

Create this form in 5 minutes!

How to create an eSignature for the 2017 wisconsin 1 es form

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the Wisconsin 1 Es Form and why is it important?

The Wisconsin 1 Es Form is a crucial document for businesses operating in Wisconsin that need to streamline their eSigning processes. By utilizing airSlate SignNow, you can effortlessly complete the Wisconsin 1 Es Form, ensuring compliance and efficiency in your document management.

-

How can airSlate SignNow help with completing the Wisconsin 1 Es Form?

airSlate SignNow provides an intuitive platform designed for completing the Wisconsin 1 Es Form quickly and easily. With features like drag-and-drop design and automated workflows, you can signNowly reduce the time spent on document signing.

-

What are the pricing options for using airSlate SignNow for the Wisconsin 1 Es Form?

airSlate SignNow offers several pricing plans to accommodate different business needs. Each plan provides access to essential features that help you efficiently manage and eSign the Wisconsin 1 Es Form at a competitive price.

-

Are there any integrations available for airSlate SignNow to support the Wisconsin 1 Es Form?

Yes, airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Salesforce, and Microsoft Office. These integrations simplify the process of managing your documents, including the Wisconsin 1 Es Form, directly from your preferred tools.

-

What benefits does airSlate SignNow offer for eSigning the Wisconsin 1 Es Form?

Using airSlate SignNow for the Wisconsin 1 Es Form offers benefits like enhanced security, reduced turnaround time, and improved accuracy. Our solution ensures that your documents are securely signed and legally binding, helping you maintain compliance.

-

Is airSlate SignNow suitable for both small and large businesses needing the Wisconsin 1 Es Form?

Absolutely! airSlate SignNow caters to businesses of all sizes. Whether you’re a small startup or a large corporation, our platform can support your needs for efficiently handling the Wisconsin 1 Es Form.

-

How do I get started with airSlate SignNow for the Wisconsin 1 Es Form?

Getting started with airSlate SignNow is simple! Sign up for an account, select a pricing plan that suits your needs, and begin creating your Wisconsin 1 Es Form. Our user-friendly interface will guide you through the process effortlessly.

Get more for Wisconsin 1 Es Form

- Publication 4134 rev 9 low income taxpayer clinic list form

- Renewal application for auxiliary grant ag supplemental nutrition assistance program snap form

- Policy exception request formrequestorrequest date

- Salon contract template form

- Salon manager contract template form

- Scaffold contract template form

- Scholarship contract template form

- School attendance contract template 787755248 form

Find out other Wisconsin 1 Es Form

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure