Form 1 ES, Wisconsin Estimated Income Tax Voucher Form 1 ES, Wisconsin Estimated Income Tax Voucher 2020-2026

Understanding the Wisconsin Estimated Income Tax Voucher Form 1 ES

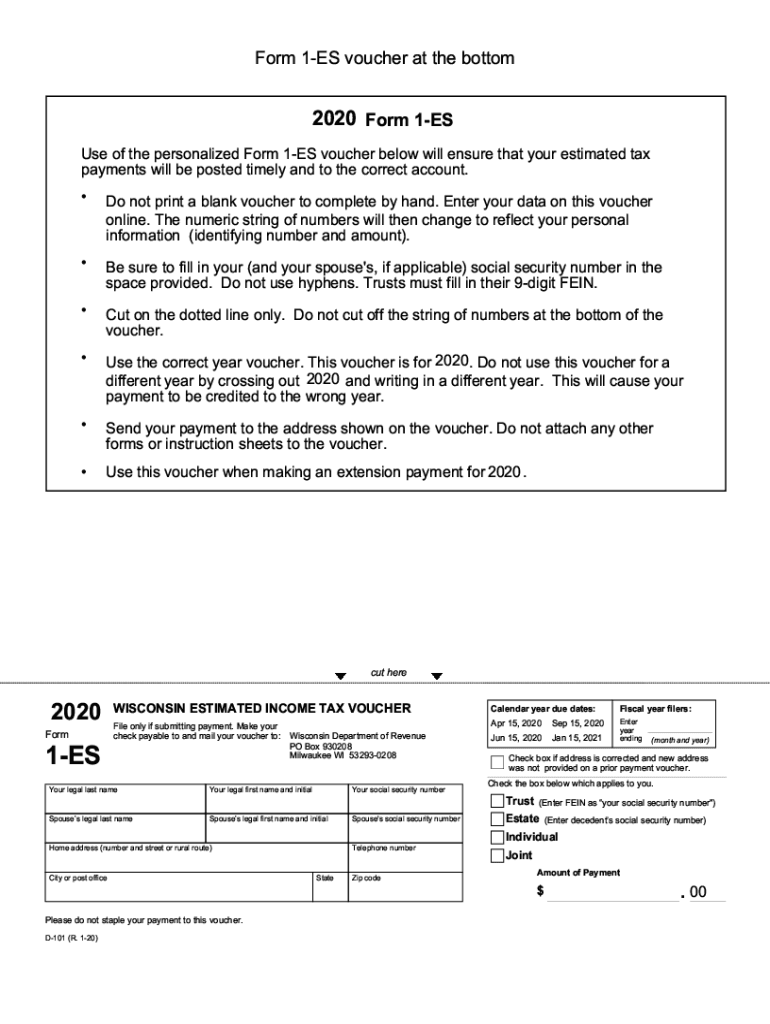

The Wisconsin Estimated Income Tax Voucher Form 1 ES is a crucial document for individuals and businesses who anticipate owing state income tax. This form is used to report and pay estimated taxes to the Wisconsin Department of Revenue. It is particularly relevant for those who have income that is not subject to withholding, such as self-employment income, rental income, or investment income. By submitting this form, taxpayers can avoid underpayment penalties and ensure compliance with state tax regulations.

Steps to Complete the Wisconsin Estimated Income Tax Voucher Form 1 ES

Completing the Wisconsin Form 1 ES requires careful attention to detail. Here are the essential steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your estimated income for the year, taking into account any deductions or credits.

- Determine the estimated tax owed based on your projected income and the current tax rates.

- Fill out the Form 1 ES with your personal information, estimated income, and tax calculations.

- Sign and date the form to certify its accuracy.

- Submit the form along with your payment to the appropriate address provided by the Wisconsin Department of Revenue.

Legal Use of the Wisconsin Estimated Income Tax Voucher Form 1 ES

The Form 1 ES is legally binding when completed and submitted according to state regulations. It is essential to ensure that all information is accurate and truthful to avoid penalties or legal issues. The form must be signed by the taxpayer, affirming that the estimates provided are correct to the best of their knowledge. Compliance with the guidelines set forth by the Wisconsin Department of Revenue is necessary for the form to be considered valid.

Key Elements of the Wisconsin Estimated Income Tax Voucher Form 1 ES

Several key elements must be included when filling out the Form 1 ES:

- Taxpayer Information: Full name, address, and Social Security number or Employer Identification Number (EIN).

- Estimated Income: A breakdown of expected income sources for the tax year.

- Tax Calculation: The estimated tax amount owed based on projected income.

- Payment Information: Instructions for submitting payment, including options for online payment or mailing a check.

Obtaining the Wisconsin Estimated Income Tax Voucher Form 1 ES

The Form 1 ES can be obtained directly from the Wisconsin Department of Revenue's website. It is available as a downloadable PDF, which can be printed and filled out by hand or completed electronically. Additionally, tax preparation software may offer the option to generate this form as part of the filing process. Ensuring you have the latest version of the form is crucial, as tax laws and requirements can change.

Filing Deadlines for the Wisconsin Estimated Income Tax Voucher Form 1 ES

Timely submission of the Form 1 ES is essential to avoid penalties. The deadlines for filing estimated taxes in Wisconsin typically fall on the following dates:

- April 15: First installment

- June 15: Second installment

- September 15: Third installment

- January 15 of the following year: Fourth installment

Taxpayers should be aware of these dates and plan accordingly to ensure compliance with state tax obligations.

Quick guide on how to complete 2020 form 1 es wisconsin estimated income tax voucher 2020 form 1 es wisconsin estimated income tax voucher

Finish Form 1 ES, Wisconsin Estimated Income Tax Voucher Form 1 ES, Wisconsin Estimated Income Tax Voucher effortlessly on any gadget

Web-based document management has become popular among companies and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1 ES, Wisconsin Estimated Income Tax Voucher Form 1 ES, Wisconsin Estimated Income Tax Voucher on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to alter and eSign Form 1 ES, Wisconsin Estimated Income Tax Voucher Form 1 ES, Wisconsin Estimated Income Tax Voucher seamlessly

- Locate Form 1 ES, Wisconsin Estimated Income Tax Voucher Form 1 ES, Wisconsin Estimated Income Tax Voucher and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of the documents or conceal sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1 ES, Wisconsin Estimated Income Tax Voucher Form 1 ES, Wisconsin Estimated Income Tax Voucher to ensure outstanding communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1 es wisconsin estimated income tax voucher 2020 form 1 es wisconsin estimated income tax voucher

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1 es wisconsin estimated income tax voucher 2020 form 1 es wisconsin estimated income tax voucher

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the importance of understanding my Wisconsin estimated income?

Understanding your Wisconsin estimated income is crucial for effective tax planning and compliance. It helps you anticipate your tax liabilities and avoid underpayment penalties, ensuring you meet state tax obligations smoothly.

-

How can airSlate SignNow help me manage my documents related to Wisconsin estimated income?

airSlate SignNow streamlines document management by allowing you to send, eSign, and store all necessary forms related to your Wisconsin estimated income. This helps in keeping your records organized and easily accessible for future reference or audits.

-

Does airSlate SignNow offer any tools to assist with Wisconsin estimated income calculations?

While airSlate SignNow doesn't provide direct income calculation tools, it facilitates the sharing of essential documents with tax professionals who can assist you. Document collaboration features ensure that all parties have access to the necessary information for your Wisconsin estimated income assessments.

-

What are the pricing plans for airSlate SignNow, especially for small businesses dealing with estimated income in Wisconsin?

airSlate SignNow offers several pricing plans tailored for small businesses, catering to various needs, including those related to Wisconsin estimated income. The affordable options make it easier for businesses to manage their documentation without breaking the bank.

-

Can airSlate SignNow integrate with accounting software to track my Wisconsin estimated income?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, making it easier to track and manage your Wisconsin estimated income. This integration ensures that your financial records and documents are synchronized for better financial insights and reporting.

-

What security features does airSlate SignNow have for documents related to my Wisconsin estimated income?

airSlate SignNow prioritizes document security with features like encryption, secure access controls, and audit trails. This ensures that documents related to your Wisconsin estimated income are kept confidential and protected against unauthorized access.

-

Is airSlate SignNow suitable for freelancers managing their Wisconsin estimated income?

Absolutely! airSlate SignNow is an ideal solution for freelancers managing their Wisconsin estimated income. Its user-friendly interface and comprehensive eSigning capabilities simplify the documentation process, allowing freelancers to focus on their work.

Get more for Form 1 ES, Wisconsin Estimated Income Tax Voucher Form 1 ES, Wisconsin Estimated Income Tax Voucher

Find out other Form 1 ES, Wisconsin Estimated Income Tax Voucher Form 1 ES, Wisconsin Estimated Income Tax Voucher

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure