Cp600f 2018

What is the Cp600f

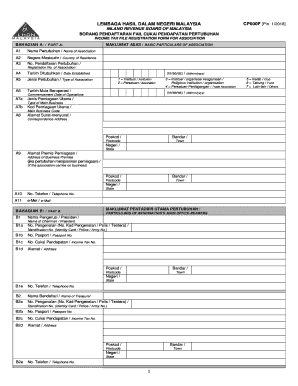

The Cp600f is a tax form utilized in Malaysia for the registration of income tax files. It is specifically designed for individuals and entities to declare their income and fulfill their tax obligations. This form is essential for ensuring compliance with the Malaysian tax system and is a critical component of the tax filing process.

How to use the Cp600f

To effectively use the Cp600f, individuals must first obtain the form, which can typically be downloaded from official tax authority websites. Once in possession of the form, users should carefully fill out the required fields, providing accurate information regarding their income sources and other relevant financial details. After completing the form, it must be submitted to the appropriate tax authority to ensure compliance with local tax regulations.

Steps to complete the Cp600f

Completing the Cp600f involves several key steps:

- Download the Cp600f form from the official tax authority website.

- Gather all necessary financial documents, including income statements and previous tax returns.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the completed form to the relevant tax authority, either online or via mail.

Legal use of the Cp600f

The legal use of the Cp600f is governed by Malaysian tax laws. It is important to ensure that the form is filled out truthfully and submitted within the designated deadlines to avoid penalties. The form serves as a legal declaration of income, and any discrepancies may lead to legal consequences, including fines or audits.

Required Documents

When completing the Cp600f, several documents are typically required to support the information provided:

- Income statements from employers or clients.

- Previous tax returns for reference.

- Bank statements that reflect income deposits.

- Any relevant receipts or documentation that may support deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Cp600f are crucial for compliance. Generally, the deadlines are set annually, and it is important for taxpayers to be aware of these dates to avoid late fees. Typically, the deadline for submission is within a specific period after the end of the financial year. Keeping track of these dates ensures that taxpayers fulfill their obligations on time.

Quick guide on how to complete cp600f

Complete Cp600f effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Cp600f on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Cp600f with ease

- Find Cp600f and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and has the same legal standing as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Modify and electronically sign Cp600f to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cp600f

Create this form in 5 minutes!

How to create an eSignature for the cp600f

The way to create an eSignature for a PDF document in the online mode

The way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the cp600f and how does it benefit my business?

The cp600f is a digital signing solution offered by airSlate SignNow that streamlines the process of sending and signing documents electronically. By utilizing the cp600f, businesses can enhance efficiency, reduce turnaround times, and ensure document security, making it an essential tool for any organization.

-

How much does the cp600f service cost?

Pricing for the cp600f varies based on the subscription plan selected. airSlate SignNow provides flexible pricing options, including monthly and annual subscriptions, which can accommodate businesses of different sizes and budgets. Check the airSlate SignNow website for the most updated pricing information and special offers.

-

What features are included in the cp600f package?

The cp600f package includes a variety of features like document templates, customizable workflows, and secure eSigning. Users will also benefit from in-app notifications and access to comprehensive audit trails, all designed to enhance the document management process while ensuring compliance and security.

-

Is the cp600f easy to integrate with other applications?

Yes, the cp600f is designed for seamless integration with a range of popular applications including CRM systems and productivity tools. This flexibility allows businesses to enhance their existing workflows without disrupting their current processes, making the cp600f a versatile choice for any organization.

-

How does the cp600f ensure document security?

The cp600f incorporates advanced security measures, including data encryption and secure cloud storage, to protect sensitive information. Additionally, it complies with industry-standard regulations such as GDPR and eIDAS, giving users confidence in the security and integrity of their documents.

-

Can I use the cp600f for mobile signing?

Absolutely! The cp600f is optimized for mobile use, allowing users to sign documents on the go. This feature is crucial for businesses that require flexibility and quick action, enabling staff to complete transactions anytime, anywhere, using their mobile devices.

-

What types of documents can be signed using the cp600f?

The cp600f supports a variety of document types, including contracts, agreements, and consent forms. Its adaptable interface allows users to create and manage any PDF or document format efficiently, making it suitable for diverse business needs across different industries.

Get more for Cp600f

- Oregon death certificate form

- Formula authorization form pennsylvania wic

- Www uslegalforms comform library258314procedure consent form se pa pain management fill and

- Security consultant contract template form

- Security contract template form

- Security deposit contract template form

- Security guard contract template form

- Security guard service contract template form

Find out other Cp600f

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed