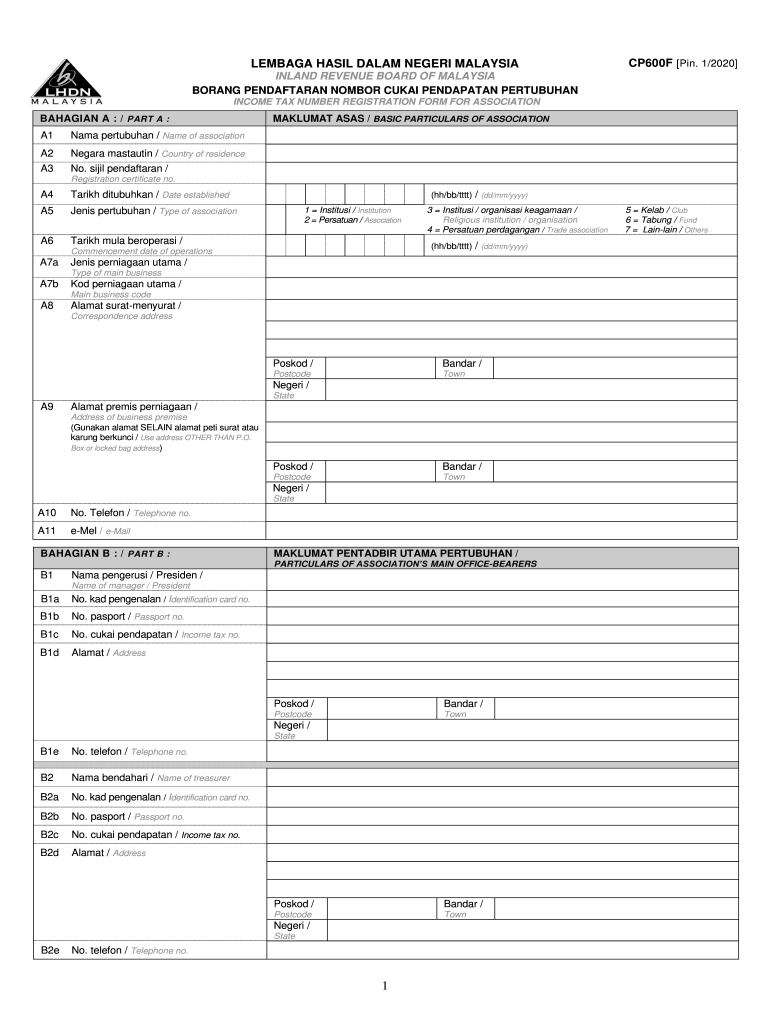

INCOME TAX NUMBER REGISTRATION FORM for ASSOCIATION 2020-2026

What is the CP600F?

The CP600F is a specific form used for income tax number registration for associations in the United States. This form is essential for organizations that need to obtain a federal tax identification number, which is crucial for tax reporting and compliance. By filling out the CP600F, associations can formalize their status and ensure they meet the necessary legal requirements to operate within the framework of U.S. tax laws.

How to Use the CP600F

Using the CP600F involves several steps to ensure accurate completion and submission. First, gather all necessary information, including the association's legal name, address, and purpose. Next, fill out the form with precise details, ensuring that all sections are complete. After completing the form, review it for accuracy before submitting it to the appropriate tax authority. This careful approach helps avoid delays and potential issues with your registration.

Steps to Complete the CP600F

Completing the CP600F involves a systematic approach:

- Gather required information, such as the association's name, address, and contact details.

- Fill out the form, ensuring all fields are accurately completed.

- Review the form for any errors or omissions.

- Sign and date the form where indicated.

- Submit the completed form via the designated method, whether online, by mail, or in person.

Legal Use of the CP600F

The CP600F is legally binding when completed correctly. It provides the necessary documentation for associations to operate legally under U.S. tax laws. Compliance with federal and state regulations is crucial, as failure to properly register can lead to penalties or issues with tax reporting. Proper use of the CP600F ensures that the association is recognized by the IRS and can engage in activities that require a tax identification number.

Required Documents for the CP600F

When filling out the CP600F, certain documents may be required to support your application. These can include:

- Proof of the association's formation, such as articles of incorporation or bylaws.

- Identification of the principal officers or members.

- Any relevant state registration documents.

Having these documents ready can facilitate a smoother registration process.

Filing Deadlines / Important Dates

It is important to be aware of specific deadlines when submitting the CP600F. While the exact dates may vary depending on the state and type of association, generally, it is advisable to submit the form as soon as the association is formed. This proactive approach helps avoid any potential penalties or complications that may arise from late submissions.

Quick guide on how to complete income tax number registration form for association

Prepare INCOME TAX NUMBER REGISTRATION FORM FOR ASSOCIATION with ease on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the required form and securely save it online. airSlate SignNow provides all the features necessary to create, edit, and electronically sign your documents rapidly without delays. Manage INCOME TAX NUMBER REGISTRATION FORM FOR ASSOCIATION across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest method to modify and electronically sign INCOME TAX NUMBER REGISTRATION FORM FOR ASSOCIATION effortlessly

- Locate INCOME TAX NUMBER REGISTRATION FORM FOR ASSOCIATION and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Mark important sections of your documents or redact sensitive details using tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal authority as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign INCOME TAX NUMBER REGISTRATION FORM FOR ASSOCIATION and guarantee outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax number registration form for association

Create this form in 5 minutes!

How to create an eSignature for the income tax number registration form for association

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cp600f and how does it work?

The cp600f is a powerful document signing solution designed for businesses looking to streamline their workflows. It allows users to send and eSign documents securely and efficiently, enhancing productivity and ensuring timely agreements. With its user-friendly interface, the cp600f simplifies the signing process for all parties involved.

-

How much does the cp600f cost?

The cp600f offers a range of pricing plans tailored to meet the needs of different businesses. Depending on your usage and feature requirements, you can choose a plan that fits your budget. Additionally, airSlate SignNow often provides special promotions for new users to experience the cp600f at an affordable rate.

-

What features does the cp600f offer?

The cp600f includes features such as customizable templates, real-time tracking of document status, and robust security measures to protect your data. These features are designed to enhance collaboration and efficiency in document management. Furthermore, the cp600f integrates with other tools for a seamless workflow experience.

-

What are the main benefits of using cp600f?

Using cp600f provides numerous benefits, such as reduced paperwork, faster turnaround times for contracts, and improved document organization. By utilizing cp600f, businesses can enhance their operational efficiency and focus on core activities. This ultimately leads to increased customer satisfaction and better business relationships.

-

Can the cp600f be integrated with other software?

Yes, the cp600f is designed to integrate smoothly with a variety of popular software applications, including CRMs and project management tools. This integration capability allows users to streamline their processes and maintain a productive workflow without manual data entry. Leveraging these integrations can signNowly enhance your overall document management strategy.

-

Is the cp600f secure for sensitive documents?

Absolutely. The cp600f prioritizes security with advanced encryption and authentication protocols to ensure that your sensitive documents are protected. Implementing such security measures helps businesses comply with regulations and fosters trust among clients and partners. With cp600f, you can sign and send documents with peace of mind.

-

How can I get started with cp600f?

Getting started with cp600f is simple. You can sign up for a free trial on the airSlate SignNow website to explore its features and capabilities. After familiarizing yourself with the platform during the trial, you can choose a subscription plan that best fits your business needs.

Get more for INCOME TAX NUMBER REGISTRATION FORM FOR ASSOCIATION

- Pahal dbtl scheme joining form 100257902

- Formulario ps 6 259 pdf

- Sample letter to terminate payroll services form

- Rio rancho high school parking pass form

- Instructional coaching cycle forms pdf

- Adp dd enrollment form

- Neisd bus stop supervision waiver form neisd

- Residential homestead exemption application central appraisal form

Find out other INCOME TAX NUMBER REGISTRATION FORM FOR ASSOCIATION

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document