to Be Attached to Corporate or Partnership Return 2019

What is the To Be Attached To Corporate Or Partnership Return

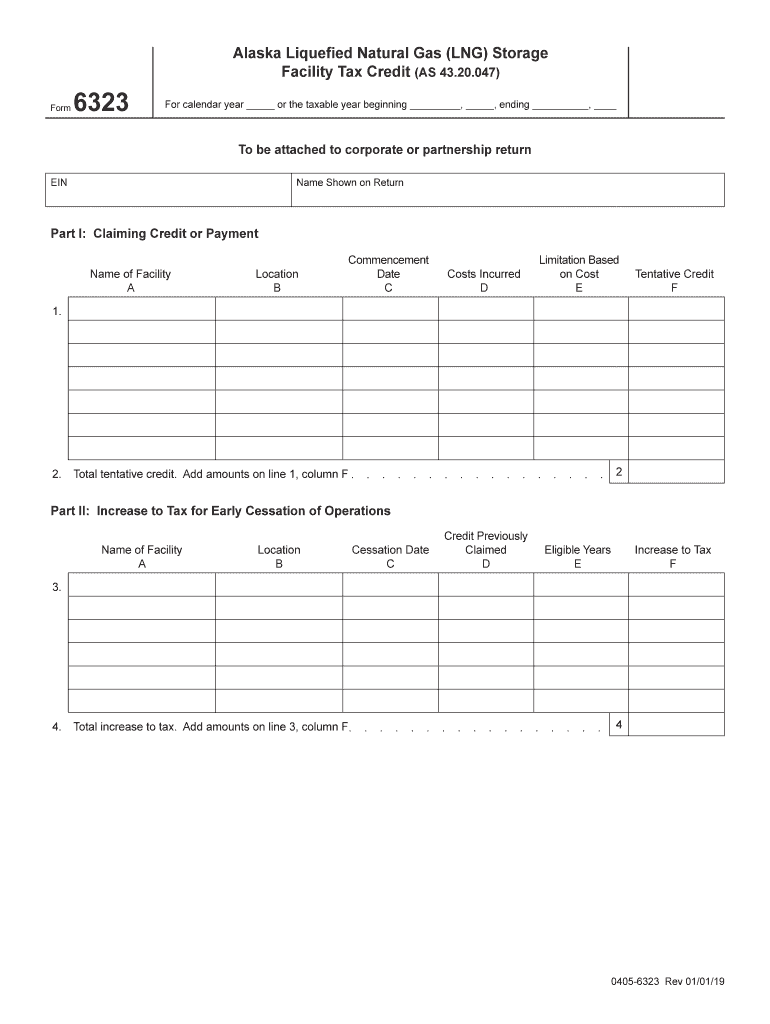

The "To Be Attached To Corporate Or Partnership Return" form is a crucial document used for reporting income, deductions, and credits for corporations and partnerships in the United States. This form is typically submitted alongside the primary corporate or partnership tax return, such as Form 1120 or Form 1065. It provides additional information that may be necessary for the IRS to assess the tax obligations of the business entity accurately. Understanding the purpose and requirements of this form is essential for compliance with federal tax laws.

How to use the To Be Attached To Corporate Or Partnership Return

Using the "To Be Attached To Corporate Or Partnership Return" form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, balance sheets, and previous tax returns. Next, fill out the form with precise details regarding income, deductions, and credits relevant to the business entity. It is important to review the form for accuracy before submission, as errors can lead to delays or penalties. Finally, attach the completed form to the primary tax return and submit it according to IRS guidelines.

Steps to complete the To Be Attached To Corporate Or Partnership Return

Completing the "To Be Attached To Corporate Or Partnership Return" involves a systematic approach:

- Gather necessary documents, including financial statements and prior tax returns.

- Fill out the form accurately, ensuring all income, deductions, and credits are reported.

- Double-check all entries for accuracy and completeness.

- Attach the form to the primary tax return, ensuring it is signed where required.

- Submit the entire package to the IRS by the designated deadline.

Legal use of the To Be Attached To Corporate Or Partnership Return

The "To Be Attached To Corporate Or Partnership Return" is legally binding when completed and submitted in accordance with IRS regulations. This form must be filled out truthfully and accurately, as any misrepresentation can lead to legal consequences, including fines or audits. Utilizing electronic signatures through a secure platform can enhance the legal validity of the submission, provided it complies with relevant eSignature laws such as ESIGN and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the "To Be Attached To Corporate Or Partnership Return" align with the deadlines for the primary tax returns of corporations and partnerships. Generally, corporate tax returns are due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For partnerships, the deadline is the fifteenth day of the third month following the end of the partnership's fiscal year. It is important to be aware of these dates to avoid penalties for late filing.

Required Documents

To complete the "To Be Attached To Corporate Or Partnership Return," several documents are required:

- Income statements detailing revenue generated by the business.

- Balance sheets summarizing assets, liabilities, and equity.

- Previous tax returns for reference and consistency.

- Supporting documentation for deductions and credits claimed.

Quick guide on how to complete to be attached to corporate or partnership return

Handle To Be Attached To Corporate Or Partnership Return effortlessly across any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the features needed to create, adjust, and electronically sign your documents quickly and without delays. Manage To Be Attached To Corporate Or Partnership Return on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to alter and electronically sign To Be Attached To Corporate Or Partnership Return with ease

- Locate To Be Attached To Corporate Or Partnership Return and click Get Form to commence.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive data with tools that airSlate SignNow specifically supplies for this purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your selected device. Edit and electronically sign To Be Attached To Corporate Or Partnership Return and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct to be attached to corporate or partnership return

Create this form in 5 minutes!

How to create an eSignature for the to be attached to corporate or partnership return

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What does it mean for a document 'To Be Attached To Corporate Or Partnership Return'?

When a document is 'To Be Attached To Corporate Or Partnership Return,' it refers to essential forms and papers that need to be submitted alongside tax returns for corporations or partnerships. This ensures compliance with tax regulations and provides necessary supporting information for various deductions or claims.

-

How can airSlate SignNow help in preparing documents 'To Be Attached To Corporate Or Partnership Return'?

airSlate SignNow streamlines the document preparation process, allowing users to easily create, send, and eSign necessary forms 'To Be Attached To Corporate Or Partnership Return.' Its user-friendly interface simplifies complex document management, ensuring timely and accurate submissions.

-

What are the pricing options for airSlate SignNow when preparing documents 'To Be Attached To Corporate Or Partnership Return'?

airSlate SignNow offers competitive pricing plans tailored to different business needs. Users can choose from monthly or annual subscriptions, which are designed to provide cost-effective solutions for managing documents 'To Be Attached To Corporate Or Partnership Return' without sacrificing essential features or support.

-

Can I integrate airSlate SignNow with other software to manage 'To Be Attached To Corporate Or Partnership Return' documents?

Yes, airSlate SignNow seamlessly integrates with a variety of popular software solutions for enhanced workflow. This means you can connect your existing tools to streamline the process of managing documents 'To Be Attached To Corporate Or Partnership Return' and ensure efficient collaboration among team members.

-

What security measures does airSlate SignNow have for documents 'To Be Attached To Corporate Or Partnership Return'?

AirSlate SignNow prioritizes the security of your documents, including those 'To Be Attached To Corporate Or Partnership Return.' It employs advanced encryption, secure cloud storage, and compliance with industry regulations to protect sensitive information throughout the document life cycle.

-

Are electronic signatures on documents 'To Be Attached To Corporate Or Partnership Return' legally binding?

Yes, electronic signatures created via airSlate SignNow on documents 'To Be Attached To Corporate Or Partnership Return' are legally binding in accordance with the Electronic Signatures in Global and National Commerce (ESIGN) Act. This means you can confidently sign and submit your documents without concerns about legality.

-

What features does airSlate SignNow offer for editing documents 'To Be Attached To Corporate Or Partnership Return'?

AirSlate SignNow provides a comprehensive set of editing tools for documents 'To Be Attached To Corporate Or Partnership Return.' You can add text, images, and signatures easily, ensuring that your final documents meet all necessary requirements for submission.

Get more for To Be Attached To Corporate Or Partnership Return

Find out other To Be Attached To Corporate Or Partnership Return

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed