North Carolina Nc 1099 2018

What is the North Carolina Nc 1099

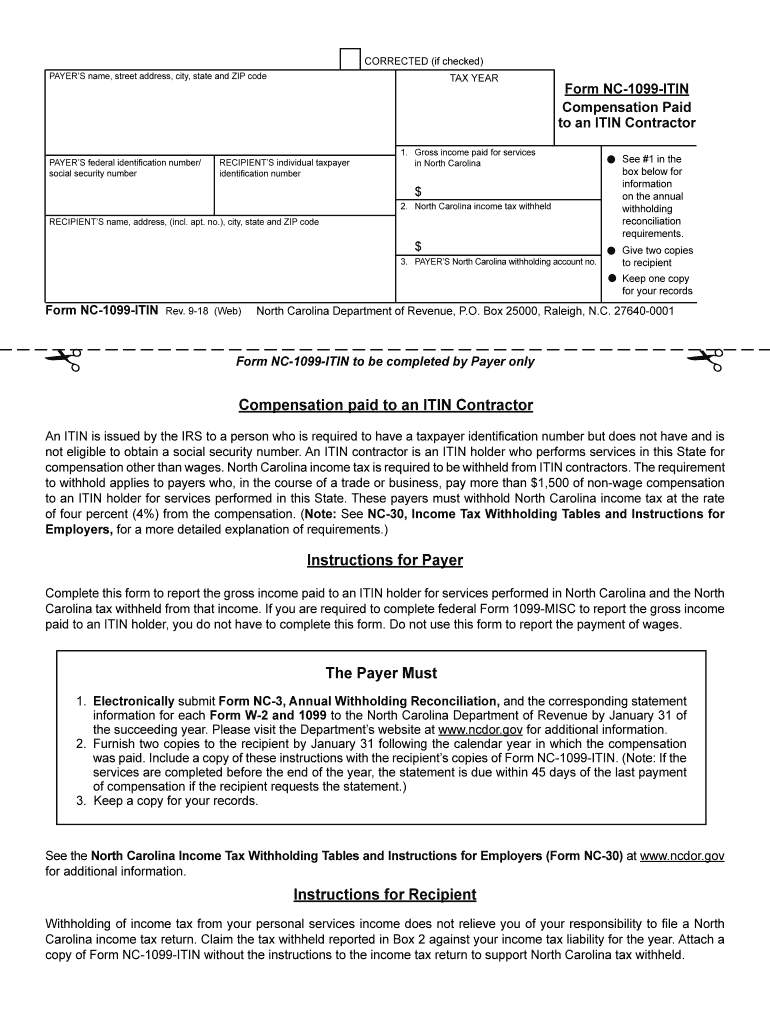

The North Carolina Nc 1099 is a tax form used to report various types of income other than wages, salaries, and tips. This form is essential for individuals and businesses that have made payments to contractors or received certain types of income, such as unemployment benefits or retirement distributions. The Nc 1099 serves as an official record that helps the state and the IRS track income for tax purposes.

How to use the North Carolina Nc 1099

Using the North Carolina Nc 1099 involves several steps to ensure accurate reporting. First, determine the type of income being reported and select the appropriate variant of the Nc 1099 form. Next, gather all necessary information, including the recipient's name, address, and taxpayer identification number. Once the form is completed, it should be submitted to the North Carolina Department of Revenue and a copy provided to the recipient. This ensures that both parties have a record of the reported income.

Steps to complete the North Carolina Nc 1099

Completing the North Carolina Nc 1099 requires careful attention to detail. Start by selecting the correct form variant based on the type of income being reported. Fill in the payer's information, including name, address, and identification number. Next, enter the recipient's details and the amount paid during the tax year. Be sure to check for accuracy, as mistakes can lead to penalties or delays. Once completed, sign and date the form before submitting it to the appropriate authorities.

Legal use of the North Carolina Nc 1099

The legal use of the North Carolina Nc 1099 is governed by state and federal tax laws. It is crucial to ensure that the form is filled out correctly and submitted on time to avoid penalties. The Nc 1099 must be used for reporting income accurately, reflecting the true nature of payments made. Failure to comply with these regulations can result in audits or fines, making it essential for businesses and individuals to understand their obligations regarding this form.

Filing Deadlines / Important Dates

Filing deadlines for the North Carolina Nc 1099 are critical for compliance. Typically, the form must be submitted to the state by January thirty-first of the year following the tax year. Recipients should also receive their copies by this date. It is important to stay informed about any changes to these deadlines, as they can vary from year to year, and late submissions may incur penalties.

Who Issues the Form

The North Carolina Nc 1099 is typically issued by businesses, organizations, or individuals who have made payments to contractors or received specific types of income. This includes employers reporting payments to independent contractors, as well as financial institutions reporting distributions from retirement accounts. Understanding who is responsible for issuing the form is essential for ensuring compliance and accurate reporting.

Examples of using the North Carolina Nc 1099

Examples of using the North Carolina Nc 1099 include reporting payments made to freelance workers, contractors, or service providers. For instance, if a business hires a graphic designer for a project and pays them more than six hundred dollars during the year, the business is required to issue an Nc 1099 to report this payment. Similarly, individuals receiving unemployment benefits must report these payments using the Nc 1099 form. These examples illustrate the form's role in documenting various income types for tax reporting purposes.

Quick guide on how to complete north carolina nc 1099

Streamline North Carolina Nc 1099 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It presents an excellent environmentally friendly alternative to traditional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage North Carolina Nc 1099 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to change and eSign North Carolina Nc 1099 with ease

- Locate North Carolina Nc 1099 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form navigation, or mistakes requiring new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign North Carolina Nc 1099 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct north carolina nc 1099

Create this form in 5 minutes!

How to create an eSignature for the north carolina nc 1099

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What are NC 1099's and why are they important?

NC 1099's are tax forms that report income paid to independent contractors and other non-employees in North Carolina. They are crucial for ensuring compliance with state tax laws and for providing accurate financial records to the IRS. Utilizing airSlate SignNow can simplify the process of sending and signing these essential documents.

-

How does airSlate SignNow help with NC 1099's?

airSlate SignNow enables seamless sending and eSigning of NC 1099's, ensuring that your documents are completed quickly and accurately. It provides an easy-to-use interface that allows you to manage these important tax forms efficiently. By streamlining the process, you can save time and reduce errors.

-

What features does airSlate SignNow offer for managing NC 1099's?

Key features for managing NC 1099's with airSlate SignNow include electronic signatures, customizable templates, and real-time tracking of document status. These capabilities ensure that your NC 1099's are processed quickly and securely. Additionally, you can automate reminders to follow up with recipients.

-

Is airSlate SignNow cost-effective for handling NC 1099's?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes looking to manage NC 1099's efficiently. The platform's affordability combined with its robust features makes it a cost-effective solution for handling tax documents. By reducing paper usage and streamlining workflows, it also saves your business money.

-

Can airSlate SignNow integrate with other software for NC 1099's?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software, enhancing its functionality for managing NC 1099's. This integration allows for easy data transfer and ensures that all relevant information is accurately reflected in your documents. Streamlining this process can signNowly improve your efficiency.

-

How secure is airSlate SignNow when handling NC 1099's?

Security is a top priority for airSlate SignNow, particularly when dealing with sensitive documents like NC 1099's. The platform employs state-of-the-art encryption and complies with data protection regulations to ensure that your information remains safe. You can rest easy knowing that your financial documents are well-protected.

-

What are the benefits of using airSlate SignNow for NC 1099's?

The primary benefits of using airSlate SignNow for NC 1099's include improved efficiency, reduced processing time, and enhanced document security. With electronic signatures and automated workflows, your tax documents can be completed faster and more accurately. This leads to streamlined operations and allows you to focus on growing your business.

Get more for North Carolina Nc 1099

- Office of the registrarnevada state collegeoffice of the registrarnevada state collegeoffice of the registrarnevada state form

- Lakotaonline form

- Bob lawhorn scholarship form

- Persuasion packet aurora city school district form

- Ymca waiver 217099128 form

- Play school registration form doc

- Reset form ohio department of job and family servi

- Ged test application owens form

Find out other North Carolina Nc 1099

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now