Nc 1099 Form 2016

What is the Nc 1099 Form

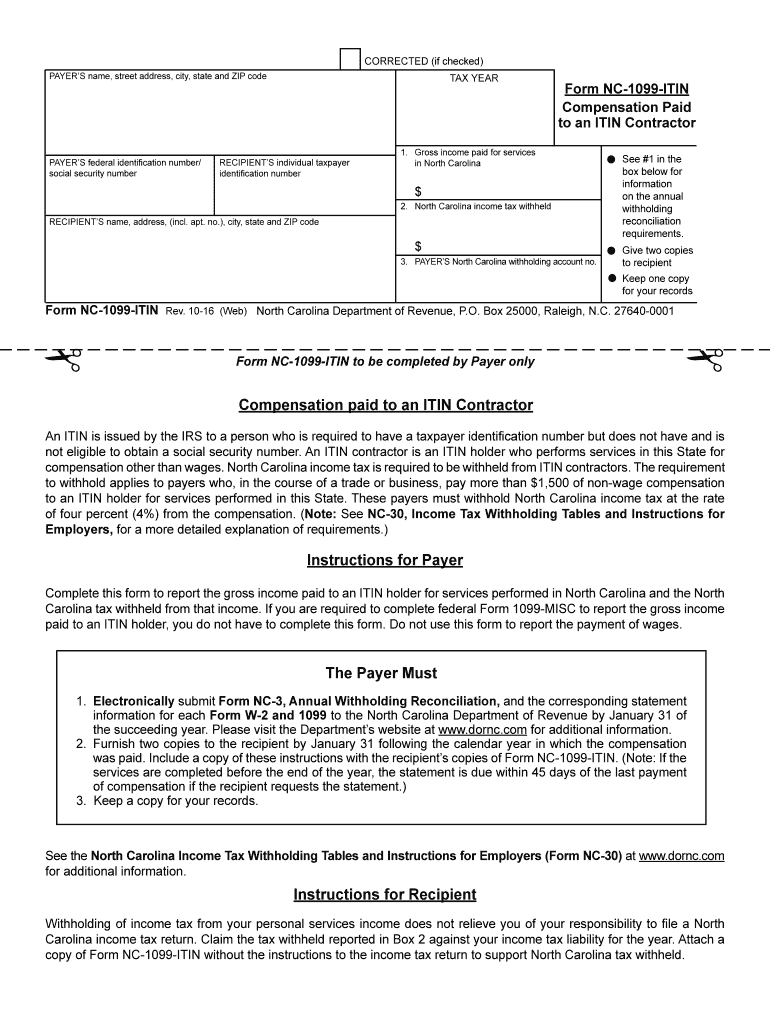

The Nc 1099 Form is a tax document used in the United States to report income received by individuals or businesses that are not classified as employees. This form is essential for reporting various types of income, such as freelance earnings, rental income, or other payments made to non-employees. It helps the Internal Revenue Service (IRS) track income and ensure that taxes are accurately reported and paid.

How to use the Nc 1099 Form

Using the Nc 1099 Form involves several steps to ensure accurate reporting of income. First, gather all necessary information, including the recipient's name, address, and taxpayer identification number (TIN). Next, accurately report the amount paid in the appropriate box on the form. It is crucial to provide correct information to avoid penalties. Once completed, the form must be submitted to both the IRS and the recipient by the designated deadlines.

Steps to complete the Nc 1099 Form

Completing the Nc 1099 Form requires careful attention to detail. Follow these steps:

- Collect all relevant information about the recipient, including their name, address, and TIN.

- Determine the total amount paid to the recipient during the tax year.

- Fill out the form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the IRS and provide a copy to the recipient by the deadline.

Legal use of the Nc 1099 Form

The Nc 1099 Form must be used in compliance with IRS regulations. It is legally required for businesses that pay non-employees $600 or more in a calendar year. Failure to file the form can result in penalties, including fines and interest on unpaid taxes. It is important to understand the legal implications of using this form to ensure compliance and avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Timely filing of the Nc 1099 Form is crucial to avoid penalties. Generally, the form must be filed with the IRS by January thirty-first of the year following the tax year in which the payments were made. Recipients should also receive their copies by this date. It is essential to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or IRS updates.

Penalties for Non-Compliance

Non-compliance with Nc 1099 Form filing requirements can lead to significant penalties. The IRS imposes fines for late filings, which can increase based on how late the form is submitted. Additionally, failure to provide accurate information can result in further penalties. Understanding these consequences is vital for businesses to maintain compliance and avoid financial repercussions.

Quick guide on how to complete nc 1099 2016 form

Complete Nc 1099 Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Nc 1099 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Nc 1099 Form without hassle

- Obtain Nc 1099 Form and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to retain your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Nc 1099 Form and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nc 1099 2016 form

Create this form in 5 minutes!

How to create an eSignature for the nc 1099 2016 form

How to create an electronic signature for your Nc 1099 2016 Form in the online mode

How to create an eSignature for your Nc 1099 2016 Form in Chrome

How to generate an electronic signature for signing the Nc 1099 2016 Form in Gmail

How to generate an electronic signature for the Nc 1099 2016 Form straight from your smart phone

How to make an electronic signature for the Nc 1099 2016 Form on iOS

How to create an electronic signature for the Nc 1099 2016 Form on Android devices

People also ask

-

What is the Nc 1099 Form and why is it important?

The Nc 1099 Form is an essential tax document used to report various types of income received by individuals or businesses throughout the year. It is crucial for accurate tax filing, ensuring compliance with North Carolina tax regulations. Understanding the Nc 1099 Form can help you avoid complications with the IRS and ensure you’re fulfilling your tax obligations.

-

How can airSlate SignNow help with the Nc 1099 Form?

airSlate SignNow simplifies the process of preparing, sending, and eSigning the Nc 1099 Form. With our user-friendly interface, you can easily create and manage your forms, ensuring that you stay organized and compliant. Our platform is designed to streamline your workflow while ensuring that all necessary documents are securely eSigned and stored.

-

Is there a cost associated with using airSlate SignNow for the Nc 1099 Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you only pay for the features you need, making it easier to manage your Nc 1099 Form processes. We also provide a free trial to help you explore our features before committing to a plan.

-

Can I integrate airSlate SignNow with other software to manage the Nc 1099 Form?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and financial software, allowing you to streamline your Nc 1099 Form management. This integration ensures that your data flows smoothly between platforms, reducing the risk of errors and increasing efficiency.

-

What features does airSlate SignNow offer for eSigning the Nc 1099 Form?

airSlate SignNow provides a range of features for eSigning the Nc 1099 Form, including customizable templates, audit trails, and secure document storage. Users can easily send out forms for signature and track their status in real-time, ensuring a smooth workflow and faster turnaround times.

-

How does airSlate SignNow ensure the security of my Nc 1099 Form?

The security of your documents, including the Nc 1099 Form, is our top priority at airSlate SignNow. We utilize bank-grade encryption and adhere to strict security protocols to protect your data from unauthorized access. Our secure platform ensures that your documents remain confidential and accessible only to authorized users.

-

Can I access my Nc 1099 Form from anywhere using airSlate SignNow?

Yes, airSlate SignNow is a cloud-based platform, which means you can access your Nc 1099 Form from anywhere, at any time. Whether you’re in the office or on the go, you can easily manage and eSign your documents using any device with internet access.

Get more for Nc 1099 Form

- Sf3107 2014 2019 form

- Form adoption 2016 2019

- Tax benefits application 2017 form

- 533a 2015 2019 form

- Nrcc elc 01 e 2016 2019 form

- Prudential beneficiary 2014 2019 form

- Virginia department of game and inland fisheries credit card authorization form

- Nuclear radiation safety inspection checklist university of bb uwo form

Find out other Nc 1099 Form

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation