Nc 1099 Form 2018-2026

What is the ITIN on W-2?

The ITIN, or Individual Taxpayer Identification Number, is a tax processing number issued by the IRS. It is used primarily by individuals who are not eligible for a Social Security number but need to file taxes in the United States. When included on a W-2 form, the ITIN serves as a unique identifier for taxpayers, ensuring that their income is accurately reported to the IRS. This is particularly important for non-resident aliens and foreign nationals who earn income in the U.S. and need to fulfill their tax obligations.

How to use the ITIN on W-2

When filling out a W-2 form, individuals should enter their ITIN in the designated space for taxpayer identification. This number replaces the Social Security number for those who do not possess one. It is crucial to ensure that the ITIN is entered correctly to avoid delays in processing tax returns or potential issues with the IRS. Employers must also ensure that they report this number accurately on the W-2 to comply with federal tax regulations.

Steps to complete the W-2 with ITIN

Completing a W-2 form with an ITIN involves several key steps:

- Obtain the W-2 form from your employer or download it from a reliable source.

- Fill in your personal information, including your name and address.

- In the taxpayer identification section, enter your ITIN instead of a Social Security number.

- Complete the remaining sections of the W-2, including wages earned and taxes withheld.

- Review the form for accuracy before submission.

Legal use of the ITIN on W-2

The inclusion of an ITIN on a W-2 form is legally recognized by the IRS, allowing individuals without a Social Security number to fulfill their tax obligations. It ensures that income is reported correctly and that taxpayers can claim any eligible tax credits or refunds. However, it is essential to use the ITIN solely for tax purposes and to keep it confidential to prevent identity theft.

Filing Deadlines / Important Dates

Filing deadlines for W-2 forms are critical for compliance. Employers must provide W-2 forms to employees by January 31 of each year. Employees must file their tax returns by April 15, unless an extension is requested. It is important to keep track of these dates to avoid penalties and ensure timely processing of tax returns.

Required Documents

To accurately complete a W-2 form with an ITIN, certain documents are necessary:

- Proof of income, such as pay stubs or previous W-2 forms.

- ITIN documentation from the IRS.

- Personal identification, such as a passport or driver's license.

Who Issues the W-2 Form

The W-2 form is issued by employers to their employees. It reports annual wages and the amount of taxes withheld from paychecks. Employers are responsible for ensuring that the information on the W-2 is accurate and that it is distributed to employees and the IRS in a timely manner. This includes the proper reporting of an ITIN when applicable.

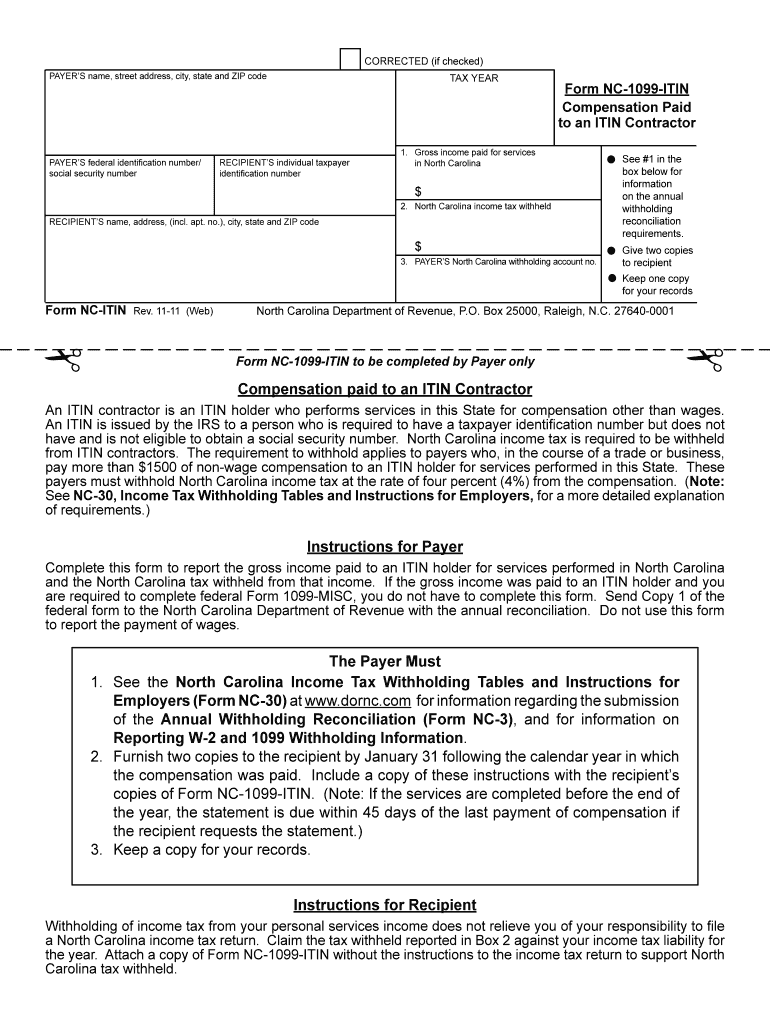

Quick guide on how to complete nc 1099 2011 form

Complete Nc 1099 Form effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Nc 1099 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Nc 1099 Form without hassle

- Obtain Nc 1099 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred way to deliver your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Nc 1099 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nc 1099 2011 form

Create this form in 5 minutes!

How to create an eSignature for the nc 1099 2011 form

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the purpose of using an itin on w2?

The itin on w2 is essential for individuals who file taxes using an Individual Taxpayer Identification Number instead of a Social Security Number. It allows you to report your income accurately while complying with IRS regulations. airSlate SignNow streamlines the process of obtaining and signing documents related to your itin on w2.

-

How does airSlate SignNow help with filing taxes using itin on w2?

airSlate SignNow provides an efficient way to send and eSign documents that may be required when filing taxes with your itin on w2. Our platform ensures that all paperwork is securely handled and easily accessible. This simplifies your tax filing process, ensuring you're compliant with IRS standards.

-

Is there a cost associated with using airSlate SignNow for creating documents related to itin on w2?

Yes, airSlate SignNow offers various pricing tiers to cater to different business needs. Starting with a free trial, you can explore the features that help generate documents linked to your itin on w2 without initial investment. Our subscription plans provide added value for ongoing use.

-

What features does airSlate SignNow offer for documents involving itin on w2?

airSlate SignNow offers features like customizable templates, automated workflows, and secure eSigning, all tailored to help with documents related to your itin on w2. Our platform enables you to create, share, and manage documents seamlessly while ensuring compliance. This convenience enhances your productivity and document management strategy.

-

Can airSlate SignNow integrate with other software for managing itin on w2 documents?

Absolutely! airSlate SignNow integrates with a variety of third-party applications, such as CRMs and accounting software, to facilitate seamless document management for your itin on w2. This ensures that your workflows remain uninterrupted as you connect multiple tools for a cohesive experience. Streamlining these processes can greatly simplify the handling of tax-related paperwork.

-

How secure is the signing process for documents related to itin on w2 with airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform employs industry-standard encryption and compliance measures to ensure that all documents involving your itin on w2 are secure during the signing process. You can confidently manage sensitive information while maintaining compliance with regulations.

-

What support options are available if I have questions about itin on w2 documents?

airSlate SignNow provides comprehensive support, including FAQs, live chat, and customer service assistance, to address your inquiries regarding documents associated with your itin on w2. Whether you're new to eSigning or have specific questions about the process, our dedicated support team is here to help. We want to ensure you have a smooth experience using our platform.

Get more for Nc 1099 Form

Find out other Nc 1099 Form

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template