Eftps Form Online

What is the EFTPS Form Online

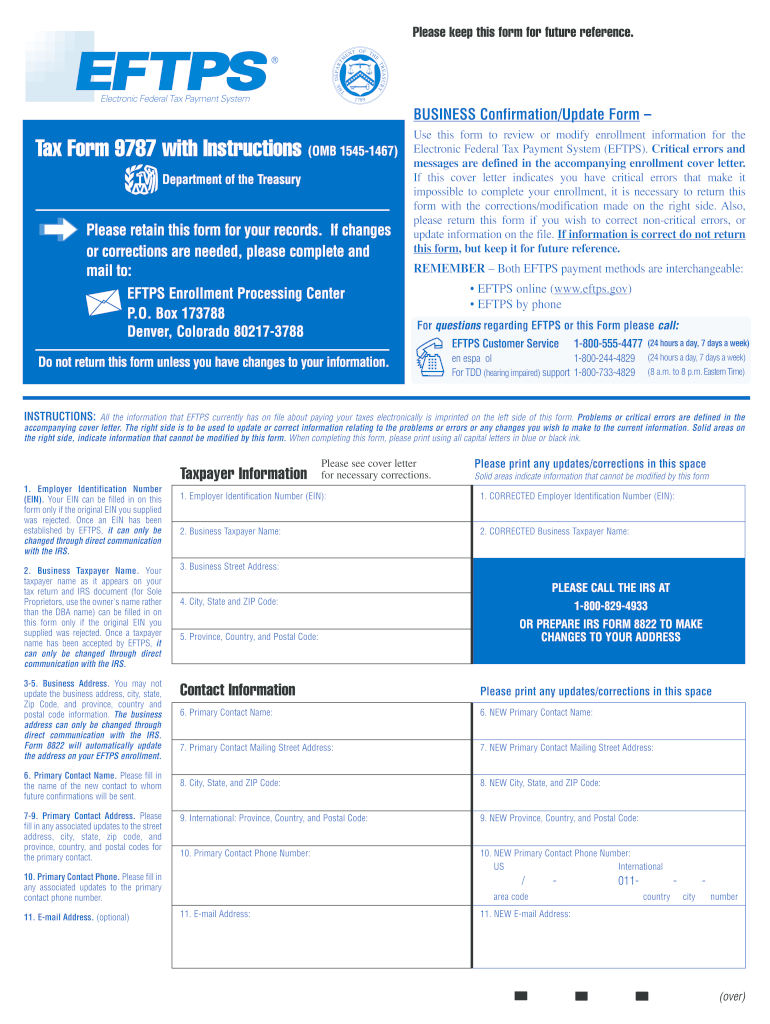

The EFTPS form, specifically the EFTPS 9787 form, is an essential document used for electronic federal tax payment. This form allows businesses and individuals to schedule and make payments to the U.S. Treasury electronically. The EFTPS system is designed to streamline the payment process, ensuring that taxpayers can manage their federal tax obligations efficiently and securely. By utilizing this online form, users can avoid the complexities of traditional payment methods, such as checks or money orders, which can be prone to delays and errors.

How to Use the EFTPS Form Online

Using the EFTPS form online is a straightforward process. First, users need to log into their EFTPS account. If you do not have an account, you must register for one, which involves providing personal and business information. Once logged in, navigate to the section for making payments. Here, you can select the type of payment you wish to make, fill out the required fields, and schedule your payment date. It is crucial to double-check all information entered to ensure accuracy before submission. After completing the form, users will receive a confirmation number, which serves as proof of payment.

Steps to Complete the EFTPS Form Online

Completing the EFTPS form online involves several key steps:

- Log in to your EFTPS account or create a new account if you do not have one.

- Select the option to make a payment.

- Choose the type of payment you are making (e.g., estimated tax, payroll tax).

- Enter the required information, including payment amount and date.

- Review all entered information for accuracy.

- Submit the form and save the confirmation number for your records.

Legal Use of the EFTPS Form Online

The EFTPS form is legally recognized for making federal tax payments. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act ensures that electronic signatures and records are legally binding. By using the EFTPS form online, taxpayers can fulfill their obligations while benefiting from the security and convenience of electronic transactions. It is essential to follow all guidelines set forth by the IRS to ensure that your payments are processed correctly and on time.

Required Documents

When using the EFTPS form, certain documents may be necessary to ensure proper completion. These typically include:

- Your Employer Identification Number (EIN) or Social Security Number (SSN).

- Bank account information for payment processing.

- Details regarding the type of tax payment you are making.

Having these documents ready can facilitate a smoother and more efficient process when filling out the EFTPS form online.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the EFTPS form is crucial for compliance. Payments made using the EFTPS system must be scheduled by specific deadlines to avoid penalties. Generally, payments for estimated taxes are due quarterly, while payroll taxes have different schedules based on your reporting frequency. It is advisable to check the IRS website or consult with a tax professional to stay informed about the latest deadlines and avoid any late fees.

Quick guide on how to complete eftps form online

Complete Eftps Form Online effortlessly on any device

Online document management has become increasingly favored by both businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can obtain the correct format and safely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Eftps Form Online on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Eftps Form Online with ease

- Obtain Eftps Form Online and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Eftps Form Online and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the eftps form online

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the eftps form and how does it work?

The eftps form is an electronic form used by businesses to make tax payments directly to the U.S. Treasury. It allows users to schedule payments online through the EFTPS system, providing a more efficient payment process. By using the eftps form, you can easily manage your tax obligations while ensuring on-time payments.

-

How can I access the eftps form through airSlate SignNow?

To access the eftps form via airSlate SignNow, you first need to create an account on our platform. Once registered, you can upload your eftps form and utilize our eSigning features to streamline the signing process. This ensures that you complete and submit your form efficiently and securely.

-

Is there a cost associated with using the eftps form through airSlate SignNow?

Yes, specific features are available through various pricing tiers on airSlate SignNow. However, our platform offers an affordable solution to handle the eftps form and other document management needs. We encourage you to review our pricing plans to find the best fit for your business requirements.

-

What features does airSlate SignNow offer for managing the eftps form?

airSlate SignNow provides a range of features to effectively manage the eftps form, including easy document uploads, customizable templates, and secure eSigning options. You can also track the status of your forms and receive notifications when they are signed. These features enhance productivity and ensure compliance with tax requirements.

-

Are there any benefits to using airSlate SignNow for the eftps form?

Using airSlate SignNow for the eftps form provides numerous benefits, such as increased efficiency in document processing and the ability to sign forms from anywhere. Additionally, our platform ensures enhanced security for your sensitive data. Overall, it simplifies the tax payment process for businesses of all sizes.

-

Can I integrate airSlate SignNow with other tools for my eftps form?

Yes, airSlate SignNow offers integrations with various third-party applications and software. This allows you to sync your workflows and manage the eftps form alongside your existing tools. Integration can enhance your efficiency and data accuracy when dealing with tax payments.

-

Is it easy to share the eftps form with my team using airSlate SignNow?

Absolutely! airSlate SignNow simplifies the sharing of the eftps form with your team members. You can easily invite colleagues to review and sign the form, ensuring a collaborative approach to managing tax payments within your organization. This promotes teamwork and expedites the completion process.

Get more for Eftps Form Online

Find out other Eftps Form Online

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast