AD 1147SideSide2Update DOC 2005-2026

What is the AD 1147 form?

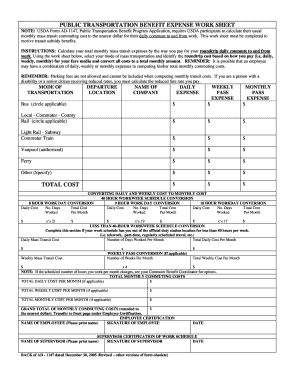

The AD 1147 form, also known as the USDA benefit expense form, is utilized by individuals and organizations to document expenses related to public benefits under USDA programs. This form helps ensure transparency and accountability in the management of funds allocated for agricultural benefits. It plays a crucial role in the financial reporting process, allowing for accurate tracking of expenses and compliance with federal regulations.

Steps to complete the AD 1147 form

Completing the AD 1147 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation that supports the expenses being reported. This may include receipts, invoices, and other financial records. Next, fill out the form by entering the required information in the designated fields, ensuring that all details are accurate and complete. After filling out the form, review it thoroughly for any errors or omissions before submission. Finally, submit the completed form through the appropriate channels, which may include online submission or mailing it to the designated office.

Legal use of the AD 1147 form

The AD 1147 form is legally recognized when completed in accordance with USDA guidelines and federal regulations. To be considered valid, the form must be signed by the authorized individual, and all information provided must be truthful and accurate. Compliance with legal standards is essential to avoid penalties and ensure the legitimacy of the reported expenses. Additionally, maintaining proper records and documentation is vital for any audits or reviews that may occur.

Examples of using the AD 1147 form

There are various scenarios in which the AD 1147 form may be used. For instance, a farmer applying for public assistance may use the form to report expenses related to crop production or livestock management. Similarly, a non-profit organization involved in agricultural education may document expenses incurred during community outreach programs. Each of these examples highlights the form's flexibility in addressing different types of agricultural benefit expenses.

Eligibility Criteria for the AD 1147 form

Eligibility to use the AD 1147 form typically includes individuals or organizations that participate in USDA programs. This may encompass farmers, ranchers, and agricultural cooperatives that receive federal assistance. Additionally, non-profit organizations involved in agricultural initiatives may also qualify. It is essential to review specific program guidelines to determine eligibility, as requirements may vary based on the type of assistance being sought.

Form Submission Methods

The AD 1147 form can be submitted through various methods depending on the requirements set forth by the USDA. Common submission methods include online filing through designated government portals, mailing a physical copy of the form to the appropriate USDA office, or delivering it in person. Each method may have specific guidelines and deadlines, so it is important to follow the instructions provided for the chosen submission method.

Filing Deadlines / Important Dates

Filing deadlines for the AD 1147 form can vary based on the specific USDA program and the type of benefits being claimed. It is crucial to be aware of these deadlines to ensure timely submission and avoid penalties. Typically, deadlines may coincide with the end of the fiscal year or specific program cycles. Keeping track of important dates and maintaining a calendar of deadlines can help ensure compliance and proper management of benefit claims.

Quick guide on how to complete ad 1147sideside2updatedoc

Set Up AD 1147SideSide2Update doc Effortlessly on Any Gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the right form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage AD 1147SideSide2Update doc on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest method to modify and eSign AD 1147SideSide2Update doc with ease

- Obtain AD 1147SideSide2Update doc and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign AD 1147SideSide2Update doc to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ad 1147sideside2updatedoc

Create this form in 5 minutes!

How to create an eSignature for the ad 1147sideside2updatedoc

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to ad1147?

airSlate SignNow is a powerful eSignature solution that simplifies the process of signing and sending documents. With the ad1147 feature, users can efficiently manage document workflows, ensuring a seamless experience from start to finish.

-

How much does airSlate SignNow cost for users looking to leverage ad1147?

Pricing for airSlate SignNow varies depending on the plan selected. Plans that include the ad1147 feature provide excellent value, starting at competitive rates to accommodate businesses of all sizes.

-

What features are included in the ad1147 offering?

The ad1147 feature set includes customizable templates, real-time document tracking, and legally binding eSignatures. These tools enhance user productivity and streamline the signing process for all kinds of documents.

-

How can ad1147 benefit my business?

By implementing the ad1147 feature, your business can reduce turnaround times for document signing and enhance collaboration. This leads to increased efficiency and allows your team to focus on more strategic tasks.

-

Can airSlate SignNow integrate with other software using ad1147?

Yes, airSlate SignNow supports numerous integrations with popular software solutions. With ad1147, you can easily connect your existing platforms and streamline workflows across your business applications.

-

Is ad1147 suitable for businesses of all sizes?

Absolutely! The ad1147 feature is designed to cater to businesses of all sizes, from startups to large enterprises. Its flexibility and scalability make it ideal for any organization looking to improve their document management processes.

-

What security measures does airSlate SignNow implement with ad1147?

airSlate SignNow, with its ad1147 feature, prioritizes security through encryption and secure data storage. Users can feel confident that their documents are protected and compliant with industry standards.

Get more for AD 1147SideSide2Update doc

- Bcbsm subrogation form

- Homeowners recovery fund attorneys north carolina form

- To change the coverage that is listed on your declarations page you may use this form to do so

- Cna form statement

- Acic bail bond forms

- Risceo form

- Pearlinsurancecomrenew form

- Before judging your first debate the world scholars cup form

Find out other AD 1147SideSide2Update doc

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter