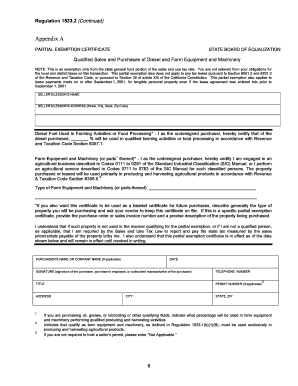

Partial Exemption Certificate Form

What is the Partial Exemption Certificate

The partial exemption certificate is a crucial document used primarily in the context of sales tax in the United States. It allows eligible purchasers to buy specific goods or services without paying sales tax, provided they meet certain criteria. This certificate is particularly relevant for businesses engaged in agriculture, manufacturing, or other sectors where sales tax exemptions apply. By submitting this certificate, purchasers can demonstrate their eligibility for tax relief on qualifying purchases, thereby reducing their overall tax burden.

How to use the Partial Exemption Certificate

Using the partial exemption certificate involves several steps to ensure compliance with state regulations. First, the buyer must complete the certificate accurately, providing all necessary information, including the seller's details and a description of the exempt items. Once filled out, the buyer presents the certificate to the seller at the time of purchase. It's essential for sellers to retain a copy of the certificate for their records, as it serves as proof of the tax-exempt status of the transaction. This process not only facilitates tax savings for the buyer but also ensures that sellers comply with tax laws.

Steps to complete the Partial Exemption Certificate

Completing the partial exemption certificate requires careful attention to detail. Follow these steps:

- Gather necessary information, including your business name, address, and tax identification number.

- Identify the specific items or services that qualify for exemption under your state’s tax laws.

- Fill out the certificate form, ensuring all fields are accurately completed.

- Sign and date the certificate to validate it.

- Provide the completed certificate to the seller at the time of purchase.

By adhering to these steps, you can ensure that your exemption certificate is valid and effective.

Legal use of the Partial Exemption Certificate

The legal use of the partial exemption certificate is governed by state-specific tax laws. It is vital for both buyers and sellers to understand these regulations to avoid potential penalties. The certificate must be used solely for qualifying purchases, and misuse can lead to audits or fines. Sellers should verify the authenticity of the certificate and ensure it is appropriately filled out before allowing tax-exempt sales. Compliance with these legal requirements protects both parties and maintains the integrity of the sales tax system.

Eligibility Criteria

Eligibility for the partial exemption certificate varies by state but generally includes specific criteria that must be met. Common eligibility factors include:

- The purchaser must be a registered business or organization.

- The items purchased must fall under categories exempt from sales tax, such as agricultural supplies or manufacturing equipment.

- The purchaser must use the items in a manner that qualifies for the exemption, such as in production or resale.

Understanding these criteria is essential for businesses to take advantage of available tax savings.

Required Documents

To successfully obtain and use a partial exemption certificate, certain documents are typically required. These may include:

- Proof of business registration or tax identification number.

- Documentation supporting the eligibility for exemption, such as purchase orders or invoices.

- Completed partial exemption certificate form.

Having these documents ready ensures a smooth process for both buyers and sellers when engaging in tax-exempt transactions.

Quick guide on how to complete partial exemption certificate

Effortlessly Prepare Partial Exemption Certificate on Any Device

Digital document management has become increasingly popular among enterprises and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, edit, and electronically sign your documents promptly without any holdups. Manage Partial Exemption Certificate on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

Steps to Edit and eSign Partial Exemption Certificate with Ease

- Find Partial Exemption Certificate and click on Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize important parts of your documents or mask sensitive details with specific tools offered by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet signature.

- Review the information and click the Done button to finalize your changes.

- Select how you wish to send your form, via email, SMS, or a link, or download it to your computer.

Stop worrying about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Partial Exemption Certificate and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the partial exemption certificate

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is a partial exemption certificate?

A partial exemption certificate is a document that allows businesses to claim partial exemption from certain taxes. It helps organizations determine how much tax they need to pay based on specific criteria. Understanding this certificate can streamline your accounting processes and enhance compliance.

-

How can airSlate SignNow assist with partial exemption certificates?

airSlate SignNow provides an efficient platform for managing and signing partial exemption certificates electronically. With our solution, you can easily create, send, and eSign these documents, ensuring that your paperwork is organized and compliant. This simplifies the administrative burden and speeds up the approval process.

-

What are the benefits of using airSlate SignNow for partial exemption certificate management?

Using airSlate SignNow for managing partial exemption certificates offers benefits like improved efficiency, reduced errors, and secure document storage. Our platform allows for quick edits and real-time collaboration, ensuring that all parties are on the same page. You'll save time and resources, making it a cost-effective solution.

-

Are there any integrations that support partial exemption certificates in airSlate SignNow?

Yes, airSlate SignNow integrates with multiple tools that enhance the management of partial exemption certificates. Whether you use accounting software or document management systems, our integrations streamline workflows and improve data accuracy. This interconnected approach ensures seamless handling of your documentation.

-

What pricing options are available for airSlate SignNow when handling partial exemption certificates?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes when managing partial exemption certificates. You can choose from monthly or annual subscriptions, depending on your needs. Our plans are designed to be cost-effective, providing a great return on investment for efficient document management.

-

Can I customize my partial exemption certificates within airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your partial exemption certificates to fit your business requirements. You can add your company logo, modify text fields, and adjust template layouts to ensure that your documents reflect your brand. This makes your communication more professional and personalized.

-

Is there customer support for questions regarding partial exemption certificates?

Yes, airSlate SignNow provides comprehensive customer support for any questions regarding partial exemption certificates. Our team is here to assist you with setup, usage, and troubleshooting. You can access resources, tutorials, and direct support to ensure you make the most out of your experience.

Get more for Partial Exemption Certificate

Find out other Partial Exemption Certificate

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form