INDEPENDENT ACCOUNTANTINTERNAL Form

What is the INDEPENDENT ACCOUNTANTINTERNAL

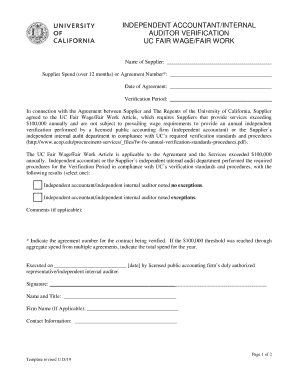

The INDEPENDENT ACCOUNTANTINTERNAL form is a crucial document used primarily by businesses and individuals to establish a formal relationship with an independent accountant. This form outlines the terms of engagement, expectations, and responsibilities of both the accountant and the client. It serves as a foundational agreement that ensures clarity in the services provided, including financial reporting, tax preparation, and advisory services. Understanding this form is essential for both parties to maintain transparency and compliance with applicable regulations.

How to use the INDEPENDENT ACCOUNTANTINTERNAL

Using the INDEPENDENT ACCOUNTANTINTERNAL form involves several steps to ensure that both the accountant and the client are aligned on their roles and responsibilities. First, both parties should review the form carefully to understand the terms outlined. Next, it is essential to fill out the required sections accurately, including details about the services to be provided and any specific terms regarding fees and payment schedules. After completing the form, both parties should sign it to formalize the agreement. Retaining a copy of the signed document is advisable for future reference.

Steps to complete the INDEPENDENT ACCOUNTANTINTERNAL

Completing the INDEPENDENT ACCOUNTANTINTERNAL form involves a systematic approach to ensure all necessary information is accurately provided. Follow these steps:

- Review the form to understand its requirements.

- Provide your personal or business information, including name, address, and contact details.

- Clearly outline the services you expect from the accountant.

- Specify the fee structure and payment terms.

- Include any additional clauses that may be relevant to your specific situation.

- Both parties should sign and date the form to validate the agreement.

Legal use of the INDEPENDENT ACCOUNTANTINTERNAL

The legal use of the INDEPENDENT ACCOUNTANTINTERNAL form is significant in establishing a binding agreement between the accountant and the client. For the form to be legally enforceable, it must comply with relevant regulations and include essential elements such as signatures, dates, and clear terms of engagement. It is advisable to consult legal counsel to ensure that the form meets all necessary legal standards, particularly if the services involve complex financial matters or sensitive information.

Key elements of the INDEPENDENT ACCOUNTANTINTERNAL

Several key elements must be included in the INDEPENDENT ACCOUNTANTINTERNAL form to ensure it is comprehensive and effective. These elements typically include:

- Identification of parties: Names and contact information of both the accountant and the client.

- Scope of services: A detailed description of the services to be provided.

- Fee structure: Clear terms regarding payment, including rates and due dates.

- Confidentiality clause: Provisions to protect sensitive information shared during the engagement.

- Termination conditions: Guidelines on how either party can terminate the agreement.

Examples of using the INDEPENDENT ACCOUNTANTINTERNAL

Examples of using the INDEPENDENT ACCOUNTANTINTERNAL form can vary based on the specific needs of the client and the accountant. For instance, a small business may use the form to outline the terms of a yearly financial review, specifying the services to be rendered and the fees involved. Alternatively, an individual seeking tax preparation services may use the form to detail the scope of work, including filing state and federal returns. These examples illustrate how the form can be tailored to fit different scenarios while maintaining a clear understanding of the relationship between the parties involved.

Quick guide on how to complete independent accountantinternal

Complete INDEPENDENT ACCOUNTANTINTERNAL effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed materials, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly and without delays. Manage INDEPENDENT ACCOUNTANTINTERNAL on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to alter and eSign INDEPENDENT ACCOUNTANTINTERNAL with ease

- Find INDEPENDENT ACCOUNTANTINTERNAL and then click Get Form to commence.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign INDEPENDENT ACCOUNTANTINTERNAL and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the independent accountantinternal

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow and how does it benefit an INDEPENDENT ACCOUNTANTINTERNAL?

airSlate SignNow is a digital document management platform that simplifies the process of sending and eSigning documents. For an INDEPENDENT ACCOUNTANTINTERNAL, it provides a cost-effective solution to streamline workflows, reduce administrative burden, and enhance client communication. This efficiency allows accountants to focus more on providing value to their clients rather than handling paperwork.

-

How much does airSlate SignNow cost for an INDEPENDENT ACCOUNTANTINTERNAL?

airSlate SignNow offers various pricing plans tailored to different business needs, including options for an INDEPENDENT ACCOUNTANTINTERNAL. The pricing is competitive and designed to fit within the budget of individual professionals and small firms. Additionally, the cost-effectiveness of the platform can lead to savings in time and resources, providing excellent value.

-

What features does airSlate SignNow provide for an INDEPENDENT ACCOUNTANTINTERNAL?

airSlate SignNow comes equipped with features like templates, customizable workflows, and secure eSignature options that cater specifically to the needs of an INDEPENDENT ACCOUNTANTINTERNAL. These capabilities help automate routine tasks, ensure compliance with legal standards, and improve client satisfaction by providing a seamless signing experience. With its user-friendly interface, accountants can easily manage multiple documents in one place.

-

Can airSlate SignNow integrate with accounting software used by an INDEPENDENT ACCOUNTANTINTERNAL?

Yes, airSlate SignNow offers integration with popular accounting software, making it easier for an INDEPENDENT ACCOUNTANTINTERNAL to manage documents alongside their financial tasks. By integrating with tools like QuickBooks or Xero, accountants can streamline their workflows, reduce errors, and enhance productivity. This interoperability is essential for maintaining effective operational processes.

-

Is airSlate SignNow secure for handling sensitive documents for an INDEPENDENT ACCOUNTANTINTERNAL?

Absolutely, airSlate SignNow prioritizes security and compliance, making it an ideal choice for an INDEPENDENT ACCOUNTANTINTERNAL who needs to handle sensitive documents. The platform employs industry-standard encryption and complies with regulations such as GDPR and HIPAA. This means accountants can send and store client information with confidence, knowing their data is protected.

-

How does airSlate SignNow improve client communication for an INDEPENDENT ACCOUNTANTINTERNAL?

airSlate SignNow enhances client communication for an INDEPENDENT ACCOUNTANTINTERNAL by providing real-time notifications and tracking features. This ensures that both the accountant and their clients are updated on the status of documents, reducing miscommunication and delays. The immediate feedback loop created by eSigning also leads to quicker decision-making, improving overall client relationships.

-

What kind of customer support does airSlate SignNow offer for an INDEPENDENT ACCOUNTANTINTERNAL?

airSlate SignNow offers comprehensive customer support tailored for users, including an INDEPENDENT ACCOUNTANTINTERNAL. Support options include live chat, email assistance, and a detailed knowledge base to help users quickly resolve any issues. This commitment to customer service ensures accountants can utilize the platform effectively and reduce downtime in their operations.

Get more for INDEPENDENT ACCOUNTANTINTERNAL

- Personal representative deed new mexico form

- 4 wheeler bill form

- New jersey legal last will and testament form for married person with minor children

- Cohabitation agreement form

- Power of attorney for bank account form

- Ohio request for notice of commencement corporation form

- Expungement forms

- Texas bill of sale camper form

Find out other INDEPENDENT ACCOUNTANTINTERNAL

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast