BUSINESS CREDIT CARD APPLICATION Village Bank 2019-2026

What is the BUSINESS CREDIT CARD APPLICATION Village Bank

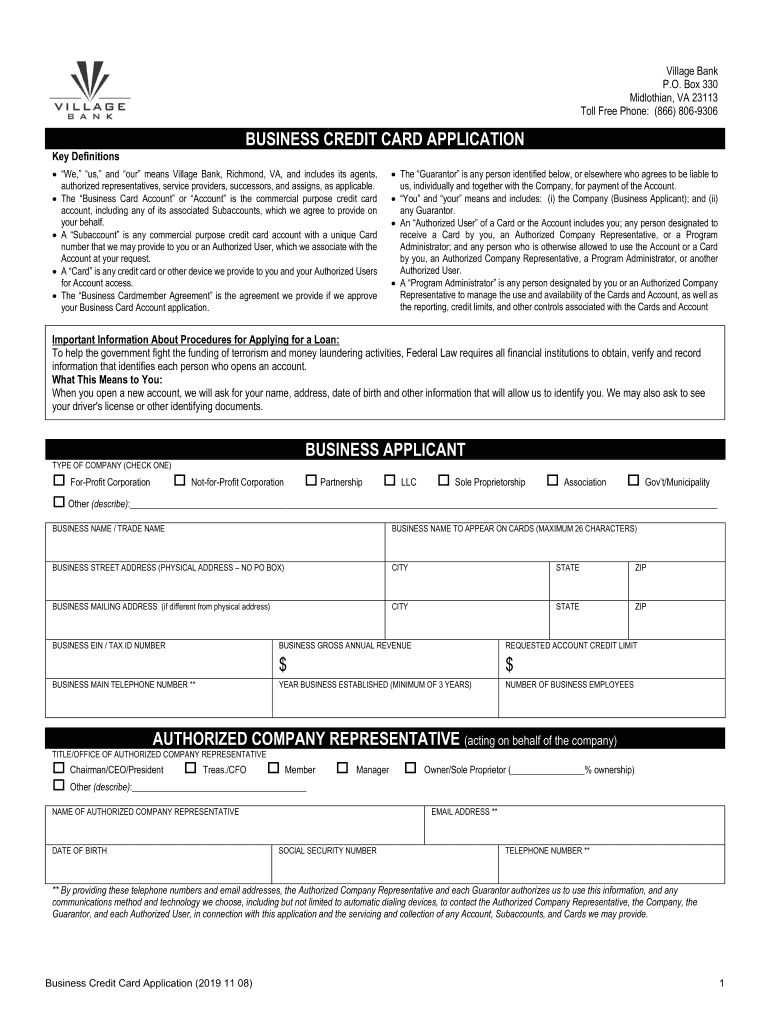

The BUSINESS CREDIT CARD APPLICATION Village Bank is a formal document that allows businesses to apply for a credit card issued by Village Bank. This application is essential for companies seeking to manage expenses, improve cash flow, and build business credit. Completing this application requires providing detailed information about the business, including its legal structure, financial history, and ownership details. The application process is designed to assess the creditworthiness of the business and its ability to repay borrowed funds.

Steps to complete the BUSINESS CREDIT CARD APPLICATION Village Bank

Completing the BUSINESS CREDIT CARD APPLICATION Village Bank involves several key steps:

- Gather necessary information: Collect details about your business, including its legal name, address, and tax identification number.

- Provide financial information: Include your business's annual revenue, expenses, and existing debts to give a clear picture of its financial health.

- List owners and authorized users: Identify all owners and any individuals who will have access to the credit card.

- Review terms and conditions: Carefully read the terms associated with the credit card, including interest rates and fees.

- Submit the application: Once all information is accurately filled out, submit the application online or via mail as instructed by Village Bank.

Eligibility Criteria

To qualify for the BUSINESS CREDIT CARD APPLICATION Village Bank, certain eligibility criteria must be met. These typically include:

- The business must be a registered entity in the United States.

- Applicants should have a minimum credit score, often around 650 or higher, depending on the bank's policies.

- The business should have been operating for a specific period, usually at least six months.

- Financial documentation, such as tax returns and bank statements, may be required to verify income and expenses.

Legal use of the BUSINESS CREDIT CARD APPLICATION Village Bank

The BUSINESS CREDIT CARD APPLICATION Village Bank must be completed in accordance with applicable laws and regulations. This includes ensuring that all information provided is accurate and truthful. Misrepresentation or fraud can lead to severe penalties, including denial of the application or legal action. Additionally, the application must comply with federal and state regulations regarding credit and lending practices, ensuring that the rights of the applicant are protected throughout the process.

How to obtain the BUSINESS CREDIT CARD APPLICATION Village Bank

The BUSINESS CREDIT CARD APPLICATION Village Bank can be obtained through various channels:

- Online: Visit the Village Bank website to download the application form or fill it out electronically.

- In-branch: Visit a local Village Bank branch to request a physical copy of the application.

- Customer service: Contact Village Bank's customer service for assistance in obtaining the application.

Application Process & Approval Time

The application process for the BUSINESS CREDIT CARD APPLICATION Village Bank typically involves several stages:

- Submission: After completing the application, submit it through the chosen method.

- Review: Village Bank will review the application, which may take a few business days.

- Approval or denial: You will receive notification regarding the approval status. If approved, the card will be issued shortly thereafter.

The total approval time can vary but generally ranges from one week to several weeks, depending on the complexity of the application and the bank's processing times.

Quick guide on how to complete business credit card application village bank

Effortlessly Prepare BUSINESS CREDIT CARD APPLICATION Village Bank on Any Device

The management of online documents has become increasingly favored by both enterprises and individuals. It offers a prime environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage BUSINESS CREDIT CARD APPLICATION Village Bank on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered procedure today.

The Easiest Way to Alter and Electronically Sign BUSINESS CREDIT CARD APPLICATION Village Bank with Ease

- Acquire BUSINESS CREDIT CARD APPLICATION Village Bank and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements for document management in just a few clicks from your chosen device. Edit and electronically sign BUSINESS CREDIT CARD APPLICATION Village Bank and promote outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business credit card application village bank

Create this form in 5 minutes!

How to create an eSignature for the business credit card application village bank

The way to generate an eSignature for your PDF file online

The way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What are the key features of the BUSINESS CREDIT CARD APPLICATION Village Bank?

The BUSINESS CREDIT CARD APPLICATION Village Bank offers a range of features including robust spending controls, flexible payment options, and integrated expense tracking. These features help businesses manage their finances more efficiently and streamline their payment processes.

-

How does the BUSINESS CREDIT CARD APPLICATION Village Bank benefit small businesses?

Small businesses can greatly benefit from the BUSINESS CREDIT CARD APPLICATION Village Bank as it provides access to credit without the stringent requirements of traditional loans. Additionally, it offers rewards and cashback opportunities that can contribute positively to cash flow.

-

What are the pricing options for the BUSINESS CREDIT CARD APPLICATION Village Bank?

The BUSINESS CREDIT CARD APPLICATION Village Bank typically features competitive pricing structures with no annual fees and transparent interest rates. This allows businesses to effectively budget their expenses and capital without hidden costs.

-

Are there any integration options with the BUSINESS CREDIT CARD APPLICATION Village Bank?

Yes, the BUSINESS CREDIT CARD APPLICATION Village Bank can integrate with various financial management software and accounting tools. This integration enhances the ease of tracking expenses and managing business finances in one centralized location.

-

Can I manage multiple users with the BUSINESS CREDIT CARD APPLICATION Village Bank?

Absolutely! The BUSINESS CREDIT CARD APPLICATION Village Bank allows businesses to set up multiple user accounts, which helps in managing employee spending. Administrators can set different spending limits and monitor transactions for better control.

-

Is there customer support available for the BUSINESS CREDIT CARD APPLICATION Village Bank?

Yes, customer support for the BUSINESS CREDIT CARD APPLICATION Village Bank is readily available through multiple channels, including phone, chat, and email. Their support team is equipped to assist you with any inquiries or issues related to your credit card.

-

How long does it take to get approved for the BUSINESS CREDIT CARD APPLICATION Village Bank?

The approval process for the BUSINESS CREDIT CARD APPLICATION Village Bank is typically quick, often taking just a few business days. This allows businesses to access the credit they need without unnecessary delays.

Get more for BUSINESS CREDIT CARD APPLICATION Village Bank

- Hmaa credentialing application form

- United healthcare insurance online w 9 form

- Application for additional classification contractor fill form

- Universal pain fellowship application form

- Authorization to release records form

- Mazzios online application form

- Corporate membership contract form

- Edmonton airports application form eia corporate

Find out other BUSINESS CREDIT CARD APPLICATION Village Bank

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document