Offer in Compromise Short Form Form OIC 1S Etax Dor Ga

Understanding the Offer In Compromise Short Form

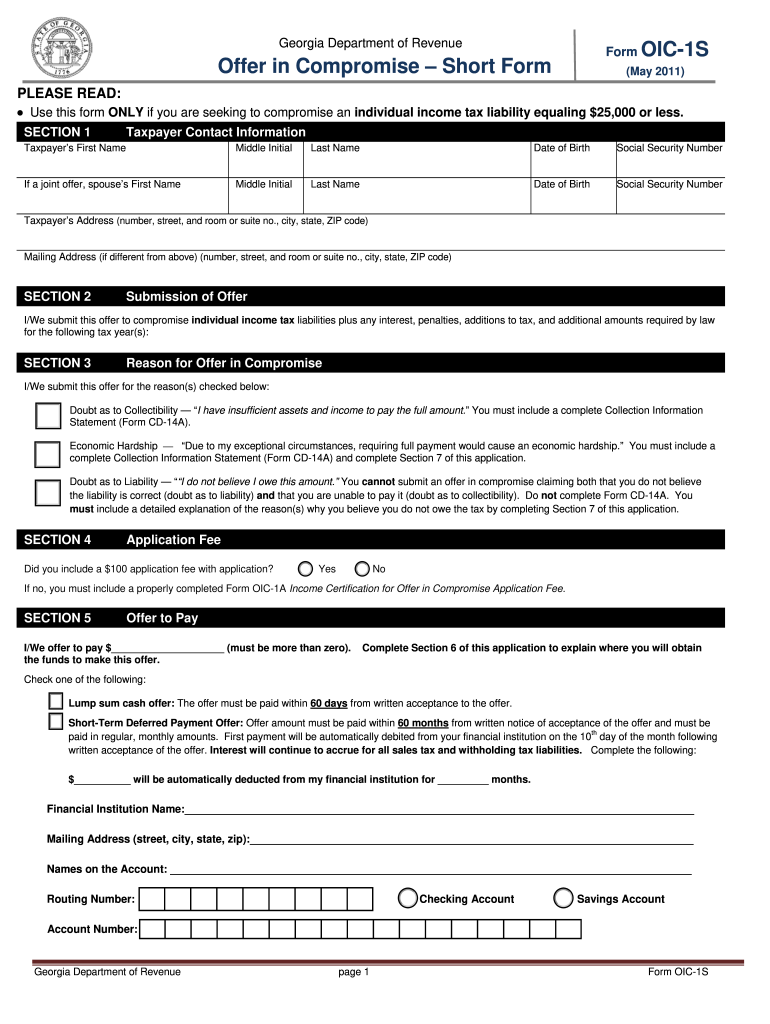

The Offer In Compromise Short Form, also known as Form OIC 1S, is a tax relief option provided by the Georgia Department of Revenue. It allows taxpayers to settle their tax debts for less than the full amount owed. This form is particularly beneficial for individuals who may be facing financial hardships and cannot pay their tax liabilities in full. By submitting this form, taxpayers can negotiate a lower tax amount based on their financial situation, making it a vital tool for managing tax obligations effectively.

Steps to Complete the Offer In Compromise Short Form

Completing the Offer In Compromise Short Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense reports, and asset information. Next, fill out the form with precise details about your financial situation, including your ability to pay and any special circumstances. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form to the Georgia Department of Revenue along with any required documentation. Ensuring that all information is accurate will help facilitate a smoother review process.

Eligibility Criteria for the Offer In Compromise Short Form

To qualify for the Offer In Compromise Short Form, taxpayers must meet specific eligibility criteria set by the Georgia Department of Revenue. Generally, applicants should demonstrate an inability to pay their tax debt in full due to financial hardship. This may include factors such as unemployment, medical expenses, or other significant financial burdens. Additionally, taxpayers must be current with all tax filings and not have any pending tax disputes. Meeting these criteria is essential for the acceptance of the offer and can significantly impact the outcome of the application.

Required Documents for Submission

When submitting the Offer In Compromise Short Form, several documents are required to support your application. These typically include proof of income, such as pay stubs or tax returns, documentation of monthly expenses, and information regarding any assets owned. It is crucial to provide comprehensive and accurate documentation to substantiate your financial claims. Failure to include required documents may delay the review process or result in denial of the offer.

Form Submission Methods

Taxpayers have various options for submitting the Offer In Compromise Short Form. The form can be submitted online through the Georgia Department of Revenue's electronic filing system, which offers a convenient and efficient method for application. Alternatively, taxpayers may choose to submit the form by mail, ensuring that all required documents are included. In-person submissions are also an option, allowing for direct interaction with department representatives. Each submission method has its benefits, and taxpayers should choose the one that best suits their needs.

Legal Use of the Offer In Compromise Short Form

The Offer In Compromise Short Form is legally recognized as a valid means for settling tax debts under specific circumstances. To ensure that the offer is legally binding, it must comply with all applicable state and federal regulations regarding tax settlements. This includes adhering to the guidelines set forth by the Georgia Department of Revenue and demonstrating a genuine inability to pay the full tax amount. Understanding the legal implications of submitting this form can help taxpayers navigate the process more effectively and avoid potential pitfalls.

Quick guide on how to complete offer in compromise short form form oic 1s etax dor ga

Accomplish Offer In Compromise Short Form Form OIC 1S Etax Dor Ga seamlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Offer In Compromise Short Form Form OIC 1S Etax Dor Ga on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to alter and electronically sign Offer In Compromise Short Form Form OIC 1S Etax Dor Ga effortlessly

- Locate Offer In Compromise Short Form Form OIC 1S Etax Dor Ga and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would prefer to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Offer In Compromise Short Form Form OIC 1S Etax Dor Ga and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the offer in compromise short form form oic 1s etax dor ga

How to create an eSignature for your Offer In Compromise Short Form Form Oic 1s Etax Dor Ga online

How to create an electronic signature for your Offer In Compromise Short Form Form Oic 1s Etax Dor Ga in Chrome

How to generate an eSignature for putting it on the Offer In Compromise Short Form Form Oic 1s Etax Dor Ga in Gmail

How to make an electronic signature for the Offer In Compromise Short Form Form Oic 1s Etax Dor Ga from your mobile device

How to generate an electronic signature for the Offer In Compromise Short Form Form Oic 1s Etax Dor Ga on iOS

How to create an eSignature for the Offer In Compromise Short Form Form Oic 1s Etax Dor Ga on Android

People also ask

-

What is the Offer In Compromise Short Form Form OIC 1S Etax Dor Ga?

The Offer In Compromise Short Form Form OIC 1S Etax Dor Ga is a tax resolution application that allows eligible taxpayers in Georgia to settle their tax debts for less than the full amount owed. This form facilitates a streamlined process for reducing financial liability through an official agreement with the Georgia Department of Revenue.

-

How can I complete the Offer In Compromise Short Form Form OIC 1S Etax Dor Ga using airSlate SignNow?

You can easily complete the Offer In Compromise Short Form Form OIC 1S Etax Dor Ga by utilizing airSlate SignNow’s intuitive document management platform. Simply upload your form, fill in the required details, and eSign electronically to submit your application smoothly and securely.

-

Are there any fees associated with submitting the Offer In Compromise Short Form Form OIC 1S Etax Dor Ga?

Yes, there may be fees associated with submitting the Offer In Compromise Short Form Form OIC 1S Etax Dor Ga. These fees can vary based on your specific tax situation and the amount of tax debt involved, so it’s advisable to review the Georgia Department of Revenue guidelines or consult a tax professional.

-

What are the benefits of using airSlate SignNow for my Offer In Compromise Short Form Form OIC 1S Etax Dor Ga application?

Using airSlate SignNow for your Offer In Compromise Short Form Form OIC 1S Etax Dor Ga application provides you with an easy-to-use platform that simplifies the eSigning process. It enhances efficiency, saves time, and ensures that your documents are securely stored and easily accessible whenever needed.

-

Can I track the status of my Offer In Compromise Short Form Form OIC 1S Etax Dor Ga application?

Absolutely! After submitting your Offer In Compromise Short Form Form OIC 1S Etax Dor Ga through airSlate SignNow, you can track the status of your application directly from your dashboard. This feature allows you to stay informed about the progress and any necessary follow-ups.

-

Does airSlate SignNow integrate with other tax software for processing the Offer In Compromise Short Form Form OIC 1S Etax Dor Ga?

Yes, airSlate SignNow offers integrations with various tax software platforms, enabling you to process the Offer In Compromise Short Form Form OIC 1S Etax Dor Ga seamlessly. This ensures that you can manage all your tax documents efficiently without switching between different tools.

-

What types of businesses can benefit from filing the Offer In Compromise Short Form Form OIC 1S Etax Dor Ga?

Any business struggling with tax liabilities may benefit from filing the Offer In Compromise Short Form Form OIC 1S Etax Dor Ga. This form is particularly useful for small to mid-sized businesses that need a viable solution for managing tax debts and improving cash flow.

Get more for Offer In Compromise Short Form Form OIC 1S Etax Dor Ga

- Fillable online subp 010 deposition subpoena for form

- Fmcsa form mcs 150b combined motor carrier identification report and hm permit application application for usdot number

- Inspection district office mido faa form

- Inspection authorization renewal course online ia renewal form

- Fill free fillable wisconsin dnr form 3400 220 dsa pdf

- Epa printable form 8500 27

- C304 ticket booklet application massgov mass form

- Da 4836 form

Find out other Offer In Compromise Short Form Form OIC 1S Etax Dor Ga

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy