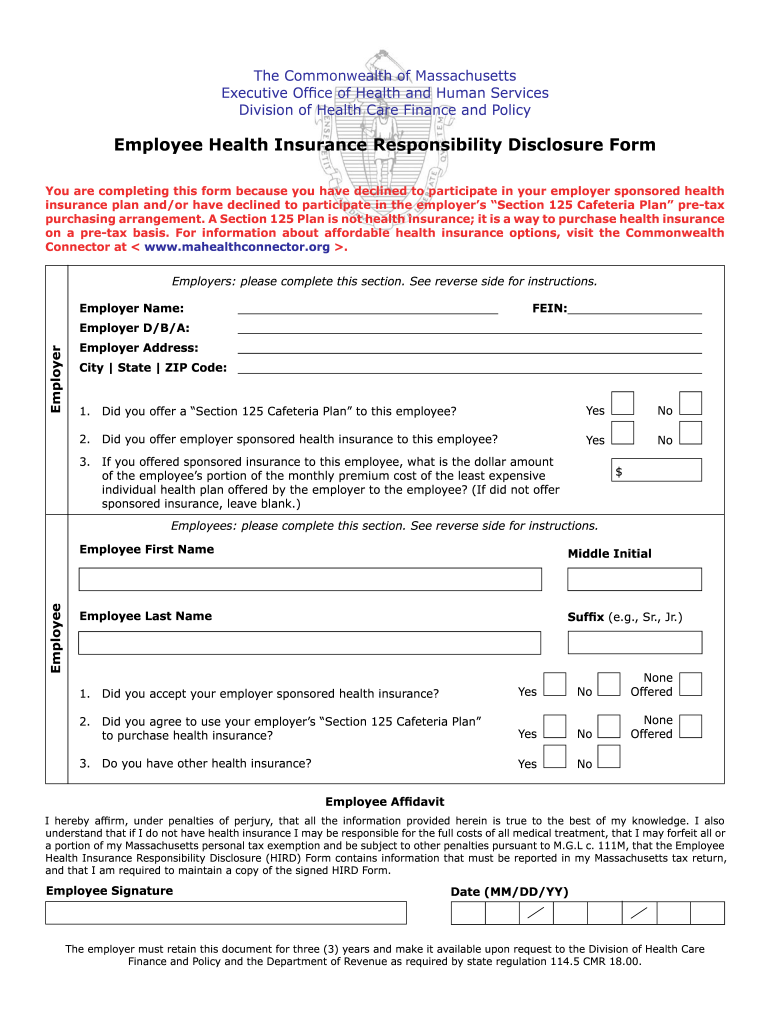

Employee Health Insurance Responsibility Disclosure Form

What is the Employee Health Insurance Responsibility Disclosure Form

The Employee Health Insurance Responsibility Disclosure Form, often referred to as the MA insurance form, is a crucial document used in Massachusetts to inform employees about their health insurance options and responsibilities. This form outlines the employer's obligation to provide health insurance coverage and details the employee's rights and responsibilities regarding health insurance enrollment. It is essential for ensuring compliance with state regulations and for maintaining transparency between employers and employees regarding health insurance matters.

How to use the Employee Health Insurance Responsibility Disclosure Form

Using the Employee Health Insurance Responsibility Disclosure Form involves a straightforward process. Employers must provide this form to their employees during the onboarding process or whenever there are changes to health insurance policies. Employees should carefully review the information provided, including coverage options and any associated costs. It is important for employees to understand their rights and responsibilities, including deadlines for enrollment and the implications of not enrolling in a health insurance plan.

Steps to complete the Employee Health Insurance Responsibility Disclosure Form

Completing the Employee Health Insurance Responsibility Disclosure Form involves several key steps:

- Obtain the form from your employer or the designated HR representative.

- Review the information regarding available health insurance plans and coverage options.

- Fill in your personal details, including your name, address, and any dependent information.

- Sign and date the form to acknowledge your understanding of the provided information.

- Submit the completed form to your employer or HR department by the specified deadline.

Key elements of the Employee Health Insurance Responsibility Disclosure Form

The Employee Health Insurance Responsibility Disclosure Form includes several key elements that are vital for both employers and employees. These elements typically consist of:

- Employer's name and contact information.

- Employee's personal information, including any dependents.

- Details of the health insurance plans offered, including coverage levels and costs.

- Information on employee responsibilities regarding enrollment and payment.

- Signature line for the employee to acknowledge receipt and understanding of the information.

Legal use of the Employee Health Insurance Responsibility Disclosure Form

The legal use of the Employee Health Insurance Responsibility Disclosure Form is governed by state regulations in Massachusetts. Employers are required to provide this form to ensure compliance with the Massachusetts health insurance laws. Failure to provide this form may result in penalties for employers and could affect employees' access to necessary health insurance coverage. It is important for both parties to understand their rights and obligations as outlined in this document.

Disclosure Requirements

Disclosure requirements for the Employee Health Insurance Responsibility Disclosure Form mandate that employers provide clear and comprehensive information about health insurance options. This includes details on:

- The types of health insurance plans available.

- Eligibility criteria for each plan.

- Enrollment deadlines and procedures.

- Any costs associated with coverage, including premiums and deductibles.

Employers must ensure that this information is communicated effectively to all employees to promote informed decision-making regarding their health insurance options.

Quick guide on how to complete employee health insurance responsibility disclosure form

Explore the simpler approach to manage your Employee Health Insurance Responsibility Disclosure Form

The traditional techniques for finalizing and validating documents consume an excessive amount of time compared to contemporary document management tools. Previously, you would search for suitable forms, print them, fill in all the details, and send them through the mail. Now, you can locate, fill out, and sign your Employee Health Insurance Responsibility Disclosure Form all within a single browser window using airSlate SignNow. Setting up your Employee Health Insurance Responsibility Disclosure Form has never been easier.

Steps to finalize your Employee Health Insurance Responsibility Disclosure Form with airSlate SignNow

- Navigate to the category page you require and locate your state-specific Employee Health Insurance Responsibility Disclosure Form. Alternatively, utilize the search bar.

- Ensure the version of the form is accurate by previewing it.

- Hit Get form to enter the editing mode.

- Fill your document with the necessary details using the editing tools.

- Review the entered information and click the Sign option to authorize your form.

- Choose the most convenient method to create your signature: generate it, draw it, or upload an image of it.

- Click DONE to confirm the modifications.

- Download the document to your device or go to Sharing settings for electronic dispatch.

Efficient online tools like airSlate SignNow simplify the processes of completing and submitting your forms. Give it a try to discover just how efficient document management and approval processes are meant to be. You'll save a signNow amount of time.

Create this form in 5 minutes or less

FAQs

-

How much time and money does it take for a new startup (<50 employees) to fill out the paperwork to become a group for the purpose of negotiating for health insurance for their founders and employees?

I'm not sure if this is a purely exploratory question or if you're inferring that you're planning on navigating the group health insurance market without the assistance of a broker. If the latter, I'd caution against it for several reasons (which I'll omit for now for the sake of brevity).To get a group quote, generally all that's needed is an employee census. Some states apply a modifier to the rate depending on the overall health of the group members (for a very accurate quote, employees may need to fill out general health statements).Obtaining rates themselves can take a few minutes (for states like CA which don't have a signNow health modifier) to several days.I suspect your cor question is the time/effort required once you've determined the most appropriate plan design for your company. This is variable depending on how cohesive your employee base is.Best case scenario - if all employees are in one location and available at the same time, I could bring an enrollment team and get all the paperwork done in the course of 1-3 hours depending on the size of your group. In the vast majority of cases, the employer's paperwork is typically around 6 pages of information, and the employee applications about 4-8 pages. Individually none of them take more than several minutes to complete.Feel free to contact me directly if you have specific questions or concerns.

-

Do the HIPAA laws prohibit Health Insurance companies from allowing members to fill out and submit medical claim forms on line?

No, nothing in HIPAA precludes collecting the claim information online.However, the information needs to be protected at rest as well as in-flight. This is typically done by encrypting the connection (HTTPS) as well the storage media

-

What are some reasons that a health insurance company would ask for a pre-authorization form to be filled out by a Dr. before filling a prescription?

One common reason would be that there is a cheaper, therapeutically equivalent drug that they would like you to try first before they approve a claim for the prescribed drug. Another reason is that they want to make sure the prescribed drug is medically necessary.Remember that nothing is stopping you from filling the prescribed drug. It just won't be covered by insurance until the pre-authorization process is complete.

-

Can someone provide me the property disclosure form which is to be filled out by the employees of the UP government as per the instructions by the new CM?

It will be available in the UP Government website. Further you can email or tweet to the Chief Minister of UP requesting for the particular information. The CM is a committed social worker and leads the life a yogi, so everything is transparent about him and his Government.

-

In what cases do you have to fill out an insurance claim form?

Ah well let's see. An insurance claim form is used to make a claim against your insurance for financial, repair or replacement of something depending on your insurance. Not everything will qualify so you actually have to read the small print.

Create this form in 5 minutes!

How to create an eSignature for the employee health insurance responsibility disclosure form

How to create an electronic signature for your Employee Health Insurance Responsibility Disclosure Form in the online mode

How to generate an electronic signature for your Employee Health Insurance Responsibility Disclosure Form in Chrome

How to make an electronic signature for putting it on the Employee Health Insurance Responsibility Disclosure Form in Gmail

How to create an electronic signature for the Employee Health Insurance Responsibility Disclosure Form from your smart phone

How to generate an electronic signature for the Employee Health Insurance Responsibility Disclosure Form on iOS

How to make an electronic signature for the Employee Health Insurance Responsibility Disclosure Form on Android OS

People also ask

-

What is the MA insurance form, and why is it important?

The MA insurance form is a crucial document for individuals seeking health insurance in Massachusetts. It helps in evaluating eligibility and enrollment in various health plans, ensuring your needs are met. Utilizing airSlate SignNow simplifies the signing process, making it easy to submit your MA insurance form efficiently.

-

How can airSlate SignNow assist with completing the MA insurance form?

AirSlate SignNow offers a user-friendly platform to fill out and eSign the MA insurance form quickly. Our intuitive interface allows you to upload necessary documents, fill in required fields, and secure your eSignature. This streamlines the submission process, saving you valuable time.

-

Is there a cost associated with using airSlate SignNow for the MA insurance form?

Yes, airSlate SignNow offers flexible pricing plans designed to suit different business needs, including affordable options for managing the MA insurance form. You can select a plan that fits your budget while benefiting from our robust features. A trial period might also be available to explore the platform's capabilities.

-

Can I integrate airSlate SignNow with other applications while handling the MA insurance form?

Certainly! airSlate SignNow allows seamless integrations with various applications, enhancing your ability to manage the MA insurance form. Whether you use CRM systems, document management tools, or email services, our platform works well with your existing software ecosystem.

-

What are the main benefits of using airSlate SignNow for the MA insurance form?

By using airSlate SignNow for the MA insurance form, you gain access to a secure, efficient, and cost-effective solution for document management. The platform reduces the time spent on paperwork and minimizes errors, ensuring a smooth signing experience. Moreover, our compliance features keep your documents secure and legally valid.

-

How does airSlate SignNow ensure the security of my MA insurance form?

AirSlate SignNow employs advanced encryption and secure storage protocols to protect your MA insurance form. Our platform ensures that only authorized users have access to sensitive information. Regular security audits also help maintain high standards of data protection and privacy.

-

What if I encounter issues while using airSlate SignNow for my MA insurance form?

If you face any issues while using airSlate SignNow for the MA insurance form, our customer support team is readily available to assist you. We provide comprehensive resources, including tutorials and FAQs, to guide you through common concerns. Additionally, our support staff is just a message away for more complex queries.

Get more for Employee Health Insurance Responsibility Disclosure Form

- Instructions for completing the statement of information no change form llc 12nc

- Dfec authorization templates doldfec authorization templates doldfec authorization templates doldfec general medical dol form

- Seneca withdrawal form

- Application for kentucky certified birth certificate form

- Medical authorization dme form

- Instructions for form cr a nycgov

- 70 gg607 7hb99iac a form

- Amp form

Find out other Employee Health Insurance Responsibility Disclosure Form

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online