Kansas Tr Revenue Form

What is the Kansas Tr Revenue?

The Kansas Tr Revenue refers to the revenue generated from the taxation of vehicle transactions within the state of Kansas. This revenue is crucial for funding state infrastructure, public services, and other essential programs. The revenue is collected through various forms, including the Kansas title form, which documents the transfer of vehicle ownership and is associated with the state’s title sales. Understanding this revenue is vital for both individuals and businesses involved in vehicle sales and purchases.

Key elements of the Kansas Tr Revenue

The Kansas Tr Revenue encompasses several key elements that are important for compliance and understanding the financial implications of vehicle transactions. These elements include:

- Sales Tax: A percentage of the sale price of the vehicle that is collected by the state.

- Title Fees: Fees associated with the issuance of a new title for the vehicle, which may vary based on the vehicle type.

- Registration Fees: Costs incurred for the registration of the vehicle, which are typically renewed annually.

- Transfer Fees: Charges applied when ownership of the vehicle is transferred from one party to another.

Steps to complete the Kansas Tr Revenue

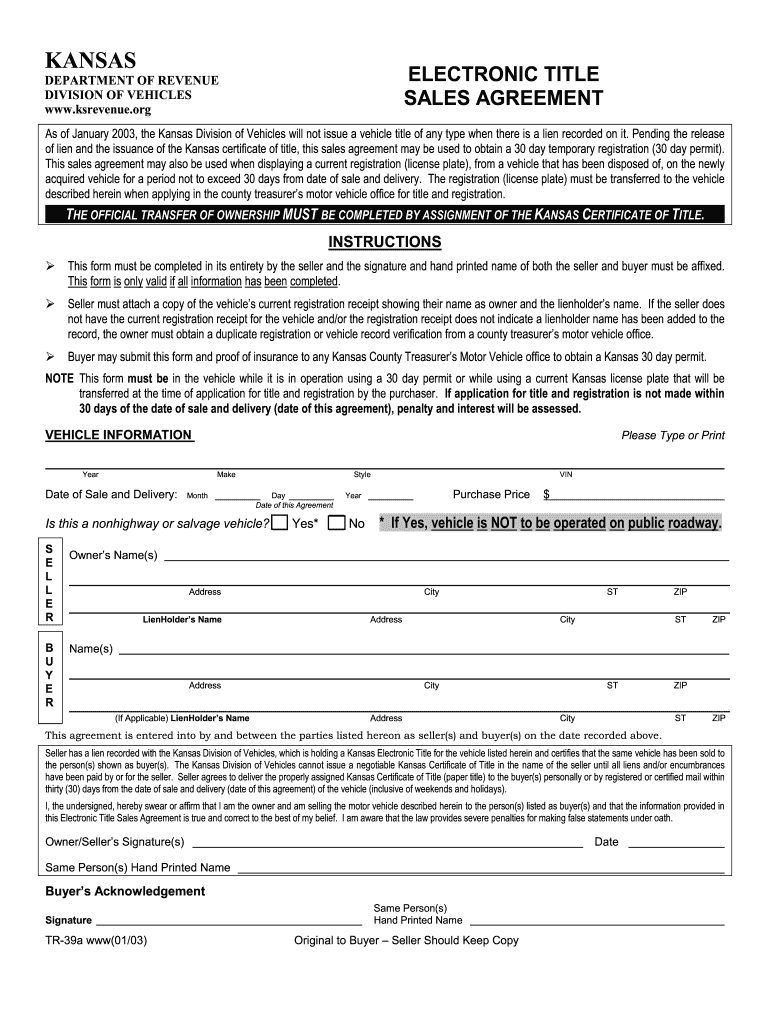

Completing the Kansas Tr Revenue process involves several steps to ensure compliance with state regulations. The following steps should be followed:

- Gather necessary documentation, including proof of purchase, previous title, and identification.

- Complete the Kansas title form, ensuring all information is accurate and complete.

- Calculate applicable taxes and fees based on the vehicle's sale price and type.

- Submit the completed form along with payment to the appropriate state agency, either online or in person.

- Receive confirmation and documentation of the transaction for your records.

Legal use of the Kansas Tr Revenue

The legal use of the Kansas Tr Revenue is governed by state laws and regulations that outline how vehicle transactions must be conducted. Compliance with these laws is essential to avoid penalties and ensure that all transactions are valid. This includes accurately reporting sales tax, completing the necessary forms, and adhering to deadlines for submission. Failure to comply can result in fines or complications in vehicle registration.

Form Submission Methods

There are several methods available for submitting the Kansas title form and associated revenue documentation. These methods include:

- Online Submission: Many transactions can be completed through the Kansas Department of Revenue's online portal, allowing for quick processing.

- Mail Submission: Forms can be printed and mailed to the appropriate office, though this may result in longer processing times.

- In-Person Submission: Individuals can visit local DMV offices to submit forms directly, which may provide immediate assistance and feedback.

Required Documents

To successfully complete the Kansas Tr Revenue process, certain documents are required. These typically include:

- The completed Kansas title form.

- Proof of identity, such as a driver's license or state ID.

- Proof of purchase, such as a bill of sale or invoice.

- The previous title, if applicable, to verify ownership.

Examples of using the Kansas Tr Revenue

Understanding practical applications of the Kansas Tr Revenue can help clarify its importance. Examples include:

- When purchasing a used vehicle from a private seller, the buyer must complete the Kansas title form to transfer ownership and pay the required taxes.

- A dealership must collect and remit sales tax on vehicle sales, ensuring compliance with Kansas regulations.

- Individuals selling vehicles must provide the title and necessary documentation to the new owner to facilitate a legal transfer.

Quick guide on how to complete kansas tr revenue

Complete Kansas Tr Revenue effortlessly on any gadget

Managing documents online has gained significance among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Handle Kansas Tr Revenue on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Kansas Tr Revenue without any hassle

- Find Kansas Tr Revenue and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive data with tools specifically available from airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Kansas Tr Revenue to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kansas tr revenue

How to generate an eSignature for a PDF in the online mode

How to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is airSlate SignNow's role in managing Kansas TR revenue?

AirSlate SignNow provides a streamlined platform for businesses to efficiently manage their Kansas TR revenue documents. By utilizing our eSignature capabilities, organizations can ensure timely approvals, thus enhancing revenue realization and ensuring compliance with state regulations.

-

How does airSlate SignNow handle document security for Kansas TR revenue?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption and authentication measures to protect documents related to Kansas TR revenue, ensuring that sensitive information remains confidential and secure during the signing process.

-

What features does airSlate SignNow offer for tracking Kansas TR revenue?

AirSlate SignNow offers robust tracking features that allow businesses to monitor the progress of documents related to Kansas TR revenue. Users can receive notifications upon document completion, track who has signed, and view a detailed history for greater transparency and accountability.

-

Can I integrate airSlate SignNow with my existing systems for Kansas TR revenue management?

Yes, airSlate SignNow seamlessly integrates with various third-party applications to enhance your Kansas TR revenue management process. This integration allows you to sync data across platforms, ensuring a smooth transition and improving overall workflow efficiency.

-

What is the pricing structure for airSlate SignNow when dealing with Kansas TR revenue?

AirSlate SignNow offers flexible pricing plans that cater to different business needs while focusing on enhancing Kansas TR revenue processes. With our cost-effective solutions, businesses of all sizes can find a plan that fits their budget without compromising on essential features.

-

How does airSlate SignNow improve the efficiency of Kansas TR revenue operations?

By automating the document signing process, airSlate SignNow signNowly boosts the efficiency of Kansas TR revenue operations. This reduces turnaround times for approvals and enhances overall productivity, allowing businesses to focus on strategic growth rather than administrative tasks.

-

Is airSlate SignNow compliant with regulations affecting Kansas TR revenue?

Absolutely! airSlate SignNow is designed to comply with various legal and regulatory standards that impact Kansas TR revenue. Our platform adheres to electronic signature laws, ensuring that all signed documents are valid and legally binding.

Get more for Kansas Tr Revenue

Find out other Kansas Tr Revenue

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document