RU 9 Refund Application State of New Jersey Newjersey 2009

What is the RU 9 Refund Application State Of New Jersey Newjersey

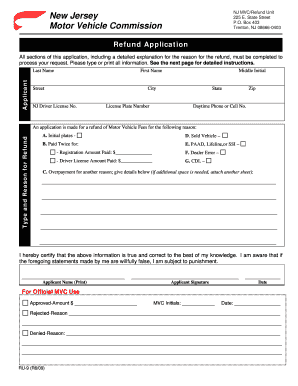

The RU 9 Refund Application is a specific form used in the State of New Jersey for individuals seeking to claim a refund for overpaid taxes. This application is essential for ensuring that taxpayers receive any excess amounts they have paid to the state. The form is designed to streamline the refund process, making it easier for residents to recover their funds in a timely manner.

Steps to complete the RU 9 Refund Application State Of New Jersey Newjersey

Completing the RU 9 Refund Application involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of income and any relevant tax documents. Next, fill out the form with the required personal information, including your name, address, and Social Security number. Be sure to provide details regarding the overpayment, including the tax year and amount. After completing the form, review it for accuracy before submitting it to the appropriate state agency.

Legal use of the RU 9 Refund Application State Of New Jersey Newjersey

The RU 9 Refund Application is a legally binding document when filled out correctly and submitted according to state regulations. To ensure its legal standing, it is important to comply with all relevant laws governing tax refunds in New Jersey. This includes providing accurate information and submitting the form within the designated timeframes. The application serves as a formal request for a refund and must adhere to the guidelines set forth by the New Jersey Division of Taxation.

Eligibility Criteria

To qualify for a refund using the RU 9 Refund Application, taxpayers must meet specific eligibility criteria. Generally, individuals who have overpaid their state taxes are eligible to apply. This includes residents who have filed their tax returns and have documentation to support their claim of overpayment. Additionally, it is important to ensure that all tax obligations are current and that the application is submitted within the state’s established deadlines.

Required Documents

When completing the RU 9 Refund Application, certain documents are required to support your claim. These may include:

- Proof of income, such as W-2 forms or 1099 statements.

- Copies of previous tax returns for the relevant tax years.

- Documentation of any payments made to the state that exceed the tax liability.

Having these documents ready will facilitate a smoother application process and help ensure that your refund is processed efficiently.

Form Submission Methods

The RU 9 Refund Application can be submitted through several methods, providing flexibility for taxpayers. Options typically include:

- Online submission through the New Jersey Division of Taxation website.

- Mailing the completed form to the designated state office.

- In-person submission at local tax offices, if available.

Choosing the right submission method can impact the speed at which your refund is processed, so consider your options carefully.

Quick guide on how to complete ru 9 refund application state of new jersey newjersey

Prepare RU 9 Refund Application State Of New Jersey Newjersey easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without hassle. Manage RU 9 Refund Application State Of New Jersey Newjersey on any platform using airSlate SignNow Android or iOS applications and enhance any document-based operation today.

The simplest method to adjust and electronically sign RU 9 Refund Application State Of New Jersey Newjersey effortlessly

- Obtain RU 9 Refund Application State Of New Jersey Newjersey and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to preserve your changes.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign RU 9 Refund Application State Of New Jersey Newjersey and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ru 9 refund application state of new jersey newjersey

Create this form in 5 minutes!

How to create an eSignature for the ru 9 refund application state of new jersey newjersey

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the RU 9 Refund Application State Of New Jersey Newjersey?

The RU 9 Refund Application State Of New Jersey Newjersey is a form designed for residents seeking a property tax refund. This application allows eligible homeowners in New Jersey to claim a refund on their property taxes, providing financial relief and supporting local communities.

-

How can I file the RU 9 Refund Application State Of New Jersey Newjersey?

To file the RU 9 Refund Application State Of New Jersey Newjersey, you can access the form online or visit your local tax office. Ensure you have the necessary documentation, including proof of income and property ownership, to complete the application process smoothly.

-

What are the eligibility requirements for the RU 9 Refund Application State Of New Jersey Newjersey?

Eligibility for the RU 9 Refund Application State Of New Jersey Newjersey generally includes being a New Jersey resident, having paid property taxes, and meeting income thresholds set by the state. It's important to review the specific guidelines on the official state website for the most accurate information.

-

What is the cost associated with processing the RU 9 Refund Application State Of New Jersey Newjersey?

There is no fee to submit the RU 9 Refund Application State Of New Jersey Newjersey itself, but be prepared to account for any potential fees related to document gathering or notary services if needed. The process is designed to be as cost-effective as possible to assist residents in receiving their refunds.

-

How long does it take to receive my refund from the RU 9 Refund Application State Of New Jersey Newjersey?

Once your RU 9 Refund Application State Of New Jersey Newjersey is submitted, it typically takes several weeks for processing. The timeline can vary based on the volume of applications received and any additional information required by the state.

-

Can I track the status of my RU 9 Refund Application State Of New Jersey Newjersey?

Yes, you can track the status of your RU 9 Refund Application State Of New Jersey Newjersey by contacting your local tax office. They can provide updates on the processing status and any next steps you may need to take.

-

What are the benefits of using the RU 9 Refund Application State Of New Jersey Newjersey?

The RU 9 Refund Application State Of New Jersey Newjersey enables residents to potentially receive signNow tax refunds, which can alleviate financial burdens. By participating, homeowners can invest those funds back into their communities or personal finances.

Get more for RU 9 Refund Application State Of New Jersey Newjersey

Find out other RU 9 Refund Application State Of New Jersey Newjersey

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free