Cra Authorization Form

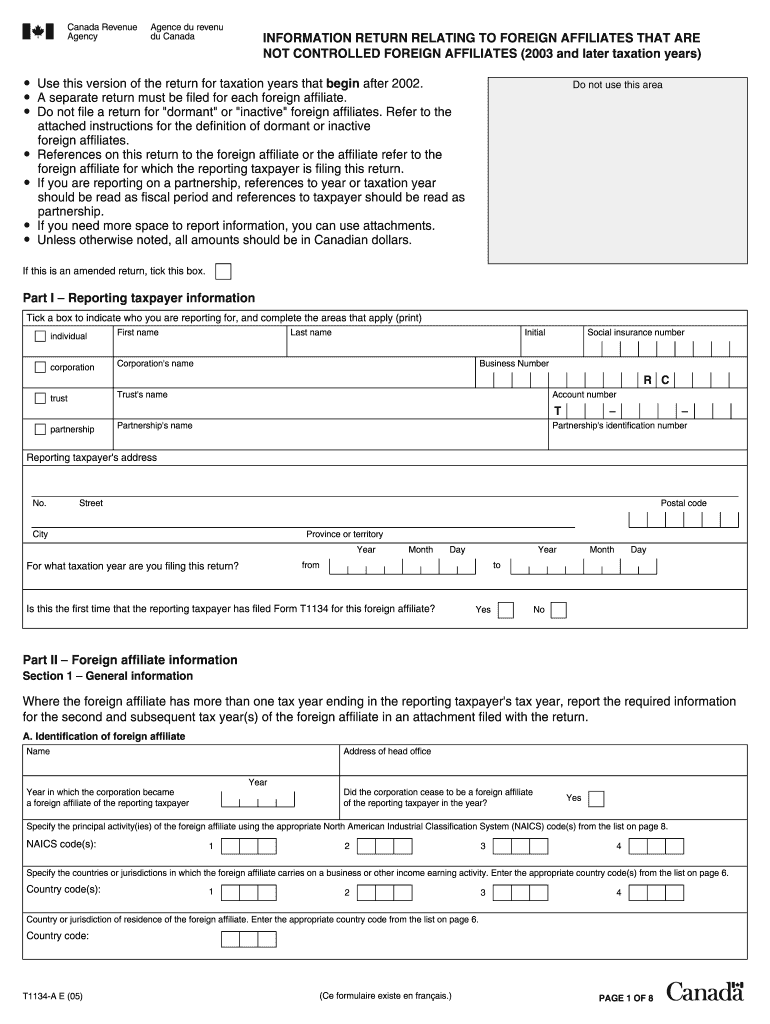

What is the CRA Authorization Form

The CRA Authorization Form is a crucial document used in the context of Canadian tax regulations. It allows individuals or businesses to authorize the Canada Revenue Agency (CRA) to communicate with a designated representative regarding their tax affairs. This form is essential for ensuring that the representative can access necessary information and act on behalf of the taxpayer, streamlining the process of managing tax-related matters.

How to Obtain the CRA Authorization Form

To obtain the CRA Authorization Form, individuals can visit the official CRA website, where the form is available for download. It is typically provided in a fillable PDF format, allowing users to complete it electronically. Additionally, taxpayers can request a physical copy by contacting the CRA directly or visiting a local CRA office. Ensuring that you have the correct version of the form is vital for compliance with current tax regulations.

Steps to Complete the CRA Authorization Form

Completing the CRA Authorization Form involves several straightforward steps:

- Download the form from the CRA website or obtain a physical copy.

- Fill in the personal information of the taxpayer, including name, address, and Social Insurance Number (SIN).

- Provide the details of the representative being authorized, including their name and contact information.

- Specify the tax years or periods for which the authorization applies.

- Sign and date the form to validate it.

Once completed, the form can be submitted to the CRA for processing.

Legal Use of the CRA Authorization Form

The CRA Authorization Form is legally binding, provided it is filled out correctly and signed by the taxpayer. This form complies with Canadian tax laws, allowing the CRA to share information with the authorized representative. It is important to ensure that the representative is trustworthy, as they will have access to sensitive tax information. Adhering to the legal guidelines surrounding this form helps protect both the taxpayer and the representative.

Key Elements of the CRA Authorization Form

Several key elements must be included in the CRA Authorization Form to ensure its validity:

- Taxpayer Information: Accurate details about the taxpayer, including full name and SIN.

- Representative Information: Complete contact information for the authorized representative.

- Authorization Scope: Clear indication of the tax years or periods covered by the authorization.

- Signature: The taxpayer's signature is required to validate the authorization.

Including all these elements ensures that the form is processed without delays.

Form Submission Methods

The CRA Authorization Form can be submitted through various methods to accommodate different preferences:

- Online: The form can be submitted electronically through the CRA's online services, which is often the quickest method.

- By Mail: Taxpayers can print the completed form and mail it to the appropriate CRA office.

- In-Person: Individuals may also deliver the form directly to a local CRA office for immediate processing.

Choosing the right submission method can help ensure that the authorization is processed efficiently.

Quick guide on how to complete cra authorization form

Effortlessly Prepare Cra Authorization Form on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the essential tools to create, edit, and electronically sign your documents quickly and without delays. Manage Cra Authorization Form on any device with the airSlate SignNow apps for Android or iOS and simplify your document processes today.

How to Edit and Electronically Sign Cra Authorization Form with Ease

- Find Cra Authorization Form and click on Get Form to begin.

- Use the tools available to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Cra Authorization Form while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cra authorization form

The best way to make an eSignature for your PDF document online

The best way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is an authorization form cra?

An authorization form cra is a specific document used to grant permission for certain actions or processes involving the Canada Revenue Agency (CRA). This form is essential for businesses that wish to manage tax-related affairs efficiently. Understanding this form can ensure compliance and smooth communication with the CRA.

-

How can airSlate SignNow help with the authorization form cra?

airSlate SignNow provides a seamless platform for businesses to create, send, and eSign the authorization form cra. With user-friendly features and compliance with legal standards, it ensures that your documents are securely stored and easily accessible. This solution simplifies the entire signature process, saving time and reducing paper waste.

-

What are the pricing options for using airSlate SignNow for the authorization form cra?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs. You can choose from monthly or annual subscriptions, which include access to all features necessary for managing the authorization form cra effectively. Each plan is designed to provide value while helping you optimize your document workflow.

-

Are there any integration capabilities with airSlate SignNow for the authorization form cra?

Yes, airSlate SignNow integrates seamlessly with a variety of applications and services, enhancing its functionality for handling the authorization form cra. This ensures you can connect it with your existing software like CRM and project management tools, thus streamlining your processes. Integration simplifies data management and reduces manual entries.

-

Can airSlate SignNow assist with audit trails for the authorization form cra?

Absolutely! airSlate SignNow provides comprehensive audit trail features that are crucial for the authorization form cra. This functionality enables you to track document activities, view who signed, and when the authorization occurred, ensuring you maintain compliance and accountability. It’s an essential aspect for any business dealing with sensitive information.

-

Is the authorization form cra secure with airSlate SignNow?

Yes, security is a top priority with airSlate SignNow when working with the authorization form cra. The platform uses robust encryption standards and adheres to industry regulations to keep your documents safe from unauthorized access. You can confidently send and manage sensitive documents knowing your data is protected.

-

What benefits does airSlate SignNow offer for managing the authorization form cra?

By using airSlate SignNow for the authorization form cra, you gain benefits such as increased efficiency, improved collaboration, and reduced turnaround time. Its intuitive interface allows for quick setup and easy circulation of documents among stakeholders. Streamlining this process can signNowly enhance your business operations.

Get more for Cra Authorization Form

Find out other Cra Authorization Form

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney