Form 5873 2010

What is the Form 5873

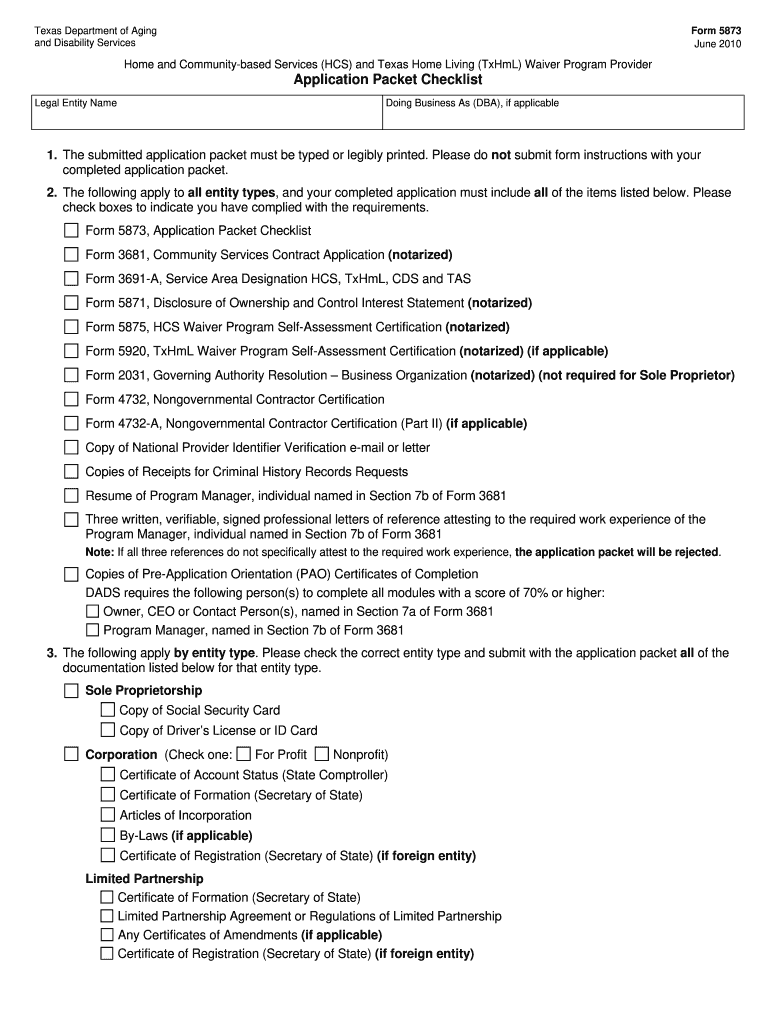

The Form 5873 is a specific document used primarily for tax purposes in the United States. It serves as a means for individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of this form is crucial for compliance with federal tax laws. It is essential for taxpayers to ensure they complete the form accurately to avoid any potential issues with their tax filings.

How to use the Form 5873

Using the Form 5873 involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents that pertain to the reporting period. Next, carefully fill out each section of the form, ensuring that all figures are correct and reflect your actual financial situation. After completing the form, review it for any errors or omissions before submission. It is advisable to keep a copy for your records once filed.

Steps to complete the Form 5873

Completing the Form 5873 can be streamlined by following these steps:

- Gather all necessary financial documents, including income statements and expense records.

- Read the instructions provided with the form to understand each section's requirements.

- Fill out the form carefully, ensuring all information is accurate and complete.

- Double-check your entries for any mistakes or missing information.

- Sign and date the form before submission.

Legal use of the Form 5873

The legal use of the Form 5873 is governed by IRS regulations. To ensure that the form is considered valid, it must be completed in accordance with the guidelines set forth by the IRS. This includes providing accurate information and submitting the form by the designated deadlines. Failure to comply with these regulations can result in penalties or legal repercussions, making it essential for taxpayers to understand their obligations when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5873 are critical for compliance. Typically, the form must be submitted by a specific date each year, which aligns with the overall tax filing deadline. It is important to stay informed about any changes to these dates, as late submissions can lead to penalties. Taxpayers should mark their calendars and set reminders to ensure timely filing.

Required Documents

To complete the Form 5873, certain documents are required. These may include:

- Income statements, such as W-2s or 1099s.

- Expense records related to the reporting period.

- Any previous tax returns that may provide context for the current filing.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy.

Who Issues the Form

The Form 5873 is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the necessary guidelines and instructions for completing the form, ensuring that taxpayers understand their responsibilities when reporting financial information. It is important to refer to the official IRS resources for the most current version of the form and any updates to its requirements.

Quick guide on how to complete form 5873 16870206

Complete Form 5873 effortlessly on any device

Managing documents online has gained immense popularity among companies and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to secure the correct form and store it safely online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Form 5873 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The optimal method to adjust and eSign Form 5873 with ease

- Locate Form 5873 and click on Get Form to begin.

- Utilize the tools we offer to finish your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your edits.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Adjust and eSign Form 5873 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5873 16870206

Create this form in 5 minutes!

How to create an eSignature for the form 5873 16870206

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is Form 5873, and how can airSlate SignNow assist with it?

Form 5873 is a document used for specific business purposes that require electronic signatures. airSlate SignNow provides an intuitive platform to create, send, and eSign Form 5873 quickly and securely, ensuring compliance and reducing turnaround time.

-

How does pricing work for using airSlate SignNow for Form 5873?

airSlate SignNow offers competitive pricing plans tailored to different business needs. Each plan includes access to essential features for managing Form 5873 documents effectively, with options for increased functionality as needed.

-

What features does airSlate SignNow offer for managing Form 5873?

airSlate SignNow provides a range of features, including customizable templates for Form 5873, automated workflows, and secure storage. These tools enhance your ability to manage documents efficiently, from creation to signature collection.

-

Are there benefits to using airSlate SignNow for eSigning Form 5873?

Yes, using airSlate SignNow for eSigning Form 5873 offers many benefits, such as increased speed and efficiency in document processing. The platform's user-friendly interface makes it easy for all parties to sign electronically, improving overall productivity.

-

Can I integrate airSlate SignNow with other applications when working with Form 5873?

Absolutely, airSlate SignNow supports various integrations with popular applications, making it easy to streamline workflows involving Form 5873. Whether you use CRM systems or cloud storage services, integration enhances usability and accessibility.

-

Is airSlate SignNow compliant with regulations for Form 5873?

Yes, airSlate SignNow is designed to meet industry compliance standards necessary for managing Form 5873 securely. The platform ensures that all eSignatures comply with legal requirements, giving users peace of mind during formal transactions.

-

How can I start using airSlate SignNow for Form 5873?

To start using airSlate SignNow for Form 5873, simply sign up for an account on our website. After creating your account, you can easily upload your document and begin sending it for signatures right away.

Get more for Form 5873

- Refusal of medical treatment form

- Procedure to get transcripts from the university of ilorin form

- Huber application winnebago county co winnebago wi form

- Form 13 502f4 capital markets participation fee calculation ontario osc gov on

- Rules and policies form 13 502f4 capital markets participation fee calculation general instructions 1 osc gov on

- Application for nacdlamp39s capital voir dire training seminar schr form

- Participation letter and form fulton county schools

- Georgia spca foster application form

Find out other Form 5873

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast