Gsis Online Loan Application Form

What is the GSIS Online Loan Application

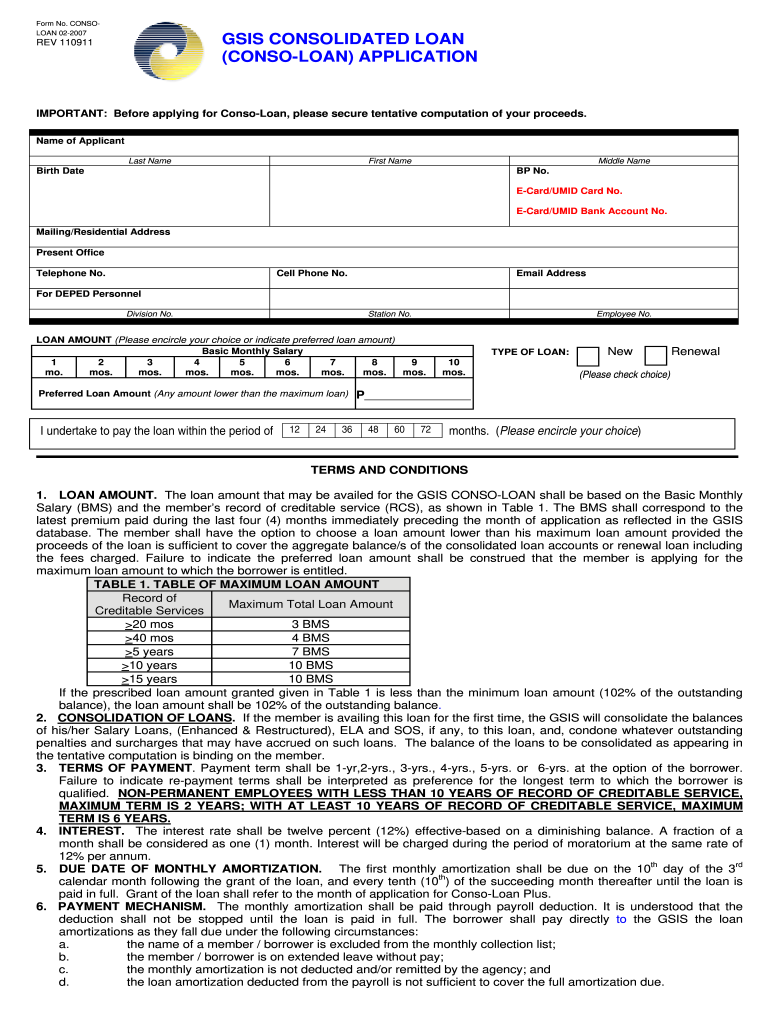

The GSIS Online Loan Application is a digital platform that allows members of the Government Service Insurance System (GSIS) to apply for loans conveniently from their homes or offices. This online application simplifies the process, making it more accessible and efficient. By utilizing this system, applicants can avoid long queues and paperwork associated with traditional loan applications. The platform is designed to cater to various loan types, including the GSIS consolidated loan and the conso loan, ensuring that members can find the services they need in one place.

Steps to Complete the GSIS Online Loan Application

Completing the GSIS Online Loan Application involves several straightforward steps:

- Access the GSIS Online Loan Application portal using a secure internet connection.

- Log in using your GSIS credentials or register if you are a new user.

- Select the type of loan you wish to apply for, such as the GSIS consolidated loan.

- Fill out the required information in the application form, ensuring accuracy and completeness.

- Upload any necessary documents, such as identification and proof of income.

- Review your application for any errors or omissions before submission.

- Submit the application and await confirmation of receipt.

Legal Use of the GSIS Online Loan Application

The GSIS Online Loan Application is legally valid and complies with relevant regulations governing electronic signatures and digital documentation. To ensure its legality, the application process incorporates secure methods for signing and submitting documents. This compliance with laws such as the ESIGN Act and UETA guarantees that the application holds the same weight as traditional paper applications. It is crucial for applicants to understand these legal frameworks to ensure their applications are processed smoothly.

Required Documents

When applying for a loan through the GSIS Online Loan Application, several documents are typically required to support your application. These may include:

- Valid identification, such as a government-issued ID.

- Proof of income, which can include recent pay slips or tax returns.

- Any additional documents specific to the type of loan being applied for, such as a GSIS loan form download.

Having these documents ready can expedite the application process and improve the chances of approval.

Eligibility Criteria

To qualify for a loan through the GSIS Online Loan Application, applicants must meet specific eligibility criteria set by the GSIS. Generally, these criteria include:

- Being a member of the GSIS with active contributions.

- Meeting the minimum service requirement, if applicable.

- Having no outstanding loans or obligations that could affect repayment.

Understanding these criteria is essential for a successful application and helps in preparing the necessary documentation.

Application Process & Approval Time

The application process for the GSIS Online Loan Application is designed to be efficient. Once the application is submitted, it typically undergoes a review process that can take a few days to a couple of weeks, depending on the volume of applications and the specifics of the loan type. During this time, the GSIS may contact applicants for additional information or clarification. Applicants will receive notifications regarding the status of their application, ensuring transparency throughout the process.

Quick guide on how to complete gsis online loan application

Effortlessly Manage Gsis Online Loan Application on Any Device

Digital document handling has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed paperwork, as you can access the correct format and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Handle Gsis Online Loan Application on any device using airSlate SignNow's Android or iOS applications and enhance any document-based activity today.

The Easiest Way to Edit and Electronically Sign Gsis Online Loan Application with Ease

- Locate Gsis Online Loan Application and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Select important sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choosing. Edit and electronically sign Gsis Online Loan Application to ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gsis online loan application

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is the process for a GSIS loan application online?

The GSIS loan application online process allows members to conveniently submit their loan requests through an easy-to-navigate platform. Users simply need to fill out the required forms, upload necessary documents, and submit their applications for approval. This streamlines the traditionally lengthy process, ensuring you can complete your GSIS loan application online quickly and efficiently.

-

What features does airSlate SignNow offer for GSIS loan applications?

airSlate SignNow provides a range of features tailored for GSIS loan applications, including document templates, automated workflows, and eSignature capabilities. These tools ensure that your application is thorough and submitted without any hassle. Utilizing airSlate SignNow makes your GSIS loan application online process smoother by eliminating paper-based workflows.

-

Is there a cost associated with using airSlate SignNow for GSIS loan applications?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan is designed to provide value for managing your GSIS loan application online, including features like unlimited document signing and storage. You can choose a plan that best fits your budget and requirements.

-

How secure is airSlate SignNow for submitting GSIS loan applications?

airSlate SignNow prioritizes the security of your information, utilizing advanced encryption protocols to protect all data submitted during your GSIS loan application online. Additionally, their compliance with major regulations ensures that sensitive information remains confidential and secure from unauthorized access.

-

Can I integrate airSlate SignNow into my current workflow for GSIS loan applications?

Absolutely! airSlate SignNow is designed to integrate easily with various tools and platforms already in use in your workflow. This flexibility allows you to streamline your GSIS loan application online while enhancing productivity without the need for major changes to your existing systems.

-

What benefits does airSlate SignNow provide for GSIS loan applications?

Utilizing airSlate SignNow for your GSIS loan application online offers numerous benefits, including faster processing times, reduced paperwork, and enhanced collaboration among stakeholders. The ability to electronically sign documents expedites approvals and diminishes the risk of errors associated with manual submissions.

-

Do I need any specific software to use airSlate SignNow for GSIS loan applications?

No specific software is required to use airSlate SignNow for your GSIS loan application online. The platform is web-based, meaning you can access all its features from any device with an internet connection. This convenience allows you to manage your applications from anywhere, at any time.

Get more for Gsis Online Loan Application

- Form dscl 100 california secretary of state state of california sos ca

- Si 350 form

- Articles of incorporation general stock form arts gs

- Conversion of a california llc into a california stock corporation fillable form

- Corporation document filing request form california secretary sos ca

- Ihss direct deposit form 17350014

- Ad904 a form

- Lic 613c form

Find out other Gsis Online Loan Application

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later