R43msed Form

What is the R43msed?

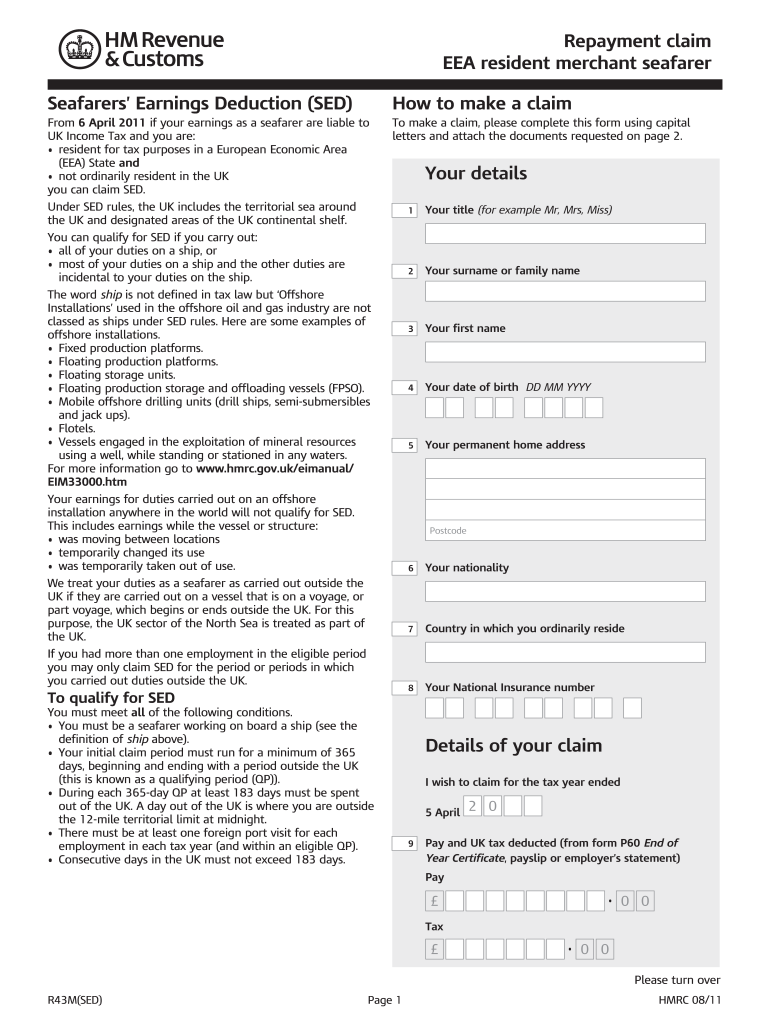

The R43msed form is a specific document used for claiming tax refunds from HM Revenue and Customs (HMRC) in the United Kingdom. It is primarily designed for individuals who have paid tax on income that is not taxable in the UK, such as certain overseas earnings. This form is essential for those seeking to reclaim overpaid taxes, ensuring that they receive the correct amount back from HMRC.

How to use the R43msed

Using the R43msed form involves several key steps. First, gather all necessary information regarding your income and tax payments. Next, fill out the form accurately, providing details about your earnings and the taxes you wish to reclaim. After completing the form, submit it to HMRC either online or by mail, depending on your preference. Ensure that you keep a copy of the submitted form for your records.

Steps to complete the R43msed

Completing the R43msed form requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including payslips and tax statements.

- Access the R43msed form online or obtain a printable version.

- Fill in your personal details, including your name, address, and National Insurance number.

- Provide information about your income and the taxes paid.

- Review the form for accuracy before submission.

- Submit the form to HMRC via the chosen method.

Legal use of the R43msed

The R43msed form must be used in compliance with legal requirements set forth by HMRC. This includes providing accurate information and submitting the form within the specified time frame. Failing to adhere to these regulations can result in delays or denial of your claim. It is important to understand your rights and obligations when using this form to ensure a smooth process.

Required Documents

To successfully complete the R43msed form, you will need to provide certain documents. These typically include:

- Proof of income, such as payslips or tax returns.

- Evidence of tax payments made, including tax statements.

- Your National Insurance number for identification purposes.

Having these documents ready will facilitate a more efficient completion and submission of the form.

Form Submission Methods

The R43msed form can be submitted through various methods, allowing for flexibility based on individual preferences. You can choose to submit the form online through the HMRC website or send a printed version by mail. If you opt for the online method, ensure you have a secure internet connection and follow the instructions provided on the HMRC platform.

Examples of using the R43msed

There are several scenarios in which individuals might use the R43msed form. For instance, a UK resident who has worked abroad and paid taxes on foreign income may use this form to reclaim those taxes. Additionally, a seafarer who qualifies as a resident merchant may also find this form useful for claiming refunds on overpaid taxes. Each case highlights the importance of the R43msed in facilitating tax refunds for eligible individuals.

Quick guide on how to complete r43msed

Finalize R43msed seamlessly on any gadget

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to draft, amend, and eSign your documents quickly without hindrance. Manage R43msed on any device using airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to modify and eSign R43msed effortlessly

- Locate R43msed and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Bid farewell to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you prefer. Modify and eSign R43msed to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r43msed

The best way to generate an eSignature for your PDF online

The best way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is the HMRC R43MSED form?

The HMRC R43MSED form is a tax-related document used to claim a tax refund for overseas residents. It allows individuals to report their UK income and apply for the relevant tax relief. Completing this form is essential to ensure that you receive the correct tax treatment.

-

How does airSlate SignNow assist with the HMRC R43MSED form?

airSlate SignNow streamlines the process of filling out the HMRC R43MSED form by offering easy-to-use electronic signatures and document management tools. With our platform, you can efficiently complete, send, and eSign documents, making tax filing straightforward and hassle-free. Our solution is designed to enhance accuracy and security in handling sensitive documents.

-

Is there a cost associated with using airSlate SignNow for the HMRC R43MSED form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including a cost-effective option for users handling the HMRC R43MSED form. The plans are designed to accommodate businesses of all sizes, ensuring you get maximum value from our eSigning capabilities. You can choose a plan based on your document volume and feature requirements.

-

What features does airSlate SignNow provide for the HMRC R43MSED form?

With airSlate SignNow, you gain access to features like customizable templates, automatic reminders, and secure cloud storage, specifically beneficial for processing the HMRC R43MSED form. These features help you manage your documents efficiently and ensure timely submissions. Additionally, real-time collaboration supports multiple users during the filing process.

-

Can I integrate airSlate SignNow with other software for managing the HMRC R43MSED form?

Absolutely! airSlate SignNow offers seamless integrations with popular software applications to simplify managing the HMRC R43MSED form. You can connect our platform with tools like CRM systems, accounting software, and email services, enabling a cohesive workflow for your tax documentation. This integration enhances productivity and data accuracy.

-

What are the benefits of using airSlate SignNow for the HMRC R43MSED form?

Using airSlate SignNow for the HMRC R43MSED form brings benefits such as improved efficiency, stronger document security, and reduced turnaround times. Our platform ensures that your tax forms are completed accurately and securely, allowing you to focus on your business instead of paperwork. Enjoy the peace of mind that comes with using a trusted eSignature solution.

-

Is airSlate SignNow compliant with HMRC regulations for the R43MSED form?

Yes, airSlate SignNow is fully compliant with HMRC regulations regarding the use of electronic signatures for the R43MSED form. We adhere to the highest security standards to ensure that your documents are legally valid and protected. This compliance not only facilitates the submission process but also builds trust in the handling of your sensitive tax information.

Get more for R43msed

- Certificate of installation cf2r env 03 e insulation ww cash4appliances form

- Insulation installation california energy commission state of ww cash4appliances form

- Outdoor lighting summary of allowed outdoor lighting power ww cash4appliances form

- U002 form

- Hyatthouse thirdparty creditcard authorization form

- Domestic intake worksheet pdf fulton county superior court form

- Manteca sunrise kiwanis joe buckman memorial scholarship form

- Counseling practicum interview rating form syracuse university soe syr

Find out other R43msed

- Can I Sign Wyoming Amendment to an LLC Operating Agreement

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure

- Sign Alabama Affidavit of Identity Myself

- Sign Colorado Trademark Assignment Agreement Online

- Can I Sign Connecticut Affidavit of Identity

- Can I Sign Delaware Trademark Assignment Agreement

- How To Sign Missouri Affidavit of Identity

- Can I Sign Nebraska Affidavit of Identity

- Sign New York Affidavit of Identity Now

- How Can I Sign North Dakota Affidavit of Identity

- Sign Oklahoma Affidavit of Identity Myself

- Sign Texas Affidavit of Identity Online

- Sign Colorado Affidavit of Service Secure