Generic Life Insurance Beneficiary Form

What is the Generic Life Insurance Beneficiary Form

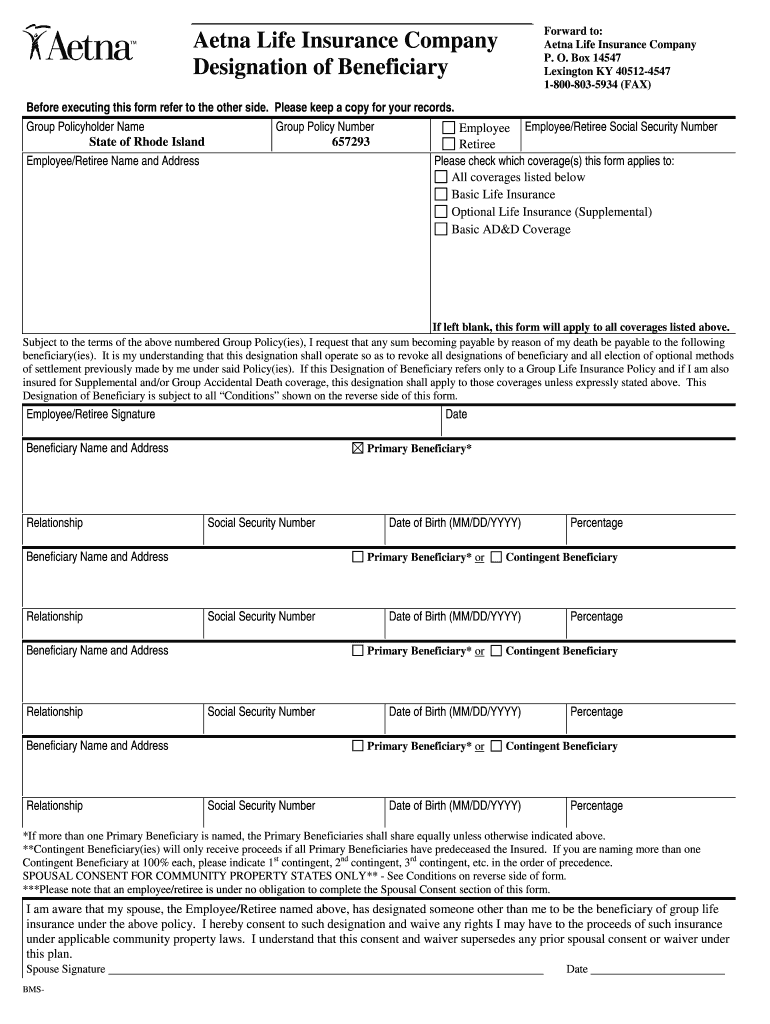

The Generic Life Insurance Beneficiary Form is a crucial document used to designate individuals or entities that will receive the benefits of a life insurance policy upon the policyholder's death. This form ensures that the policyholder's wishes are clearly documented and legally recognized. It typically includes essential information such as the policyholder's details, the beneficiary's name, relationship to the policyholder, and the percentage of benefits allocated to each beneficiary. Proper completion of this form is vital to avoid disputes and ensure that the intended beneficiaries receive their benefits without delay.

Steps to Complete the Generic Life Insurance Beneficiary Form

Completing the Generic Life Insurance Beneficiary Form involves several straightforward steps. First, gather all necessary information about the policyholder and the intended beneficiaries. Next, accurately fill out the form, ensuring that all names are spelled correctly and that the relationship to the policyholder is clearly stated. It is important to specify the percentage of benefits for each beneficiary, as this can prevent confusion later. After completing the form, review it for any errors or omissions. Finally, sign and date the form, as required, to make it legally binding.

Legal Use of the Generic Life Insurance Beneficiary Form

The legal use of the Generic Life Insurance Beneficiary Form is governed by federal and state laws, which recognize electronic signatures and documents as valid under certain conditions. To ensure the form is legally binding, it must be completed accurately and signed by the policyholder. Additionally, it is advisable to keep a copy of the completed form with the insurance provider and another in a safe place. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is also essential when submitting the form electronically.

Key Elements of the Generic Life Insurance Beneficiary Form

Key elements of the Generic Life Insurance Beneficiary Form include the policyholder's full name, address, and contact information. The form should also capture the beneficiary's details, including their name, relationship to the policyholder, and contact information. Additionally, it is crucial to include the policy number and the specific percentage of benefits each beneficiary will receive. Some forms may also require the policyholder's signature and the date of signing to validate the document.

How to Obtain the Generic Life Insurance Beneficiary Form

The Generic Life Insurance Beneficiary Form can typically be obtained directly from the life insurance provider's website or customer service. Many insurers offer downloadable versions of the form in PDF format, which can be printed and filled out. Additionally, some insurance agents may provide the form during consultations. It is important to ensure that you are using the most current version of the form to comply with any updates in legal requirements or company policies.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Generic Life Insurance Beneficiary Form can be done through various methods, depending on the insurance provider's requirements. Common submission methods include online submission through the insurer's secure portal, mailing the completed form to the designated address, or delivering it in person to a local office. Each method may have specific instructions regarding documentation and signatures, so it is essential to follow the guidelines provided by the insurance company to ensure proper processing.

Quick guide on how to complete generic life insurance beneficiary form

Manage Generic Life Insurance Beneficiary Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Generic Life Insurance Beneficiary Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Generic Life Insurance Beneficiary Form effortlessly

- Locate Generic Life Insurance Beneficiary Form and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for such tasks.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, repetitive form searching, or errors requiring new document copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Generic Life Insurance Beneficiary Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the generic life insurance beneficiary form

The way to create an eSignature for your PDF file in the online mode

The way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What types of life insurance does Aetna offer?

Aetna life insurance provides a variety of options, including term life, whole life, and universal life insurance policies. Each type is designed to meet specific financial goals and needs, making it easier for customers to choose the right coverage for themselves and their families.

-

How much does Aetna life insurance cost?

The cost of Aetna life insurance varies depending on several factors, including the type of policy, coverage amount, and individual health assessments. To get an accurate quote, prospective customers are encouraged to evaluate their needs and provide relevant information to receive a personalized estimate.

-

What are the key benefits of Aetna life insurance?

Aetna life insurance offers numerous benefits, including flexible policy options, competitive pricing, and additional riders that can enhance coverage. These features ensure that customers can tailor their life insurance policies to fit their unique situations and financial objectives.

-

Can I customize my Aetna life insurance policy?

Yes, Aetna life insurance policies are customizable to meet individual needs. Customers can choose from various riders and add-ons that provide additional coverage or benefits, allowing for a more tailored insurance solution.

-

How does the claims process work for Aetna life insurance?

The claims process for Aetna life insurance is designed to be straightforward and efficient. Beneficiaries can initiate a claim by contacting Aetna's customer service, providing necessary documentation, and the company will guide them through each step until the claim is processed.

-

Does Aetna life insurance cover pre-existing conditions?

Coverage for pre-existing conditions with Aetna life insurance can vary based on the policy and underwriting guidelines. It's essential for potential policyholders to discuss their health history with Aetna representatives to understand how it may affect coverage options.

-

What integrations does Aetna life insurance offer?

Aetna life insurance integrates with various health and financial platforms, allowing customers to manage their policies efficiently. These integrations can facilitate communication and tracking of policy details, ensuring users have easy access to their insurance information.

Get more for Generic Life Insurance Beneficiary Form

Find out other Generic Life Insurance Beneficiary Form

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free