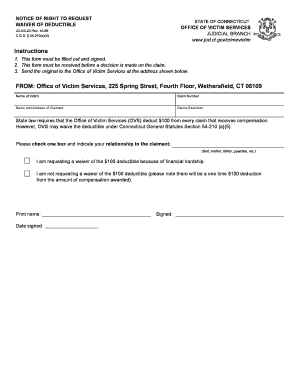

Ct Request Waiver Form

What is the Ct Request Waiver

The Ct Request Waiver is a legal document used in Connecticut that allows individuals to request a waiver of certain requirements or obligations. This form is particularly relevant for taxpayers who may need to adjust their tax obligations or seek relief from penalties due to specific circumstances. Understanding the purpose of this waiver is crucial for ensuring compliance with state tax laws.

Steps to complete the Ct Request Waiver

Completing the Ct Request Waiver involves several key steps to ensure that the form is filled out accurately. Start by gathering all necessary information, including your personal details and the specific reasons for your request. Follow these steps:

- Download the Ct Request Waiver form from the appropriate state website.

- Fill in your personal information, including your name, address, and Social Security number.

- Clearly state the reason for your waiver request, providing any supporting documentation if necessary.

- Review the completed form to ensure accuracy and completeness.

- Sign and date the form before submission.

How to use the Ct Request Waiver

Using the Ct Request Waiver effectively requires understanding the context in which it applies. Once completed, the form should be submitted to the relevant tax authority in Connecticut. It is important to keep a copy of the waiver for your records. If your request is approved, you will receive confirmation from the tax authority, which may include further instructions or information regarding your tax obligations.

Eligibility Criteria

To be eligible for the Ct Request Waiver, individuals must meet certain criteria set forth by the state of Connecticut. These criteria typically include being a resident of Connecticut and having a valid reason for requesting the waiver. Common reasons may include financial hardship, medical emergencies, or other extenuating circumstances that affect an individual's ability to comply with tax obligations.

Required Documents

When submitting the Ct Request Waiver, it is essential to include all required documents to support your request. This may include:

- Proof of income or financial hardship.

- Medical documentation if applicable.

- Any previous correspondence with the tax authority regarding your situation.

Providing comprehensive documentation can significantly enhance the chances of your waiver being approved.

Legal use of the Ct Request Waiver

The Ct Request Waiver is legally binding once submitted and accepted by the relevant authorities. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies could lead to penalties or denial of the waiver. Understanding the legal implications of the waiver helps individuals navigate their tax responsibilities while ensuring compliance with state laws.

Quick guide on how to complete ct request waiver

Prepare Ct Request Waiver seamlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers a perfect sustainable alternative to traditional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents swiftly without delays. Handle Ct Request Waiver on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The easiest way to edit and electronically sign Ct Request Waiver effortlessly

- Obtain Ct Request Waiver and then click Get Form to begin.

- Utilize the features we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether via email, SMS, an invitation link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Ct Request Waiver and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct request waiver

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is a notice deductible in the context of airSlate SignNow?

A notice deductible refers to the minimum amount that must be paid out of pocket before insurance coverage starts. In the context of airSlate SignNow, understanding notice deductibles is essential for businesses that rely on signing insurance-related documents efficiently. This ensures that all parties are aware of their financial responsibilities upfront.

-

How does airSlate SignNow streamline the process of handling notice deductibles?

airSlate SignNow streamlines the handling of notice deductibles by allowing users to digitally sign and send documents in a secure and efficient manner. This eliminates delays associated with printing and mailing, ensuring that all necessary information related to notice deductibles is captured quickly and accurately. The platform also allows easy access to documents for all relevant parties.

-

Is airSlate SignNow cost-effective for managing notice deductibles?

Yes, airSlate SignNow is a cost-effective solution for managing notice deductibles, saving businesses both time and money. With affordable pricing plans, businesses can efficiently handle their document signing needs without incurring high operational costs. This cost-effectiveness is especially beneficial for organizations frequently dealing with insurance documents and notice deductibles.

-

What features of airSlate SignNow support compliance with notice deductibles?

airSlate SignNow offers robust features that ensure compliance with notice deductibles, including audit trails, secure storage, and electronic signatures that are legally binding. These features provide businesses with peace of mind that all documents are handled securely and in accordance with regulations. Furthermore, customizable templates assist in properly formatting documents to meet notice deductible requirements.

-

Can airSlate SignNow integrate with other software for managing notice deductibles?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, including CRMs and project management tools that help manage notice deductibles effectively. This integration allows users to synchronize their data and streamline workflows, ensuring that all notice deductible information is organized and accessible across multiple platforms.

-

What are the benefits of using airSlate SignNow for documents involving notice deductibles?

The benefits of using airSlate SignNow for documents involving notice deductibles include increased efficiency, reduced turnaround times, and enhanced security. The platform allows for quick access to documents, minimizing the risk of errors and ensuring all parties meet their obligations. Additionally, electronic signatures provide a more environmentally friendly solution compared to traditional paper processes.

-

How can small businesses benefit from using airSlate SignNow to manage notice deductibles?

Small businesses can greatly benefit from using airSlate SignNow to manage notice deductibles by gaining access to a user-friendly and affordable electronic signature solution. This enables them to efficiently handle compliance requirements without the need for extensive resources. By simplifying the document signing process, small businesses can focus more on their growth rather than administrative tasks.

Get more for Ct Request Waiver

- Indiana laborers fringe benefit funds form

- Answer sheet to nova video questions hunting the elements form

- The jean keating transcript freedom school form

- Crescent lodge scholarship application form

- Wahealthplanfinder paper application form

- Annual high schools that work staff development conference publications sreb form

- Transportation order los angeles unified school district form

- Contributions section form

Find out other Ct Request Waiver

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast