New Mexico 4a Form

What is the New Mexico 4A?

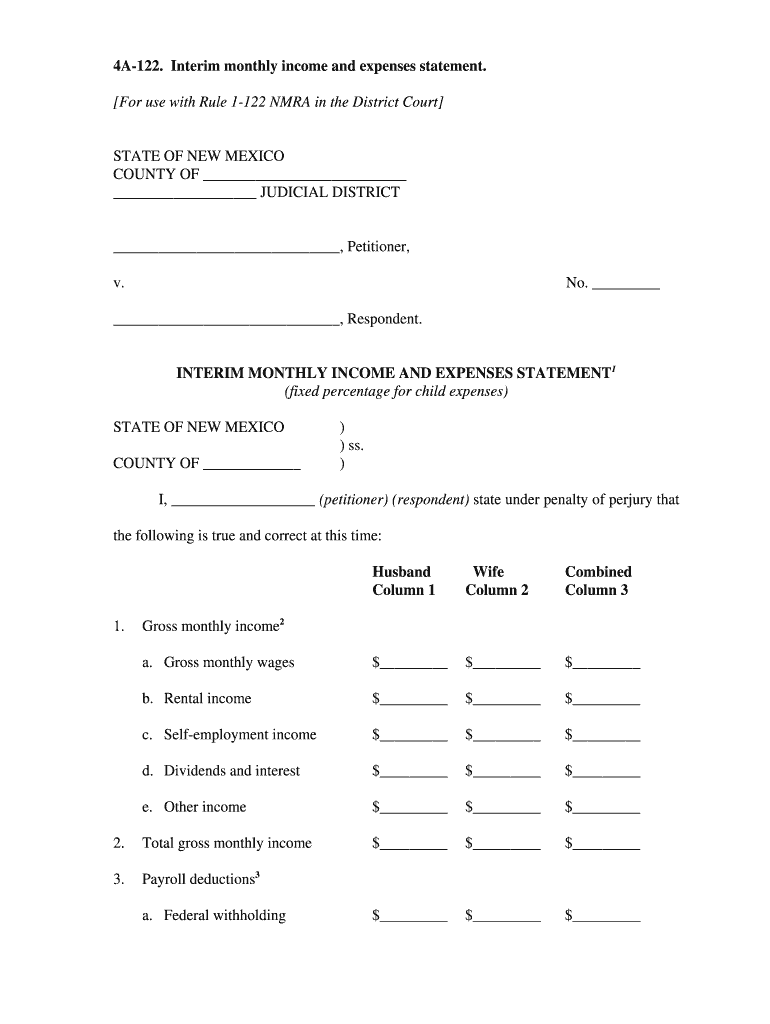

The New Mexico 4A form is a crucial document used for reporting monthly income and expenses. It is primarily utilized by individuals and families to provide a comprehensive overview of their financial situation. This form is particularly important for those applying for assistance programs or undergoing financial assessments. By detailing both income and expenditures, the 4A helps to ensure that applicants can demonstrate their financial needs effectively.

How to Use the New Mexico 4A

Using the New Mexico 4A involves a straightforward process. First, gather all necessary financial information, including income sources and monthly expenses. Next, fill out the form accurately, ensuring that all figures are correct and reflect your current financial situation. It is essential to provide detailed descriptions for each income and expense category to avoid any discrepancies. Once completed, the form can be submitted as part of your application for various state assistance programs.

Steps to Complete the New Mexico 4A

Completing the New Mexico 4A requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, such as pay stubs, bank statements, and bills.

- Begin filling out the form by entering your personal information at the top.

- List all sources of income, including wages, benefits, and any other earnings.

- Document your monthly expenses, categorizing them into fixed and variable costs.

- Review the form for accuracy and completeness before submission.

Legal Use of the New Mexico 4A

The New Mexico 4A is legally recognized and must be filled out truthfully to ensure compliance with state regulations. Misrepresentation of financial information can lead to penalties or denial of assistance. It is crucial to understand that this form serves as a legal declaration of your financial status and may be subject to verification by state agencies.

Key Elements of the New Mexico 4A

Several key elements define the New Mexico 4A. These include:

- Personal Information: Basic details such as name, address, and contact information.

- Income Section: A comprehensive list of all income sources, including wages, benefits, and any additional earnings.

- Expense Section: A detailed account of monthly expenses, categorized appropriately.

- Signature: A declaration that the information provided is accurate and complete.

Who Issues the Form?

The New Mexico 4A is issued by the New Mexico Human Services Department. This department oversees various assistance programs and utilizes the 4A to assess applicants' financial needs accurately. Understanding the issuing authority can help applicants navigate the submission process more effectively.

Quick guide on how to complete new mexico 4a

Effortlessly Prepare New Mexico 4a on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to design, update, and electronically sign your documents swiftly and without interruptions. Manage New Mexico 4a on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest method to modify and electronically sign New Mexico 4a without hassle

- Obtain New Mexico 4a and then select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether via email, SMS, an invite link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, the hassle of searching for forms, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign New Mexico 4a while ensuring effective communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new mexico 4a

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The way to create an eSignature for a PDF document on Android

People also ask

-

What is the 4a 122 feature in airSlate SignNow?

The 4a 122 feature in airSlate SignNow is designed to streamline the document signing process. It allows users to easily send and eSign documents, making transactions faster and more efficient. This feature enhances productivity, ensuring that important documents are handled promptly.

-

How much does airSlate SignNow with the 4a 122 feature cost?

The pricing for airSlate SignNow, including the 4a 122 feature, varies based on the plan you choose. The solutions offer flexible pricing models to cater to different business needs, ensuring cost-effectiveness while maximizing value. You can explore various packages to find one that best suits your budget.

-

What benefits does the 4a 122 feature offer to businesses?

The 4a 122 feature offers numerous benefits, including reduced turnaround times for document approvals and enhanced collaboration among teams. This feature allows businesses to securely manage their documents while maintaining compliance with legal standards. It ultimately leads to increased operational efficiency and customer satisfaction.

-

Can I integrate airSlate SignNow's 4a 122 feature with other applications?

Yes, airSlate SignNow's 4a 122 feature seamlessly integrates with various applications, enhancing workflow automation. It supports integrations with popular tools such as CRMs, cloud storage services, and productivity software. This ensures that you can keep your existing processes while benefiting from eSigning capabilities.

-

How does the 4a 122 feature ensure document security?

The 4a 122 feature prioritizes document security by using advanced encryption technology to protect sensitive information. This means that all documents are securely transmitted and stored, keeping them safe from unauthorized access. Additionally, airSlate SignNow complies with industry standards to ensure maximum security for your eSigning needs.

-

Is the 4a 122 feature user-friendly for non-technical users?

Absolutely! The 4a 122 feature in airSlate SignNow is designed with user-friendliness in mind. Its intuitive interface allows non-technical users to easily navigate the platform, making document sending and signing a hassle-free experience. Users can get started quickly with minimal training.

-

What types of documents can I send using the 4a 122 feature?

With the 4a 122 feature, you can send various types of documents, including contracts, agreements, and forms. This versatility allows businesses to manage all their documentation needs within a single platform. The feature supports multiple formats, ensuring compatibility with your existing documents.

Get more for New Mexico 4a

Find out other New Mexico 4a

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe