Bbva Compass Bank Direct Deposit Authorization Form 2011

What is the Bbva Compass Bank Direct Deposit Authorization Form

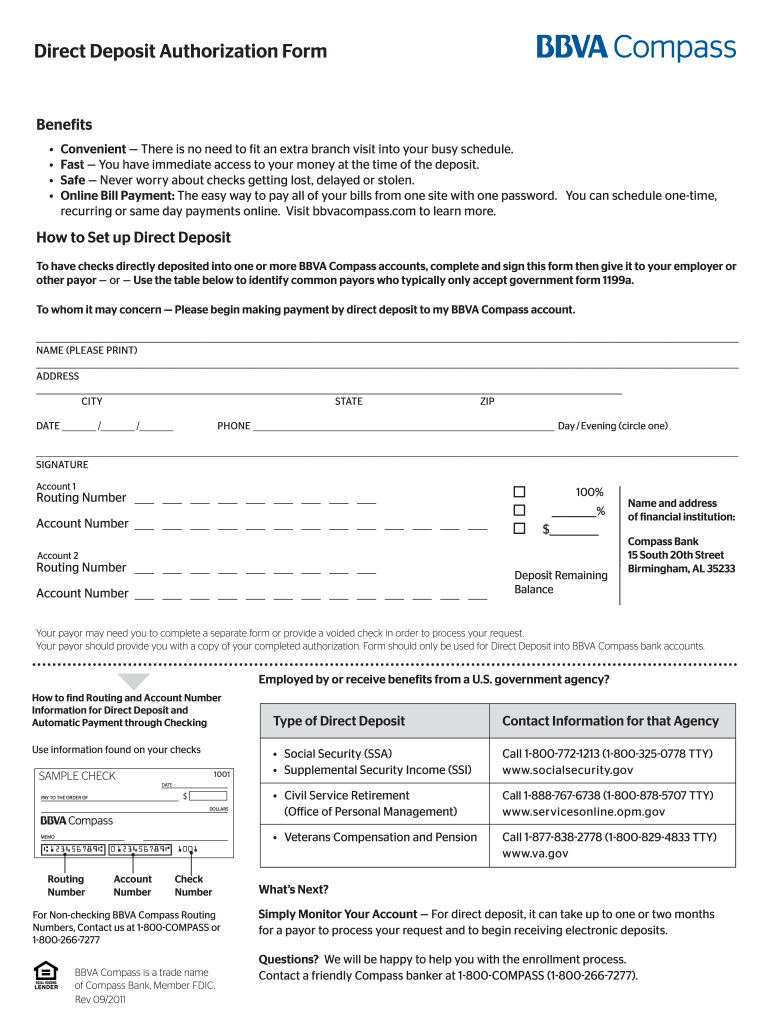

The Bbva Compass Bank Direct Deposit Authorization Form is a document that allows individuals to authorize their employer or other payers to deposit funds directly into their Bbva Compass Bank account. This form simplifies the payment process by eliminating the need for physical checks, ensuring that funds are available immediately upon deposit. It is commonly used for payroll, government benefits, and other recurring payments.

How to use the Bbva Compass Bank Direct Deposit Authorization Form

To use the Bbva Compass Bank Direct Deposit Authorization Form, individuals must complete the form with accurate information, including their bank account details and personal identification information. Once completed, the form should be submitted to the employer or payer responsible for making the deposits. It is essential to ensure that all information is correct to avoid delays or issues with the direct deposit process.

Steps to complete the Bbva Compass Bank Direct Deposit Authorization Form

Completing the Bbva Compass Bank Direct Deposit Authorization Form involves several straightforward steps:

- Obtain the form from your employer or download it from the Bbva Compass Bank website.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide your Bbva Compass Bank account number and routing number.

- Indicate the type of account (checking or savings) for the direct deposit.

- Sign and date the form to authorize the direct deposit.

- Submit the completed form to your employer or payer.

Legal use of the Bbva Compass Bank Direct Deposit Authorization Form

The Bbva Compass Bank Direct Deposit Authorization Form is legally binding once it is signed by the account holder. This means that the account holder agrees to the terms of direct deposit and authorizes the payer to deposit funds into their account. It is important to keep a copy of the signed form for personal records. Compliance with relevant laws and regulations ensures that the direct deposit process is secure and valid.

Key elements of the Bbva Compass Bank Direct Deposit Authorization Form

Key elements of the Bbva Compass Bank Direct Deposit Authorization Form include:

- Personal Information: Name, address, and Social Security number.

- Bank Account Details: Bbva Compass Bank account number and routing number.

- Account Type: Indication of whether the account is checking or savings.

- Authorization Signature: Signature of the account holder to authorize the direct deposit.

- Date: The date on which the form is signed.

Form Submission Methods

The Bbva Compass Bank Direct Deposit Authorization Form can typically be submitted in several ways, depending on the employer or payer's requirements. Common submission methods include:

- Online: Some employers may allow the form to be submitted electronically through their payroll system.

- Mail: The completed form can be mailed directly to the payroll department or designated office.

- In-Person: Individuals may also choose to deliver the form in person to ensure it is received.

Quick guide on how to complete bbva compass bank direct deposit authorization form

The optimal method to obtain and sign Bbva Compass Bank Direct Deposit Authorization Form

Across the breadth of your entire organization, ineffective procedures regarding document approval can consume a signNow amount of work hours. Signing documents such as Bbva Compass Bank Direct Deposit Authorization Form is a standard procedure in any sector, which is why the efficiency of each agreement’s lifecycle is crucial to the company’s overall success. With airSlate SignNow, executing your Bbva Compass Bank Direct Deposit Authorization Form is as straightforward and quick as possible. This platform provides you access to the latest version of virtually any document. Moreover, you can sign it instantly without the need for any external software or physical printouts.

Steps to acquire and sign your Bbva Compass Bank Direct Deposit Authorization Form

- Explore our library by category or utilize the search bar to find the form you require.

- View the form preview by clicking Learn more to confirm it is the correct one.

- Select Get form to begin editing immediately.

- Fill out your form and incorporate any necessary information using the toolbar.

- Once completed, click the Sign tool to sign your Bbva Compass Bank Direct Deposit Authorization Form.

- Select the signature method that suits you best: Draw, Generate initials, or upload a photo of your handwritten signature.

- Press Done to complete editing and move on to document-sharing options if necessary.

With airSlate SignNow, you possess everything essential to handle your documents efficiently. You can locate, complete, edit, and even dispatch your Bbva Compass Bank Direct Deposit Authorization Form within a single tab without any complications. Simplify your procedures by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct bbva compass bank direct deposit authorization form

FAQs

-

Is it fishy if a company wants you to fill out the direct deposit form before you receive any paper work about being hired?

Hi, To give a little more context, if you are worried about completing a direct deposit form, which should be for receiving remuneration of your wages, then request a your employment contract and tell them you will complete the direct deposit form after the employment has been received. Always be open and honest with a potential em0ployer and set parameters for your employment relationship from the get go. you would like to follow procedures. Every Employer will respect you more for that. I do not think it is fishy but a little odd

-

Is it legal to fill out a deposit slip and deposit a DD in someone else's bank account without seeking permission/authorization? Does it constitute operating a bank account without authorization and what liabilities (civil/criminal) would it attract?

Banks accept deposits from a third party either in cash or through bank draft if the instrument is in order otherwise. However, if any suspicious deposit is made, the account holder should bring it to the notice of bank for such irregular transactions. If he withdraws the money or fails to file details in IT returns if any he will be liable for consequences for such deposits.

-

How do I deposit a personal check written out to me to my online bank account without a direct deposit?

Dear M. Anonymous,Good question. It can be confusing when you are new to online banking (or to checking accounts in general), so I totally understand. For years, I used a local bank. I deposited checks by going to the physical bank. Once I was at the bank, I would give the check to the teller to deposit, or I would put the check (and deposit slip) in the slot outside. This was long before online banking had been invented.My local bank once made a serious mistake in my account, which I resolved after spending many hours at a bank executive’s desk. The executive could not figure out the problem, but I was able to see that it had been my bank’s error that had caused the discrepancy. This sour experience prompted me to look elsewhere for another bank. I decided to use a bank that is primarily online and that is connected with a world-class organization that also provides car and home insurance to U.S. military officers and their dependents. I had done my research long before I ever selected this organization for my banking and car and home insurance.I currently have a bank account at this organization’s excellent online bank based in San Antonio, Texas (I’m in the D.C. area), and the way I prefer to deposit checks to my bank is by regular mail.For a good long while, my bank had a contract with a UPS Store that could scan checks and deposit them electronically into someone’s bank account, but I always felt a little uneasy doing that, and only used this service a few times. It certainly did not feel too secure to have a non-bank-related person touch my checks. Eventually, my bank stopped offering that as an option. (I would love to know the back story of what prompted my bank to stop doing this.)There are at least six ways to deposit checks including using electronic means (see this WikiHow: How to Deposit Checks).PRO TIP: Of course, the best thing for you to do is to go on your bank’s website and find out their process. Their website might even have a generic deposit ticket you can print out if you want to mail it in.Below are the steps I take to deposit checks by mail to my online bank.Endorse the check (that is, write your signature on the back). Under your signature, write “Deposit to” and then write your bank account number. NOTE: Make sure the check is valid.Fill out a deposit ticket (these are included with your checkbook). If you don’t have paper checks or deposit slips, contact your bank to find out how to get one.Put both the endorsed check and deposit ticket in an envelope addressed to the bank. Seal the envelope. My bank provides me with preaddressed envelopes that do not need postage.MAIL the envelope.Wait a few days, and you should see that deposit showing up in your account online.—Sarah M. 9/12/2018ORIGINAL QUESTION: How do I deposit a personal check written out to me to my online bank account without a direct deposit?

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

Why would a bank mail me an SSA-89 form to fill out for a new checking account after it's already been opened with money that's already been deposited (and even though I'm already an existing customer)?

Why would a bank mail me an SSA-89 form to fill out for a new checking account after it's already been opened with money that's already been deposited (and even though I'm already an existing customer)?Banks have rules regarding “knowing their customers” that they must comply with or face penalties. In all likelihood the SSN on your account was flagged for some reason or another. Maybe it was mistyped, or maybe you’re using a fake SSN. Either way, the bank is going to want to see documentation of your SSN or they’ll have to restrict or close the account.You should get ahold of the bank to avoid any hassles with the funds that are in there or any transactions your had set up.

-

How do I make an online payment check out form directly to my bank if I do not like PayPal?

I cannot tell if you are a developer creating an online payment form or a consumer asking about the check-out and payment process in general. I will answer for the consumer's perspective: Short answer: debit cards issued by your bank offer the best compromise between directness, convenience, and security when paying online. If the website doesn't offer fields to input bank account and routing information, you cannot directly charge your bank account for a purchase from an online check out form. This is usually a good thing. Do not provide your bank account information to arbitrary merchants online. You may compromise your security by doing so because many banks have little protection against fraud from direct withdrawals. If you must pay using your bank account, try calling the company. Their phone representatives might have access to payment methods that are unavailable online, and they can process your order over the phone. Again, do this only if you trust the company. Although PayPal enables you to "connect" your bank account, you never directly pay from that account when you check out with PayPal. The merchant never accesses your account themselves. PayPal withdraws the order amount from your account and disburses your payment to the merchant.Similarly, debit cards provide what seems to be direct access to you bank account, but there is still a layer in between: the debit processing network. Some debit card providers offer similar protection against fraudulent transactions as the protection credit cards typically include.Arguably, payments by check (cheque) and "direct debit" can be considered indirect as well (in the US, at least), because these transactions must pass through the ACH network. Withdrawing the cash at your own bank in person would be the only true direct method. Similar wire transfer systems of payment exist as well that enable transfer of money electronically. However, ACH and wire transfers are seldom used for online payments unless the value of the product is quite large. Both offer almost no protection against fraud. Here's a quick, (very) simplified illustration of the path of these payment methods: Merchant > Check (ACH) > Your Bank

Create this form in 5 minutes!

How to create an eSignature for the bbva compass bank direct deposit authorization form

How to create an eSignature for your Bbva Compass Bank Direct Deposit Authorization Form online

How to create an eSignature for the Bbva Compass Bank Direct Deposit Authorization Form in Chrome

How to create an electronic signature for signing the Bbva Compass Bank Direct Deposit Authorization Form in Gmail

How to generate an electronic signature for the Bbva Compass Bank Direct Deposit Authorization Form right from your smartphone

How to generate an eSignature for the Bbva Compass Bank Direct Deposit Authorization Form on iOS devices

How to create an electronic signature for the Bbva Compass Bank Direct Deposit Authorization Form on Android

People also ask

-

What is the Bbva Compass Bank Direct Deposit Authorization Form?

The Bbva Compass Bank Direct Deposit Authorization Form is a document that allows employees to authorize their employers to deposit their paychecks directly into their Bbva Compass Bank accounts. This form simplifies the payroll process and ensures that funds are available immediately on payday.

-

How can I create a Bbva Compass Bank Direct Deposit Authorization Form using airSlate SignNow?

With airSlate SignNow, creating a Bbva Compass Bank Direct Deposit Authorization Form is straightforward. Simply log in, select the template for the authorization form, fill in the required details, and send it for eSignature to your employees. It streamlines the process, making it efficient and secure.

-

What are the benefits of using the Bbva Compass Bank Direct Deposit Authorization Form?

Using the Bbva Compass Bank Direct Deposit Authorization Form offers numerous benefits, including timely payments, reduced check handling, and increased security for your financial transactions. Additionally, it enhances employee satisfaction by ensuring funds are readily accessible.

-

Is there a cost associated with using the Bbva Compass Bank Direct Deposit Authorization Form through airSlate SignNow?

airSlate SignNow offers competitive pricing for its services, including the use of the Bbva Compass Bank Direct Deposit Authorization Form. You can choose from various subscription plans that best fit your business needs, ensuring you get value for your investment.

-

Can I integrate the Bbva Compass Bank Direct Deposit Authorization Form with other software?

Yes, airSlate SignNow allows for seamless integrations with various HR and payroll software, enhancing the workflow of the Bbva Compass Bank Direct Deposit Authorization Form. This integration enables better data management and simplifies the payroll process for businesses.

-

How secure is the Bbva Compass Bank Direct Deposit Authorization Form when using airSlate SignNow?

When you use airSlate SignNow for the Bbva Compass Bank Direct Deposit Authorization Form, you can rest assured that your data is protected. The platform employs advanced encryption and security measures to ensure that all sensitive information remains confidential and secure.

-

Can I customize the Bbva Compass Bank Direct Deposit Authorization Form?

Absolutely! airSlate SignNow allows you to customize the Bbva Compass Bank Direct Deposit Authorization Form to meet your specific needs. You can add company logos, modify fields, and adjust the layout to align with your branding and requirements.

Get more for Bbva Compass Bank Direct Deposit Authorization Form

Find out other Bbva Compass Bank Direct Deposit Authorization Form

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement