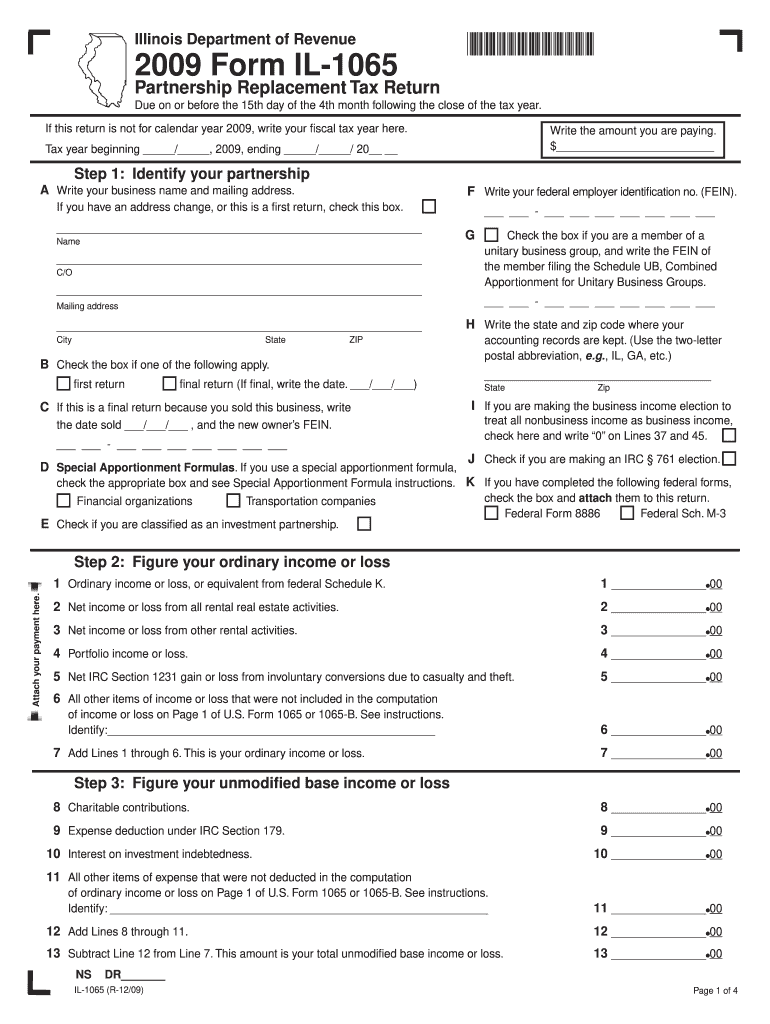

Illinois Department of Revenue Partnership Replacement Tax Return Due on or Before the 15th Day of the 4th Month Following the C Form

What is the Illinois replacement tax?

The Illinois replacement tax is a tax imposed on partnerships, corporations, and other business entities operating within the state. This tax serves as a substitute for property taxes that would typically be levied on businesses. The revenue generated from this tax is allocated to local governments, helping to fund essential services. Understanding the Illinois replacement tax is crucial for businesses to ensure compliance and to take advantage of any available credits, such as the Illinois replacement tax credit.

Key elements of the Illinois replacement tax credit

The Illinois replacement tax credit is designed to reduce the tax burden for qualifying businesses. Key elements include:

- Eligibility: Businesses must meet specific criteria to qualify for the credit, including being subject to the Illinois replacement tax.

- Credit Amount: The amount of the credit can vary based on the business's income and the total replacement tax paid.

- Application Process: Businesses must complete the necessary forms and provide documentation to claim the credit on their tax returns.

Steps to complete the Illinois replacement tax credit application

To successfully apply for the Illinois replacement tax credit, follow these steps:

- Determine eligibility by reviewing the criteria set by the Illinois Department of Revenue.

- Gather all necessary documentation, including financial statements and tax forms.

- Complete the appropriate forms, such as the IL Form 1065, ensuring all information is accurate and up-to-date.

- Submit the completed forms to the Illinois Department of Revenue by the specified deadline.

Filing deadlines for the Illinois replacement tax

It is essential for businesses to be aware of the filing deadlines associated with the Illinois replacement tax. Generally, the tax return is due on or before the fifteenth day of the fourth month following the close of the tax year. For partnerships, this means that the return must be filed by April 15 for calendar year filers. Late submissions may incur penalties, so timely filing is crucial.

Required documents for the Illinois replacement tax credit

When applying for the Illinois replacement tax credit, businesses must prepare several key documents:

- Completed IL Form 1065, which details the partnership's income and expenses.

- Supporting documentation, such as financial statements and proof of tax payments made.

- Any additional forms required by the Illinois Department of Revenue to substantiate the credit claim.

Penalties for non-compliance with the Illinois replacement tax

Failure to comply with the Illinois replacement tax regulations can result in significant penalties. These may include:

- Monetary fines based on the amount of tax owed.

- Interest on unpaid taxes, which accumulates over time.

- Potential legal action from the Illinois Department of Revenue for persistent non-compliance.

Quick guide on how to complete illinois department of revenue partnership replacement tax return due on or before the 15th day of the 4th month following the

Complete Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents rapidly without any hold-ups. Handle Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and eSign Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C without any hassle

- Obtain Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue partnership replacement tax return due on or before the 15th day of the 4th month following the

How to create an electronic signature for the Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The online

How to generate an electronic signature for your Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The in Google Chrome

How to make an eSignature for putting it on the Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The in Gmail

How to make an eSignature for the Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The right from your mobile device

How to generate an electronic signature for the Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The on iOS devices

How to create an eSignature for the Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The on Android

People also ask

-

What is the Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C?

The Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C is a mandatory tax obligation for partnerships operating in Illinois. This return is essential for reporting income and ensuring compliance with state tax laws. It's crucial for businesses to be aware of this deadline to avoid penalties.

-

How can airSlate SignNow help with filing the Illinois Department Of Revenue Partnership Replacement Tax Return?

airSlate SignNow streamlines the process of preparing and submitting the Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C. Our platform allows you to easily fill out necessary forms, eSign documents, and securely share them with relevant parties, ensuring timely submission.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers a range of features including document templates, eSignature capabilities, and secure storage, all designed to facilitate efficient management of tax documents. With our solution, you can ensure that your Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C is handled with ease and accuracy.

-

Is airSlate SignNow compliant with Illinois tax regulations?

Yes, airSlate SignNow is designed to comply with various regulatory requirements, including those set by the Illinois Department Of Revenue. By using our platform, you can confidently manage your Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C while adhering to state laws.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our affordable solutions ensure that you can efficiently manage your Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C without breaking the bank, making it accessible for all.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing your workflow. This integration allows for smoother management of your Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C, making it easier to keep your records organized.

-

What benefits does eSigning provide for tax returns?

eSigning through airSlate SignNow offers numerous benefits for tax returns, including faster processing times and enhanced security. By eSigning your Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C, you can submit your documents quickly and reduce the risk of fraudulent activities.

Get more for Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C

Find out other Illinois Department Of Revenue Partnership Replacement Tax Return Due On Or Before The 15th Day Of The 4th Month Following The C

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself