Important Tax Form W 4 Changes and Workday Tax Elections 2020

What is the Important Tax Form W-4 Changes and Workday Tax Elections

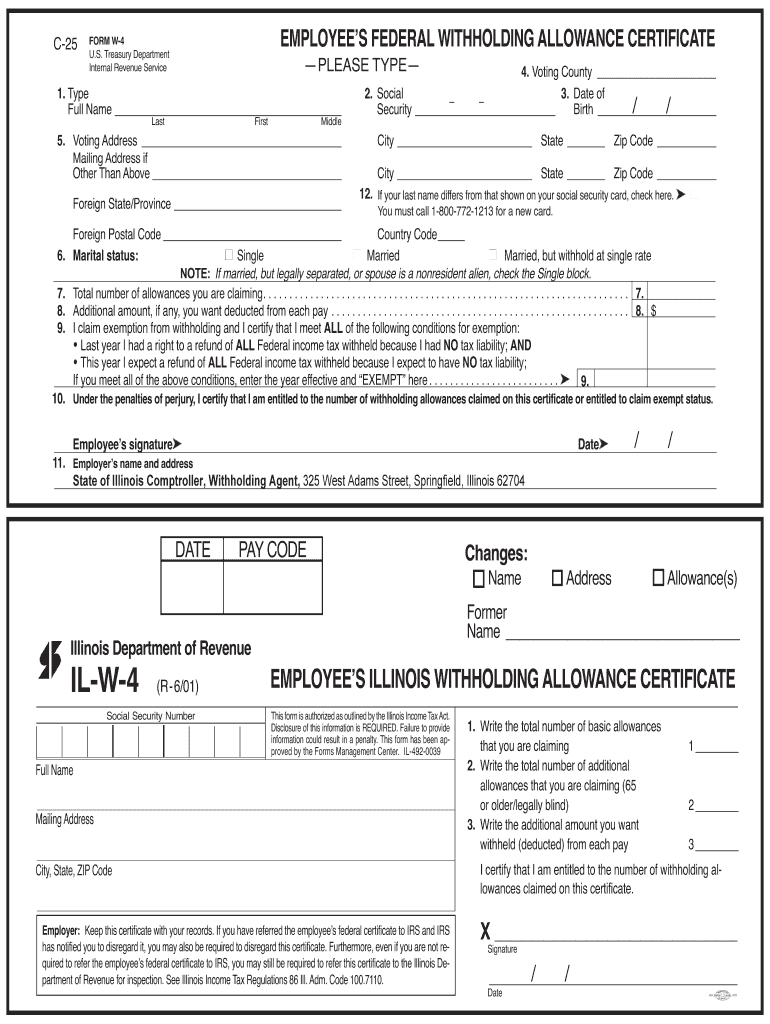

The Important Tax Form W-4 is a critical document used by employees in the United States to inform their employers about their tax situation. This form helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck. Recent changes to the W-4 have simplified the process, allowing employees to provide more accurate information about their tax liabilities. Workday tax elections refer to the selections made by employees within the Workday platform regarding their tax withholding preferences, which can directly impact the information submitted on the W-4.

Steps to Complete the Important Tax Form W-4 Changes and Workday Tax Elections

Completing the Important Tax Form W-4 involves several key steps:

- Personal Information: Fill in your name, address, Social Security number, and filing status.

- Multiple Jobs or Spouse Works: Indicate if you have multiple jobs or if your spouse works, as this can affect your withholding.

- Claim Dependents: If applicable, provide information about any dependents you wish to claim for tax credits.

- Other Adjustments: Specify any additional income or deductions that may influence your tax situation.

- Sign and Date: Ensure you sign and date the form to validate it.

Once completed, you can submit the form to your employer through the Workday platform or directly, depending on your company's procedures.

Legal Use of the Important Tax Form W-4 Changes and Workday Tax Elections

The Important Tax Form W-4 is legally binding when filled out correctly and submitted to your employer. It is essential to provide accurate information to avoid under-withholding or over-withholding of taxes. Employers are required to keep this form on file and use it to calculate the appropriate tax withholding. The legal validity of the form is upheld by compliance with IRS regulations, ensuring that both employees and employers fulfill their tax obligations.

IRS Guidelines

The IRS provides specific guidelines for completing the W-4. These guidelines include instructions on how to calculate your withholding based on your income, deductions, and credits. It is advisable to refer to the latest IRS publications or the IRS website for updates. Following these guidelines helps ensure that you are withholding the correct amount of taxes throughout the year, reducing the risk of owing taxes when filing your return.

Form Submission Methods (Online / Mail / In-Person)

There are various methods for submitting the Important Tax Form W-4:

- Online: Many employers allow employees to submit their W-4 electronically through platforms like Workday.

- Mail: You can print the completed form and mail it directly to your employer's HR department.

- In-Person: You may also choose to deliver the form in person to your HR representative.

It is important to confirm with your employer which submission method is preferred to ensure timely processing.

Examples of Using the Important Tax Form W-4 Changes and Workday Tax Elections

Employees may need to update their W-4 in various scenarios:

- Change in Marital Status: If you get married or divorced, you may need to adjust your withholding.

- New Job: Starting a new job typically requires submitting a new W-4.

- Change in Dependents: If you have children or dependents, claiming them can affect your tax situation.

- Significant Income Changes: A change in income can necessitate a review of your withholding amounts.

These examples illustrate the importance of keeping your W-4 up to date to reflect your current financial situation accurately.

Quick guide on how to complete important tax form w 4 changes and workday tax elections

Prepare Important Tax Form W 4 Changes And Workday Tax Elections effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed documents, as you can locate the necessary form and securely maintain it online. airSlate SignNow provides all the tools required to generate, modify, and electronically sign your documents quickly and efficiently. Manage Important Tax Form W 4 Changes And Workday Tax Elections on any device utilizing the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest way to alter and electronically sign Important Tax Form W 4 Changes And Workday Tax Elections with ease

- Obtain Important Tax Form W 4 Changes And Workday Tax Elections and then click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature by using the Sign tool, which can be done in seconds and carries the same legal significance as a traditional pen-and-ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form retrieval, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Important Tax Form W 4 Changes And Workday Tax Elections and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct important tax form w 4 changes and workday tax elections

Create this form in 5 minutes!

How to create an eSignature for the important tax form w 4 changes and workday tax elections

The best way to generate an electronic signature for your PDF file online

The best way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What are the Important Tax Form W 4 Changes and how do they impact my payroll?

The Important Tax Form W 4 Changes are designed to simplify the process of calculating withholding taxes. These changes can impact your payroll as they allow for more accurate deductions based on individual circumstances. It’s essential to stay updated with these changes to ensure compliance and optimize your tax situation.

-

How can Workday Tax Elections be managed within airSlate SignNow?

Managing Workday Tax Elections within airSlate SignNow is streamlined with our electronic signature capabilities. By integrating your tax documents into our platform, you can ensure that all Workday Tax Elections are executed efficiently and securely. This feature reduces paperwork and enhances the speed of document processing.

-

Are there any costs associated with implementing the Important Tax Form W 4 Changes in airSlate SignNow?

airSlate SignNow offers a cost-effective solution for integrating Important Tax Form W 4 Changes into your workflow. Subscription pricing is structured to provide flexibility based on your business needs. You can either choose a monthly plan or an annual subscription, both tailored to fit various budgets.

-

What features does airSlate SignNow offer for handling tax forms?

airSlate SignNow provides a range of features for handling tax forms, including document templates, e-signature capabilities, and secure storage. These features ensure that the Important Tax Form W 4 Changes and Workday Tax Elections are easily accessible and maintain compliance with federal regulations. You can also track the status of documents in real-time.

-

How does airSlate SignNow improve compliance with tax regulations?

By using airSlate SignNow, businesses can improve compliance with tax regulations through automated workflows and audit trails. The platform helps ensure that all Important Tax Form W 4 Changes and Workday Tax Elections are documented properly and can be retrieved easily. This not only maintains accuracy but also facilitates seamless audits.

-

Can airSlate SignNow integrate with other payroll systems for tax form management?

Yes, airSlate SignNow can integrate with various payroll systems, allowing for efficient management of tax forms. This integration means that Important Tax Form W 4 Changes and Workday Tax Elections can be updated across systems automatically, saving you time and reducing the potential for errors. Our API allows for seamless connectivity with other applications.

-

What are the benefits of using airSlate SignNow for tax form eSigning?

Using airSlate SignNow for tax form eSigning offers signNow benefits such as speed, security, and convenience. The platform allows for quick signing of Important Tax Form W 4 Changes and Workday Tax Elections, helping you avoid delays in payroll processing. Additionally, it ensures that all transactions are secure and compliant with e-signature laws.

Get more for Important Tax Form W 4 Changes And Workday Tax Elections

- Page 1 of 4 headaches residual functional capacity form

- Single tenant lease net 01 air commercial real estate form

- Printable waybill form

- Eviction packet manatee county clerk of circuit court amp comptroller form

- Waybill non negotiable form

- Urine initial drug screen result form cliawaivedcom

- Lic 610a form

- Wake dom form

Find out other Important Tax Form W 4 Changes And Workday Tax Elections

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile