Illinois W4 2017

What is the Illinois W-4?

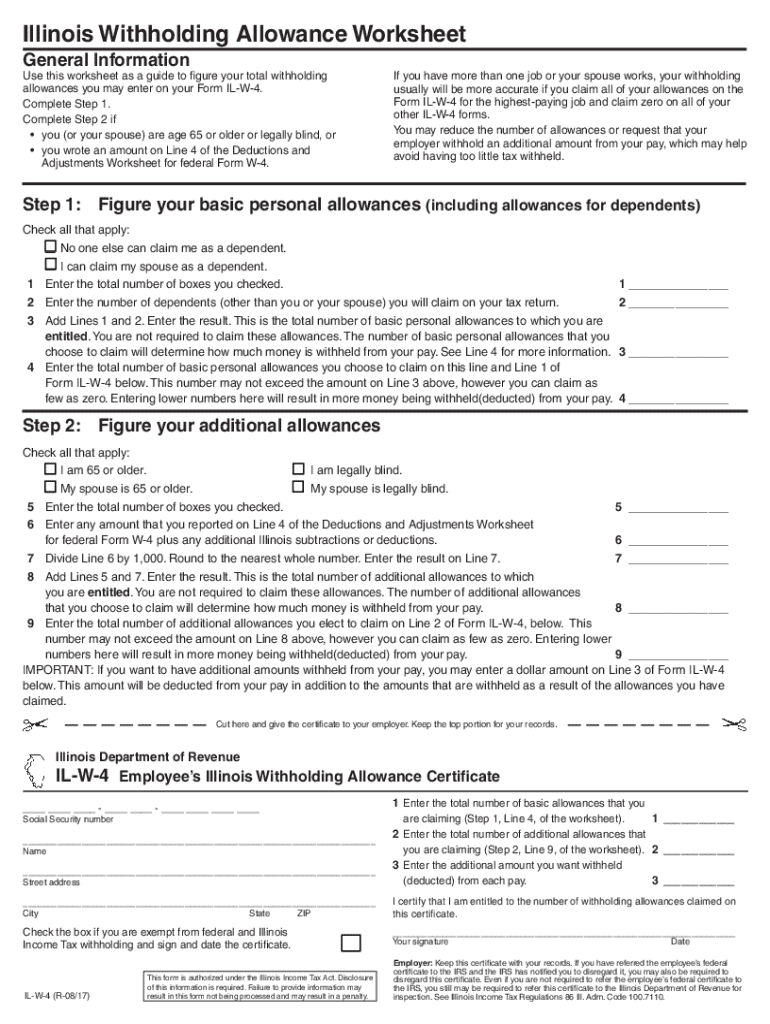

The Illinois W-4, officially known as the Illinois Employee Withholding Form, is a state-specific tax form used by employees to determine the amount of state income tax withheld from their paychecks. This form is crucial for ensuring that the correct amount of taxes is withheld based on the employee's financial situation, including their filing status and any allowances they claim. The information provided on the Illinois W-4 directly impacts the employee's take-home pay and their tax obligations at the end of the year.

Steps to Complete the Illinois W-4

Completing the Illinois W-4 involves several straightforward steps:

- Personal Information: Fill in your name, address, Social Security number, and filing status.

- Allowances: Determine the number of allowances you are claiming based on your personal circumstances, such as dependents and tax credits.

- Additional Withholding: If you wish to have extra tax withheld, specify the additional amount in the designated section.

- Signature: Sign and date the form to validate your information.

Once completed, the form should be submitted to your employer, who will use it to adjust your state tax withholding accordingly.

How to Obtain the Illinois W-4

The Illinois W-4 form can be easily obtained through several methods:

- Online: Download the form from the official Illinois Department of Revenue website.

- Employer: Request a copy from your employer's human resources or payroll department.

- Tax Professionals: Consult with a tax advisor who can provide the form and assist with filling it out accurately.

Having the correct version of the form is essential to ensure compliance with state tax regulations.

Key Elements of the Illinois W-4

The Illinois W-4 includes several key elements that are important for accurate tax withholding:

- Personal Information: Essential for identifying the employee.

- Filing Status: Determines the tax rate applied to your income.

- Allowances Claimed: Affects the amount of tax withheld; more allowances typically mean less tax withheld.

- Additional Withholding Amount: Optional section for those who want to increase their withholding.

Understanding these elements helps employees make informed decisions about their tax withholdings.

Legal Use of the Illinois W-4

The Illinois W-4 is legally required for employees to ensure that appropriate state taxes are withheld from their pay. Employers must keep this form on file for each employee and use it to calculate withholding amounts accurately. Failure to provide a completed form can result in the employer withholding taxes at the highest rate, which may not reflect the employee's actual tax liability. It is important for employees to review and update their W-4 whenever there are changes in their personal or financial circumstances.

Form Submission Methods

Once the Illinois W-4 is completed, it can be submitted in several ways:

- In-Person: Hand the form directly to your employer's payroll department.

- Mail: If required by your employer, send the form via postal mail.

- Electronic Submission: Some employers may allow you to submit the form digitally through their payroll systems.

It is advisable to confirm with your employer about their preferred submission method to ensure timely processing.

Quick guide on how to complete what should i fill on line 4 on il w4 2017 2019 form

Your assistance manual on how to prepare your Illinois W4

If you’re curious about how to generate and submit your Illinois W4, here are some straightforward instructions on how to simplify tax filing.

To start, you only need to set up your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is a highly intuitive and powerful document solution that allows you to modify, draft, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to update information whenever necessary. Optimize your tax management with enhanced PDF editing, eSigning, and easy sharing.

Follow the steps below to finalize your Illinois W4 in just a few minutes:

- Create your account and commence working on PDFs in moments.

- Utilize our catalog to find any IRS tax form; explore versions and schedules.

- Click Get form to access your Illinois W4 in our editor.

- Complete the necessary fillable fields with your information (textual details, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes digitally with airSlate SignNow. Please remember that filing on paper can increase return errors and delay reimbursements. It’s also important to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct what should i fill on line 4 on il w4 2017 2019 form

FAQs

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How should I fill out the choices on the NIMCET 2017?

Visit the NIMCET-2017 through NIMCET 2017 and login using Hall ticket number and password.Screen shot: here you can loginAfter login you can fill your choicesThe sequence you can Fill:NIT TrichyNITK SurathkalMNNIT AllahabadNIT WarangalMANIT Bhopal/ NIT CalicutNIT KKRNIT JSRNIT DGPNIT RaipurNIT AgartalaAll the Colleges provide excellent facilities, accommodation, and educational. Fill the College preference which suitable to you, Above list is not mandatory are useful for everyone to choose the college.

-

How should I fill out the NDA course serial in TES (10+2)?

GO TOJoin Indian Army.THEN GO TO APPLY ONLINE..THATS ALL. THEY WILL GIVE YOU A CHANCE TO FILL THE FORM. do it fast.

Create this form in 5 minutes!

How to create an eSignature for the what should i fill on line 4 on il w4 2017 2019 form

How to make an eSignature for your What Should I Fill On Line 4 On Il W4 2017 2019 Form in the online mode

How to make an eSignature for your What Should I Fill On Line 4 On Il W4 2017 2019 Form in Google Chrome

How to make an eSignature for putting it on the What Should I Fill On Line 4 On Il W4 2017 2019 Form in Gmail

How to create an eSignature for the What Should I Fill On Line 4 On Il W4 2017 2019 Form from your smartphone

How to make an eSignature for the What Should I Fill On Line 4 On Il W4 2017 2019 Form on iOS

How to generate an eSignature for the What Should I Fill On Line 4 On Il W4 2017 2019 Form on Android OS

People also ask

-

What is Il Form W 4 2019 and why is it important?

Il Form W 4 2019 is a crucial tax document used in the United States that helps employees determine the amount of federal income tax withheld from their paychecks. Understanding and filling out this form accurately is essential to avoid overpaying or underpaying taxes, which can impact your financial situation signNowly.

-

How can airSlate SignNow help with Il Form W 4 2019?

airSlate SignNow offers a streamlined process for completing and eSigning your Il Form W 4 2019. With our intuitive interface, you can securely fill out and send the form electronically, ensuring that you can manage your tax documents efficiently and effectively.

-

Is there a cost associated with using airSlate SignNow for Il Form W 4 2019?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, allowing you to choose the one that best fits your requirements while successfully managing documents like the Il Form W 4 2019.

-

What features does airSlate SignNow provide for managing Il Form W 4 2019?

airSlate SignNow includes features such as document templates, real-time tracking, and robust security protocols specifically for forms like Il Form W 4 2019. These features simplify the eSigning process and ensure your documents are secure and compliant.

-

Can I integrate airSlate SignNow with other tools for handling Il Form W 4 2019?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your workflow when managing the Il Form W 4 2019. This integration allows you to synchronize your data with tools you already use for maximum efficiency.

-

What are the benefits of using airSlate SignNow for Il Form W 4 2019?

Using airSlate SignNow for Il Form W 4 2019 streamlines the eSigning process, reduces the time spent on paperwork, and minimizes errors. Additionally, our platform offers a user-friendly experience that makes managing and submitting your tax forms easier than ever.

-

Is airSlate SignNow secure for submitting Il Form W 4 2019?

Yes, security is a top priority at airSlate SignNow. We use advanced encryption and security measures to protect your personal information when submitting sensitive documents like Il Form W 4 2019, ensuring your data remains confidential.

Get more for Illinois W4

Find out other Illinois W4

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form