Rrb W 4p 2007-2026

What is the RRB W-4P?

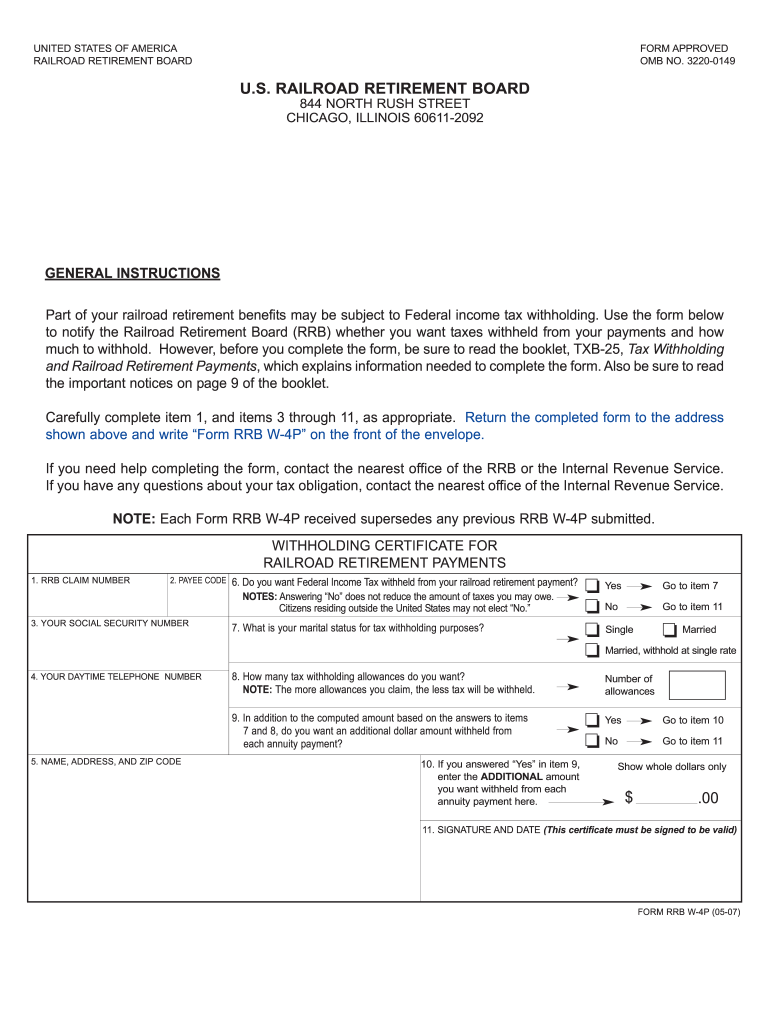

The RRB W-4P is a tax withholding form used by railroad retirement beneficiaries in the United States. This form allows individuals to specify how much federal income tax should be withheld from their monthly benefits. It is essential for ensuring that the correct amount of tax is deducted, helping beneficiaries avoid underpayment penalties or unexpected tax liabilities. The form is specifically designed for those receiving payments from the Railroad Retirement Board (RRB).

How to use the RRB W-4P

Using the RRB W-4P involves a few straightforward steps. First, download the form from the official Railroad Retirement Board website or obtain a physical copy. Next, fill out the required fields, including your personal information and the amount you wish to withhold. After completing the form, submit it to the RRB to ensure your withholding preferences are updated. It is advisable to review your withholding annually or when your financial situation changes to ensure accuracy.

Steps to complete the RRB W-4P

Completing the RRB W-4P requires careful attention to detail. Follow these steps:

- Download or request the RRB W-4P form.

- Provide your name, Social Security number, and address in the designated fields.

- Indicate your filing status, such as single or married.

- Specify the amount of federal income tax you wish to have withheld from your payments.

- Sign and date the form to validate your submission.

- Submit the completed form to the RRB via mail or through their online submission portal.

Legal use of the RRB W-4P

The RRB W-4P is legally recognized as an official document for tax withholding purposes. To ensure its validity, it must be filled out accurately and submitted to the appropriate authorities. Misrepresentation or failure to submit the form can lead to legal consequences, including penalties for incorrect tax payments. Therefore, it is crucial to provide truthful information and keep a copy of the submitted form for your records.

Key elements of the RRB W-4P

Several key elements are essential when filling out the RRB W-4P. These include:

- Personal Information: Your name, Social Security number, and address.

- Filing Status: Indicating whether you are single, married, or head of household.

- Withholding Amount: The specific amount you want withheld from your benefits.

- Signature: Your signature and date to validate the form.

IRS Guidelines

The IRS provides guidelines for using the RRB W-4P, emphasizing the importance of accurate withholding. Beneficiaries should refer to IRS publications for detailed instructions on how to calculate withholding amounts based on their income and tax situation. Staying informed about changes in tax laws and regulations is also crucial for compliance and optimal tax planning.

Quick guide on how to complete rrb form w 4p

A straightforward guide on how to prepare Rrb W 4p

Filling out electronic forms has shown to be more efficient and safer than conventional pen-and-paper methods. Unlike physically writing on printed copies, correcting a typo or entering data in the wrong section is simple. Such errors can be a signNow hindrance when preparing applications and petitions. Consider utilizing airSlate SignNow for completing your Rrb W 4p. Our all-inclusive, user-friendly, and compliant e-signature solution will simplify this process for you.

Follow our instructions on how to quickly complete and sign your Rrb W 4p with airSlate SignNow:

- Verify your chosen document’s purpose to ensure it meets your needs, and click Get Form if it does.

- Find your template uploaded to our editor and discover the features our tool offers for form modification.

- Complete empty fields with your information and mark options using Check or Cross selections.

- Insert Text boxes, replace existing content, and add Images wherever necessary.

- Utilize the Highlight button to emphasize what you want, and conceal irrelevant information for your recipient using the Blackout feature.

- In the right-side panel, create additional fillable fields assigned to specific parties if needed.

- Secure your document with watermarks or set a password when you complete your edits.

- Insert Date, click Sign → Add signature and choose your preferred signing method.

- Draw, type, upload, or generate your legally binding electronic signature with a QR code or by using your device's camera.

- Review your responses and click Done to finalize editing and move on to file sharing.

Use airSlate SignNow to prepare your Rrb W 4p and manage other professional fillable documents safely and efficiently. Register now!

Create this form in 5 minutes or less

FAQs

-

What is the last date to fill out the form of a technician post RRB?

Railway Recruitment Board invites online applications for the technical posts in Indian Railway.The Board has announced the notification for ALP & Technician posts.This notification has been released on 3 November 2018.Candidates can check the complete information for this notification from here – RRB ALP 2018.The last date to complete your registration is 31 March 2018.There are 26502 posts for RRB ALP & Technicians.So hurry up and fill the registration form.

-

How many candidates applied for IBPS RRB 2018?

Fill rti you will come to know.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Can I fill out the IBPS RRB Scale 1 form twice due to a mistake the first time?

Today I've done a mistake. Uploaded Right Thumb Impression instead of left.Everybody said that this is a very little mistake but I'm considering it a huge one and I'll fill my form again tomorrow.What you need is:new Email ID.A phone number that you have not used in previous registrations.You'll have to pay the fee again (I hope you know this already).So, YES! Go for it.NOTE: I’M TALKING ABOUT IBPS BANK FORM, IN BANKS YOU REQUIRE NEW EMAIL ID TO FILL ANOTHER FORM IF YOU MADE A MISTAKE IN YOUR PREVIOUS FORM. HOWEVER, IN RRB YOU MAY NOT NEED TO HAVE ANOTHER EMAIL ID BUT HAVING IT IS ALWAYS BETTER THAN TO NOT HAVE IT BECAUSE HAVING A NEW EMAIL ID IS UNIVERSAL CORRECTION PROCEDURE.

Create this form in 5 minutes!

How to create an eSignature for the rrb form w 4p

How to make an eSignature for your Rrb Form W 4p in the online mode

How to make an electronic signature for your Rrb Form W 4p in Google Chrome

How to generate an electronic signature for signing the Rrb Form W 4p in Gmail

How to generate an eSignature for the Rrb Form W 4p straight from your smart phone

How to make an eSignature for the Rrb Form W 4p on iOS

How to make an electronic signature for the Rrb Form W 4p on Android

People also ask

-

What is the Rrb W 4p form used for in airSlate SignNow?

The Rrb W 4p form is designed for employees receiving railroad retirement benefits who need to provide withholding information for federal income tax purposes. With airSlate SignNow, you can easily fill out, sign, and send the Rrb W 4p electronically, streamlining the process and ensuring compliance.

-

How does airSlate SignNow simplify the Rrb W 4p eSigning process?

airSlate SignNow simplifies the Rrb W 4p eSigning process by offering a user-friendly interface that allows you to fill out and sign forms from anywhere. You can upload your Rrb W 4p documents, add your signature, and send them securely to recipients in just a few clicks.

-

Is there a cost to use airSlate SignNow for Rrb W 4p signatures?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for eSigning Rrb W 4p forms. You can choose a plan that fits your budget and requirements, ensuring you only pay for the features you need.

-

Can I integrate airSlate SignNow with other software for Rrb W 4p management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage Rrb W 4p forms efficiently. Whether you use CRM systems, cloud storage solutions, or project management tools, you can streamline your document workflow easily.

-

What security measures does airSlate SignNow provide for Rrb W 4p documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the Rrb W 4p. The platform employs industry-standard encryption, secure cloud storage, and compliance with regulations to ensure your documents are safe and confidential.

-

How can airSlate SignNow help businesses save time with Rrb W 4p forms?

By using airSlate SignNow, businesses can signNowly reduce the time spent on manual paperwork for Rrb W 4p forms. The eSigning feature allows for quick approvals and eliminates the need for printing and scanning, enabling faster turnaround on important documents.

-

What features does airSlate SignNow offer specifically for Rrb W 4p processing?

airSlate SignNow offers a range of features tailored for Rrb W 4p processing, including customizable templates, automated reminders, and real-time tracking of document status. These features enhance efficiency and ensure that your Rrb W 4p forms are processed promptly.

Get more for Rrb W 4p

Find out other Rrb W 4p

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template