Individual Vehicle Mileage and Fuel Report Idaho State Tax 2019-2026

What is the Individual Vehicle Mileage And Fuel Report Idaho State Tax

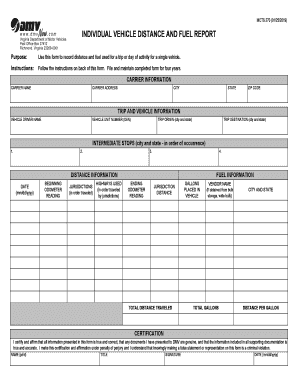

The Individual Vehicle Mileage and Fuel Report for Idaho State Tax is a form designed for taxpayers to report their vehicle mileage and fuel expenses. This report is essential for individuals who need to document their vehicle usage for tax purposes, particularly those who are self-employed or use their vehicles for business-related activities. The information provided in this report can help in calculating deductions related to mileage and fuel costs, which can significantly affect overall tax liability.

How to use the Individual Vehicle Mileage And Fuel Report Idaho State Tax

Using the Individual Vehicle Mileage and Fuel Report involves several steps. First, gather all relevant information, including total miles driven, the purpose of each trip, and fuel expenses incurred. Next, fill out the form accurately, ensuring that all sections are completed. After completing the form, review it for any errors before submission. This report can be submitted electronically or via mail, depending on the preferred method of filing. Utilizing digital tools can streamline this process, making it easier to manage and submit your report.

Steps to complete the Individual Vehicle Mileage And Fuel Report Idaho State Tax

Completing the Individual Vehicle Mileage and Fuel Report involves a systematic approach:

- Gather your vehicle usage records, including odometer readings and fuel receipts.

- Document the date, purpose, and miles driven for each trip.

- Calculate total mileage for business use and total fuel expenses.

- Fill out the report form with accurate information.

- Double-check all entries for accuracy and completeness.

- Submit the form electronically or by mail, as required.

Legal use of the Individual Vehicle Mileage And Fuel Report Idaho State Tax

The Individual Vehicle Mileage and Fuel Report is legally binding when completed correctly. To ensure its legality, it must comply with the relevant tax regulations set forth by the state of Idaho. This includes accurate reporting of mileage and expenses, as well as proper signatures if required. Utilizing a reliable electronic signature solution can enhance the legal standing of the document, ensuring it meets all necessary legal criteria.

State-specific rules for the Individual Vehicle Mileage And Fuel Report Idaho State Tax

Idaho has specific regulations governing the use of the Individual Vehicle Mileage and Fuel Report. Taxpayers must adhere to state guidelines regarding what qualifies as deductible mileage and the documentation required to support these claims. It is important to stay informed about any changes in state tax laws that may affect how this report should be completed and submitted.

Filing Deadlines / Important Dates

Filing deadlines for the Individual Vehicle Mileage and Fuel Report are typically aligned with the state tax filing schedule. Taxpayers should be aware of the annual deadlines for submitting their tax returns to ensure compliance. It is advisable to check for any specific dates related to the mileage report, as these can vary based on individual circumstances or changes in tax law.

Quick guide on how to complete individual vehicle mileage and fuel report idaho state tax

Effortlessly prepare Individual Vehicle Mileage And Fuel Report Idaho State Tax on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Individual Vehicle Mileage And Fuel Report Idaho State Tax on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to modify and electronically sign Individual Vehicle Mileage And Fuel Report Idaho State Tax without hassle

- Locate Individual Vehicle Mileage And Fuel Report Idaho State Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Individual Vehicle Mileage And Fuel Report Idaho State Tax and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual vehicle mileage and fuel report idaho state tax

Create this form in 5 minutes!

How to create an eSignature for the individual vehicle mileage and fuel report idaho state tax

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Individual Vehicle Mileage And Fuel Report Idaho State Tax?

The Individual Vehicle Mileage And Fuel Report Idaho State Tax is a document that helps vehicle owners in Idaho track their mileage and fuel usage for tax purposes. It provides a comprehensive overview of the distances traveled and fuel consumed, which is essential for accurate tax reporting.

-

How can airSlate SignNow assist with the Individual Vehicle Mileage And Fuel Report Idaho State Tax?

airSlate SignNow simplifies the process of creating and signing the Individual Vehicle Mileage And Fuel Report Idaho State Tax. With our platform, you can efficiently manage your reports, ensuring that all details are captured accurately and securely signed.

-

What features are included in airSlate SignNow for the Individual Vehicle Mileage And Fuel Report Idaho State Tax?

Our platform includes features such as customizable templates for the Individual Vehicle Mileage And Fuel Report Idaho State Tax, easy document sharing, and secure e-signatures. These features streamline the reporting process while ensuring compliance with state tax regulations.

-

Is there a cost associated with using airSlate SignNow for the Individual Vehicle Mileage And Fuel Report Idaho State Tax?

Yes, airSlate SignNow offers a cost-effective solution for managing your Individual Vehicle Mileage And Fuel Report Idaho State Tax. We provide various pricing plans to accommodate different needs, ensuring you get the best value for effective document management.

-

Can I integrate airSlate SignNow with other tools for my Individual Vehicle Mileage And Fuel Report Idaho State Tax?

Absolutely! airSlate SignNow integrates seamlessly with several popular applications, allowing you to manage your Individual Vehicle Mileage And Fuel Report Idaho State Tax in one cohesive workflow. This integration helps enhance productivity and ensures all your data is streamlined.

-

Who can benefit from the Individual Vehicle Mileage And Fuel Report Idaho State Tax?

Individuals, businesses, and contractors in Idaho can benefit from the Individual Vehicle Mileage And Fuel Report Idaho State Tax. Accurate mileage tracking is crucial for reimbursing travel expenses and ensuring compliance with tax laws, making it essential for any vehicle owner.

-

How does airSlate SignNow ensure the security of the Individual Vehicle Mileage And Fuel Report Idaho State Tax?

At airSlate SignNow, we prioritize the security of your documents, including the Individual Vehicle Mileage And Fuel Report Idaho State Tax. Our platform uses advanced encryption methods and secure storage solutions to protect your sensitive information from unauthorized access.

Get more for Individual Vehicle Mileage And Fuel Report Idaho State Tax

- Us government passenger transportation handbook gsagov form

- Surety bonds circular 570 fiscaltreasurygov form

- Fillable online aginspectors form sf 1187 aginspectorsorg

- For labor organization dues cancellation of payroll opm form

- Sf 1200 gbl correction fillable fill online printable fillable form

- Property condition assessment report property form

- Graduate school letters of intenthtml in unowadopewogithub form

- Pgi 2046contract reporting form

Find out other Individual Vehicle Mileage And Fuel Report Idaho State Tax

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast