Irs Form 673 Fillable

What is the IRS Form 673 Fillable

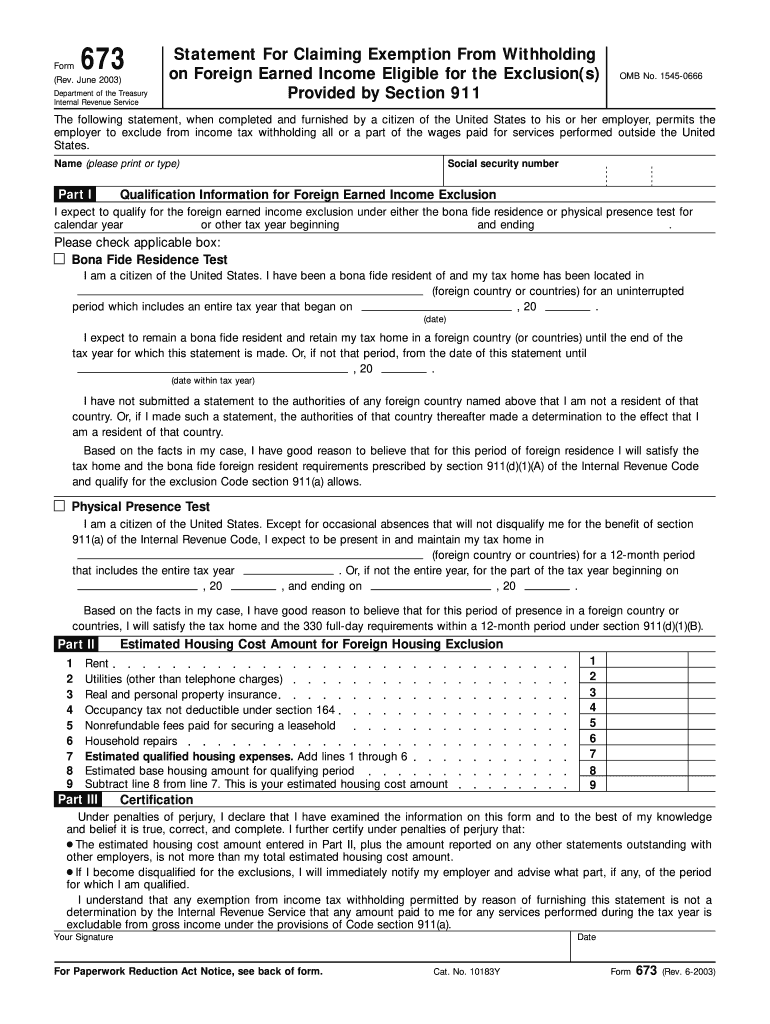

The IRS Form 673, officially known as the "Statement for Claiming Benefits Under Section 871(d)," is a document used primarily by non-resident aliens claiming tax treaty benefits. This fillable form allows individuals to provide necessary information to the Internal Revenue Service (IRS) to ensure proper tax treatment of their income. The fillable version of Form 673 simplifies the process, enabling users to enter their information directly into the form electronically, which can then be printed or submitted as required.

How to Use the IRS Form 673 Fillable

Using the IRS Form 673 fillable version is straightforward. Begin by downloading the form from the IRS website or a trusted source. Open the form in a compatible PDF reader that supports fillable forms. Enter your personal information, including your name, address, and taxpayer identification number. Be sure to accurately complete sections related to your eligibility for tax treaty benefits. Once completed, review the form for accuracy before saving and printing it for submission.

Steps to Complete the IRS Form 673 Fillable

Completing the IRS Form 673 fillable version involves several key steps:

- Download the fillable form from a reliable source.

- Open the form in a PDF reader that supports fillable fields.

- Fill in your personal details, including your name and address.

- Provide your taxpayer identification number and any relevant tax treaty information.

- Review the form to ensure all information is accurate and complete.

- Save the completed form for your records.

- Print the form for submission to the IRS or your withholding agent.

Legal Use of the IRS Form 673 Fillable

The IRS Form 673 is legally binding when completed accurately and submitted in accordance with IRS guidelines. It is essential for non-resident aliens to file this form to claim tax treaty benefits, which can significantly reduce their tax liability in the United States. Failure to use the form correctly may result in withholding at the maximum tax rate, so understanding its legal implications is crucial for eligible individuals.

IRS Guidelines for Form 673

The IRS provides specific guidelines for completing and submitting Form 673. It is important to follow these guidelines closely to ensure compliance. The form must be filed with the appropriate withholding agent, such as an employer or financial institution, and must be updated annually if the individual's tax status changes. Additionally, the IRS requires that all claims for tax treaty benefits be substantiated with the correct documentation, which may include a copy of the relevant tax treaty.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 673 vary depending on the individual's tax situation. Generally, the form should be submitted before the first payment subject to withholding is made. For most taxpayers, this means submitting the form by the end of the calendar year or by the time of their first paycheck. It is advisable to consult IRS guidelines or a tax professional for specific deadlines related to individual circumstances.

Quick guide on how to complete irs form 673 fillable

Effortlessly Prepare Irs Form 673 Fillable on Any Gadget

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can locate the needed form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Irs Form 673 Fillable on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-centric procedure today.

How to modify and eSign Irs Form 673 Fillable effortlessly

- Find Irs Form 673 Fillable and click Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and press the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Sayonara to lost or misplaced documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Irs Form 673 Fillable and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

Create this form in 5 minutes!

How to create an eSignature for the irs form 673 fillable

How to make an electronic signature for your Irs Form 673 Fillable online

How to generate an eSignature for your Irs Form 673 Fillable in Google Chrome

How to create an electronic signature for putting it on the Irs Form 673 Fillable in Gmail

How to generate an electronic signature for the Irs Form 673 Fillable right from your smartphone

How to create an eSignature for the Irs Form 673 Fillable on iOS devices

How to generate an electronic signature for the Irs Form 673 Fillable on Android OS

People also ask

-

What is the IRS Form 673 Fillable and how can it help me?

The IRS Form 673 Fillable is a tax form that allows individuals to claim a tax exemption for certain income types. By using the fillable version, you can easily complete the form online and ensure accurate submission. This can save you time and reduce the chances of errors in your tax filing.

-

How do I access the IRS Form 673 Fillable through airSlate SignNow?

To access the IRS Form 673 Fillable, simply log in to your airSlate SignNow account and search for the form in our template library. You can fill it out directly online, sign it, and send it securely to the appropriate parties. This process streamlines your documentation workflow, making tax season less stressful.

-

Is the IRS Form 673 Fillable free to use with airSlate SignNow?

While airSlate SignNow offers various subscription plans, accessing and using the IRS Form 673 Fillable may be included in your plan. We recommend checking our pricing page for specific details about included features and any applicable fees for advanced functionalities.

-

Can I integrate other tools with airSlate SignNow for IRS Form 673 Fillable?

Yes, airSlate SignNow supports integrations with various tools that can enhance your experience with the IRS Form 673 Fillable. You can connect platforms like Google Drive, Dropbox, and others to easily manage and store your signed documents, ensuring seamless access to your tax forms.

-

What are the benefits of using the IRS Form 673 Fillable with airSlate SignNow?

Using the IRS Form 673 Fillable with airSlate SignNow offers numerous benefits, including the ability to fill out the form electronically, sign it securely, and store it in the cloud. This not only speeds up your filing process but also ensures that your documents are accessible anytime, anywhere.

-

Is eSigning the IRS Form 673 Fillable legally binding?

Yes, eSigning the IRS Form 673 Fillable through airSlate SignNow is legally binding and complies with federal regulations. Our platform uses advanced security measures to ensure that your electronic signatures are valid and secure, providing peace of mind during your tax preparation.

-

How can I get support if I have questions about the IRS Form 673 Fillable?

If you have questions about the IRS Form 673 Fillable while using airSlate SignNow, you can access our comprehensive help center or contact our customer support team. We are here to assist you with any inquiries, ensuring you have a smooth experience while managing your documents.

Get more for Irs Form 673 Fillable

Find out other Irs Form 673 Fillable

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later

- Can I Sign Texas Life-Insurance Quote Form

- Sign Texas Life-Insurance Quote Form Fast

- How To Sign Washington Life-Insurance Quote Form

- Can I Sign Wisconsin Life-Insurance Quote Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free