Oregon Wh 153 Form

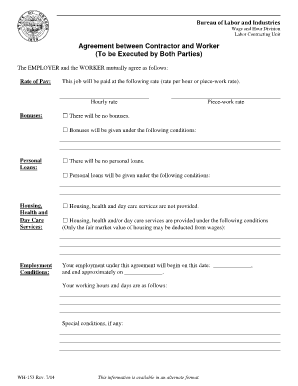

What is the Oregon WH-153?

The Oregon WH-153 form is a withholding exemption certificate used by employees in Oregon to claim exemption from state income tax withholding. This form allows individuals to inform their employers of their eligibility for exemption based on specific criteria, such as having no tax liability in the previous year and expecting none in the current year. Understanding the purpose and requirements of the Oregon WH-153 is essential for employees who wish to manage their tax withholdings effectively.

How to Use the Oregon WH-153

To utilize the Oregon WH-153 form, employees must complete it accurately and submit it to their employer. The form requires personal information, including the employee's name, address, and Social Security number. Additionally, the employee must indicate their eligibility for exemption and sign the form. It is important to ensure that the information provided is correct to avoid any issues with tax withholding.

Steps to Complete the Oregon WH-153

Completing the Oregon WH-153 form involves several straightforward steps:

- Obtain the Oregon WH-153 form from your employer or the Oregon Department of Revenue website.

- Fill in your personal details, including your full name, address, and Social Security number.

- Indicate whether you meet the criteria for exemption by checking the appropriate box.

- Sign and date the form to certify the accuracy of the information provided.

- Submit the completed form to your employer's payroll department for processing.

Legal Use of the Oregon WH-153

The Oregon WH-153 form is legally binding when completed and submitted according to state guidelines. Employees must ensure they meet the eligibility requirements for exemption to avoid penalties for incorrect submissions. Employers are responsible for maintaining accurate records of the forms submitted by their employees and ensuring compliance with state tax laws.

Key Elements of the Oregon WH-153

Several key elements are crucial for the Oregon WH-153 form:

- Personal Information: Accurate personal details must be provided to ensure proper identification.

- Eligibility Criteria: Employees must meet specific criteria to qualify for exemption from withholding.

- Signature: The employee's signature is required to validate the information and confirm their understanding of the form's implications.

Who Issues the Form

The Oregon WH-153 form is issued by the Oregon Department of Revenue. This state agency oversees tax collection and ensures compliance with tax laws in Oregon. Employees can obtain the form directly from their employer or through the Oregon Department of Revenue's official resources.

Quick guide on how to complete oregon wh 153

Effortlessly Prepare Oregon Wh 153 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without hitches. Manage Oregon Wh 153 on any device with the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

The Easiest Way to Modify and Electronically Sign Oregon Wh 153 Seamlessly

- Locate Oregon Wh 153 and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with features that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your updates.

- Choose your preferred method to send your form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Oregon Wh 153 and ensure outstanding communication at any point in the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon wh 153

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is the oregon wh 153 form used for?

The oregon wh 153 form is primarily utilized for reporting withholdings related to employment. Businesses operating in Oregon must complete this form to ensure proper tax compliance and documentation. Using tools like airSlate SignNow simplifies the process of preparing, signing, and submitting this form.

-

How does airSlate SignNow help with the oregon wh 153?

airSlate SignNow streamlines the management of the oregon wh 153 by allowing users to create, edit, and electronically sign the document easily. Our platform offers templates that adhere to state regulations, ensuring you maintain compliance while saving time. With airSlate SignNow, submitting your oregon wh 153 is just a few clicks away.

-

Is airSlate SignNow suitable for small businesses needing to process the oregon wh 153?

Yes, airSlate SignNow is an excellent solution for small businesses dealing with the oregon wh 153 form. It provides a cost-effective way to manage your documentation needs without sacrificing features or usability. Small businesses can benefit from our user-friendly interface and robust eSigning capabilities.

-

What are the pricing options for airSlate SignNow for managing oregon wh 153 forms?

airSlate SignNow offers flexible pricing plans that cater to a variety of business needs. Whether you’re a sole proprietor or a large organization, we have a plan that’s right for processing the oregon wh 153. Our competitive pricing ensures you get value while managing your documentation efficiently.

-

Can I integrate airSlate SignNow with other applications for oregon wh 153 management?

Absolutely! airSlate SignNow supports multiple integrations with popular platforms and tools that can help streamline your workflow for documents like the oregon wh 153. This allows you to connect with your existing systems seamlessly, enhancing efficiency and productivity.

-

What features does airSlate SignNow provide for the oregon wh 153?

With airSlate SignNow, you gain access to features like customizable templates, secure eSigning, and document tracking, all tailored for forms like the oregon wh 153. Additionally, our comprehensive audit trails ensure that you maintain compliance and can easily retrieve documentation when needed. These features enhance the management process signNowly.

-

How secure is my information when using airSlate SignNow for the oregon wh 153?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the oregon wh 153. Our platform employs industry-standard encryption, secure servers, and compliance with regulations to protect your information. You can trust us to keep your data safe throughout the signing process.

Get more for Oregon Wh 153

- Mi summons 2012 2019 form

- Court proof service form

- Illinois petitioner investigative alcoholdrug evaluation form

- Hearing officer facility locations illinois secretary of state form

- Illinois court of claims illinois secretary of state 6966502 form

- 2017 m4 corporation franchise tax return form

- Field trip permission form bwhs music boosters

- Financial aid checklist university of san francisco wcb ny form

Find out other Oregon Wh 153

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free