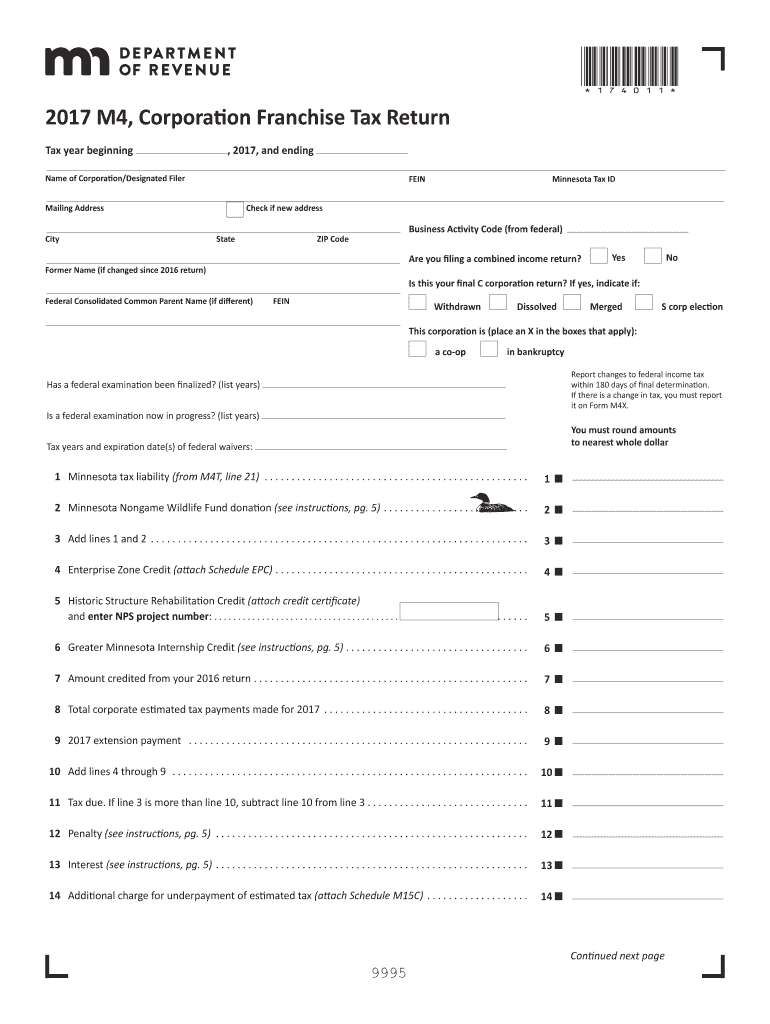

M4, Corporation Franchise Tax Return 2017

What is the M4, Corporation Franchise Tax Return

The M4, Corporation Franchise Tax Return is a tax form used by corporations operating in certain states to report their income and calculate their franchise tax liability. This form is essential for compliance with state tax regulations and ensures that corporations fulfill their tax obligations. The M4 form typically requires detailed financial information, including revenue, expenses, and any applicable deductions. Understanding this form is crucial for maintaining good standing with state tax authorities.

Steps to complete the M4, Corporation Franchise Tax Return

Completing the M4, Corporation Franchise Tax Return involves several key steps to ensure accurate reporting and compliance. Here is a structured approach:

- Gather financial documents: Collect all necessary financial statements, including income statements and balance sheets, to provide accurate data.

- Fill out the form: Input the required information, ensuring all sections are completed thoroughly to avoid errors.

- Review for accuracy: Double-check all entries for correctness and completeness to minimize the risk of penalties.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent before the deadline.

Legal use of the M4, Corporation Franchise Tax Return

The M4, Corporation Franchise Tax Return serves as a legally binding document once submitted to the appropriate state tax authority. It is important to ensure that all information provided is accurate and truthful, as discrepancies can lead to legal repercussions. Compliance with state tax laws is essential, and this form plays a vital role in demonstrating that a corporation is fulfilling its tax responsibilities.

Filing Deadlines / Important Dates

Filing deadlines for the M4, Corporation Franchise Tax Return can vary by state, making it crucial for corporations to be aware of specific dates. Generally, these forms are due on the 15th day of the fourth month following the end of the corporation's fiscal year. Missing these deadlines can result in penalties and interest on unpaid taxes. Corporations should mark their calendars and prepare their documentation well in advance to ensure timely submission.

Required Documents

To complete the M4, Corporation Franchise Tax Return, several documents are typically required. These may include:

- Financial statements (income statement and balance sheet)

- Previous year’s tax return for reference

- Documentation of any deductions or credits claimed

- Records of estimated tax payments made during the year

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The M4, Corporation Franchise Tax Return can be submitted through various methods, depending on the state’s regulations. Common submission options include:

- Online: Many states offer an electronic filing option, which can expedite processing and reduce the risk of errors.

- Mail: Corporations can print and mail the completed form to the designated state tax office.

- In-Person: Some states allow for in-person submissions at local tax offices, providing an opportunity for immediate confirmation of receipt.

Choosing the right submission method can enhance efficiency and ensure compliance with state requirements.

Quick guide on how to complete 2017 m4 corporation franchise tax return

Prepare M4, Corporation Franchise Tax Return effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can obtain the required form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage M4, Corporation Franchise Tax Return on any device using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign M4, Corporation Franchise Tax Return without any hassle

- Locate M4, Corporation Franchise Tax Return and click Get Form to begin.

- Utilize the resources we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign M4, Corporation Franchise Tax Return and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 m4 corporation franchise tax return

Create this form in 5 minutes!

How to create an eSignature for the 2017 m4 corporation franchise tax return

How to generate an eSignature for the 2017 M4 Corporation Franchise Tax Return online

How to make an eSignature for your 2017 M4 Corporation Franchise Tax Return in Google Chrome

How to generate an electronic signature for signing the 2017 M4 Corporation Franchise Tax Return in Gmail

How to make an eSignature for the 2017 M4 Corporation Franchise Tax Return straight from your smartphone

How to make an electronic signature for the 2017 M4 Corporation Franchise Tax Return on iOS

How to create an eSignature for the 2017 M4 Corporation Franchise Tax Return on Android

People also ask

-

What is the M4, Corporation Franchise Tax Return?

The M4, Corporation Franchise Tax Return is a tax form required for corporations operating in certain states. It is used to report the income, deductions, and taxes owed by the corporation. Completing the M4 correctly is essential to avoid penalties and ensure compliance with local tax laws.

-

How can airSlate SignNow assist with the M4, Corporation Franchise Tax Return?

airSlate SignNow provides a user-friendly platform for businesses to prepare and eSign their M4, Corporation Franchise Tax Return documents. With streamlined document management and eSignature capabilities, it enables quick submission and saves valuable time during tax season.

-

What are the pricing options for using airSlate SignNow for the M4, Corporation Franchise Tax Return?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. The cost-effective plans allow you to access essential features necessary for completing your M4, Corporation Franchise Tax Return, ensuring you only pay for what you need.

-

Is airSlate SignNow secure for handling M4, Corporation Franchise Tax Return documents?

Yes, airSlate SignNow takes security seriously and employs advanced encryption and security measures. This ensures that your M4, Corporation Franchise Tax Return and other sensitive documents are safely protected throughout the signing process.

-

What features does airSlate SignNow offer for completing the M4, Corporation Franchise Tax Return?

airSlate SignNow provides several features like template creation, team collaboration, and straightforward eSignature processes. These tools simplify the preparation of your M4, Corporation Franchise Tax Return, allowing you to focus on your business's financial health.

-

Can I integrate airSlate SignNow with other software to manage the M4, Corporation Franchise Tax Return?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including accounting and tax software. This compatibility enhances your ability to manage and track your M4, Corporation Franchise Tax Return efficiently.

-

How does using airSlate SignNow benefit my team when preparing the M4, Corporation Franchise Tax Return?

Using airSlate SignNow enhances collaboration among your team members by providing a centralized platform to manage documents. This ensures everyone is on the same page when it comes to completing the M4, Corporation Franchise Tax Return and reduces the risk of errors.

Get more for M4, Corporation Franchise Tax Return

- Gettysburg street vendor form

- Penndot sales store 2008 form

- Philadelphia school guard applicationpdffillercom form

- Khubakiqbrtwebeo 2014 form

- New business registration city of pittsburgh form

- Job application form webpages charter

- Northampton st patrick association form

- Patient care report template form

Find out other M4, Corporation Franchise Tax Return

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online