Tax Withholding Election Tax Withholding Election 2018-2026

What is the CalPERS Tax Withholding?

The CalPERS tax withholding refers to the process by which the California Public Employees' Retirement System deducts a portion of retirement benefits for federal and state taxes. This withholding is essential for ensuring that retirees meet their tax obligations. The amount withheld can vary based on individual circumstances, including filing status and the number of exemptions claimed. Understanding this process helps retirees manage their finances effectively and avoid unexpected tax liabilities.

How to Complete the CalPERS Tax Withholding Form

Completing the CalPERS tax withholding form involves several steps to ensure accuracy and compliance. First, gather necessary information, including your Social Security number and details about your retirement benefits. Next, indicate your filing status and the number of exemptions you wish to claim. After filling out the form, review it carefully for any errors. Finally, submit the completed form to CalPERS through the specified method, ensuring it is sent before any deadlines to avoid complications.

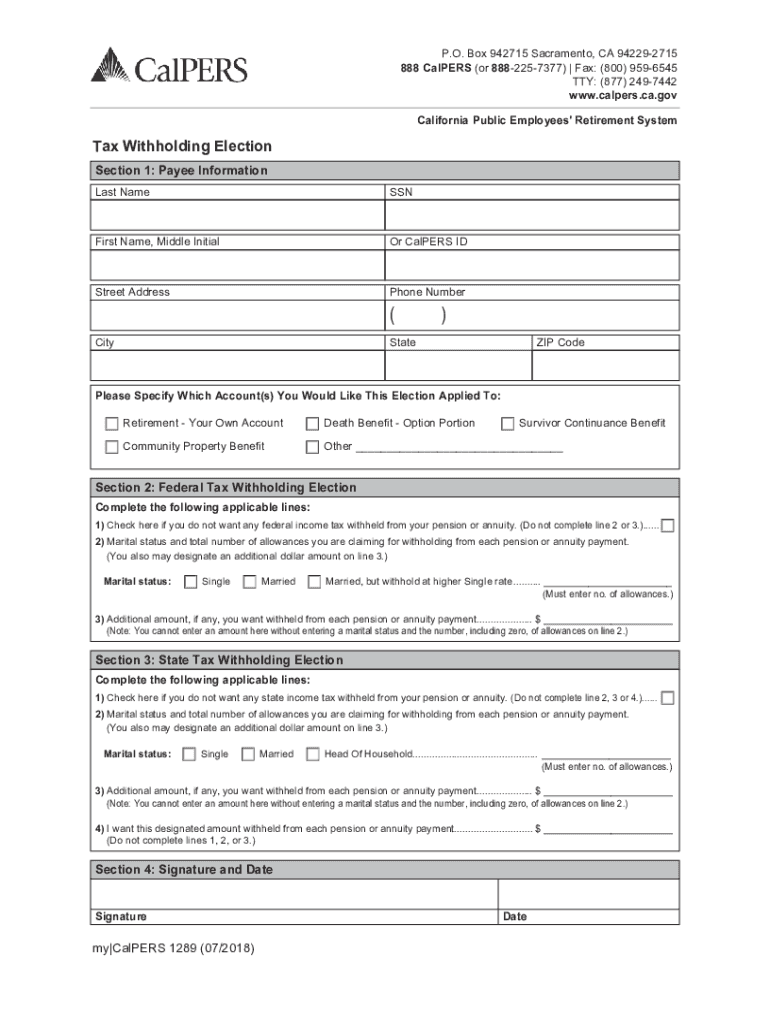

Key Elements of the CalPERS Tax Withholding Form

The CalPERS tax withholding form includes several key elements that are crucial for accurate processing. These elements typically consist of:

- Personal Information: This includes your name, address, and Social Security number.

- Filing Status: You must select your appropriate filing status, such as single or married.

- Exemptions: Indicate the number of exemptions you are claiming.

- Signature: A signature is required to certify that the information provided is accurate.

IRS Guidelines for Tax Withholding

Following IRS guidelines is essential when completing the CalPERS tax withholding form. The IRS provides specific rules regarding how much tax should be withheld based on your income level and filing status. It is advisable to consult the IRS Publication 505, which outlines tax withholding and estimated tax, to ensure compliance. Adhering to these guidelines helps prevent under-withholding or over-withholding, which can affect your financial situation during tax season.

Filing Deadlines for CalPERS Tax Withholding

Timely submission of the CalPERS tax withholding form is crucial to avoid penalties. Generally, the form should be submitted at least thirty days before the first payment date to ensure that the correct amount is withheld. Additionally, if there are changes in your tax situation, such as a change in marital status or income, it is important to update your withholding promptly. Keeping track of these deadlines helps maintain compliance and ensures that your tax obligations are met efficiently.

Digital vs. Paper Version of the CalPERS Tax Withholding Form

When it comes to submitting the CalPERS tax withholding form, both digital and paper versions are available. The digital version offers convenience, allowing for quicker completion and submission. It often includes features that help minimize errors. On the other hand, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the method chosen, ensuring that the form is filled out correctly is essential for accurate tax withholding.

Quick guide on how to complete tax withholding election tax withholding election

Complete Tax Withholding Election Tax Withholding Election effortlessly on any device

Online document administration has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Tax Withholding Election Tax Withholding Election on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and electronically sign Tax Withholding Election Tax Withholding Election with ease

- Find Tax Withholding Election Tax Withholding Election and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Highlight essential parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing out new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Tax Withholding Election Tax Withholding Election to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax withholding election tax withholding election

Create this form in 5 minutes!

How to create an eSignature for the tax withholding election tax withholding election

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is calpers tax withholding?

Calpers tax withholding refers to the process of deducting taxes from your CalPERS pension payments. Understanding this is crucial for proper financial planning and ensuring compliance with tax regulations. Using airSlate SignNow, you can streamline document management related to calpers tax withholding, making it easier to manage your financial responsibilities.

-

How does airSlate SignNow help with calpers tax withholding documentation?

AirSlate SignNow simplifies the process of signing and managing documents related to calpers tax withholding. With our platform, businesses can quickly prepare, send, and eSign documents, ensuring they meet tax deadlines and regulatory requirements efficiently. Our user-friendly interface makes it easy for anyone to complete necessary paperwork.

-

Are there any costs associated with using airSlate SignNow for calpers tax withholding?

Yes, while airSlate SignNow offers a variety of pricing plans, each tailored to different business needs, using our services for calpers tax withholding is a cost-effective solution. By reducing paper usage and streamlining workflow, the long-term savings can often outweigh the initial costs. Check our pricing page for more details on plans.

-

What features of airSlate SignNow benefit calpers tax withholding processes?

AirSlate SignNow provides several features that benefit calpers tax withholding, including secure electronic signatures, customizable templates, and real-time tracking. These features ensure that all necessary documents are efficiently handled and properly executed, helping users stay compliant with tax regulations effortlessly. Enhanced security measures also protect sensitive tax information.

-

Can airSlate SignNow integrate with other tools for managing calpers tax withholding?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and tax software, enhancing the efficiency of managing calpers tax withholding. This integration allows for a smoother workflow and ensures that all related financial documents are easily accessible. Users can connect their existing tools to simplify their documentation processes.

-

How secure is airSlate SignNow when handling calpers tax withholding documents?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive documents like those related to calpers tax withholding. Our platform uses advanced encryption and complies with industry-standard security protocols to protect your data. You can rest assured that your documents are safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for calpers tax withholding compared to traditional methods?

Using airSlate SignNow for calpers tax withholding offers several benefits over traditional methods, such as reduced paperwork, faster processing times, and easier access to documents. Our electronic solution minimizes the risk of errors associated with manual processes, ensuring accuracy in your tax documentation. Additionally, it allows for remote work flexibility, saving time and effort.

Get more for Tax Withholding Election Tax Withholding Election

- Cit 0002 form

- Louisiana student residency questionnaire form fill online

- Dbpr form co 6000 2 developercondominium filing statement

- Category ii non ache credits form

- Nims record number form

- 0115 application to proceed in district court without prepaying fees or costs long form

- Critical care medicine certification exam datesabimorg form

- Pdf food stamp application texas wordpresscom form

Find out other Tax Withholding Election Tax Withholding Election

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors