Tc846 2014-2026

What is the TC846?

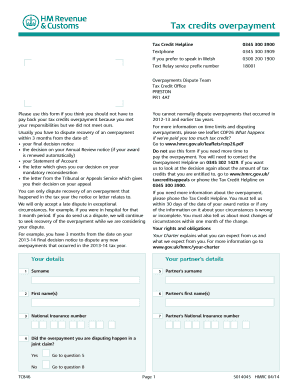

The TC846 is a form used primarily for claiming overpayments related to tax credits in the United States. Specifically, it is associated with the HMRC (Her Majesty's Revenue and Customs) tax system. This form allows taxpayers to request refunds for overpayments made during the tax year. Understanding its purpose is essential for individuals and businesses looking to manage their tax liabilities effectively.

How to Obtain the TC846

To obtain the TC846 form, taxpayers can visit the official HMRC website or contact their local tax office. The form is typically available in PDF format, allowing for easy downloading and printing. Additionally, some tax preparation software may include the TC846 template, streamlining the process for users who prefer digital solutions.

Steps to Complete the TC846

Completing the TC846 form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documentation related to your tax overpayment.

- Download the TC846 PDF from the official source.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details about the overpayment, including the amount and the tax year it pertains to.

- Sign and date the form to validate your claim.

Legal Use of the TC846

The TC846 form is legally binding when completed correctly. For it to be considered valid, it must comply with relevant tax regulations. This includes ensuring that all information provided is accurate and that the form is submitted within the designated time frame. Utilizing a reliable eSignature platform can enhance the legitimacy of the submission.

Key Elements of the TC846

Understanding the key elements of the TC846 form is crucial for successful completion. Important components include:

- Taxpayer identification information.

- Details of the overpayment being claimed.

- Signature and date, confirming the authenticity of the claim.

Form Submission Methods

The TC846 can be submitted through various methods, including online, by mail, or in person. Each method has its own requirements and timelines:

- Online: Use an approved eSignature platform to submit the form digitally.

- Mail: Print the completed form and send it to the designated tax office address.

- In-Person: Deliver the form directly to your local tax office for immediate processing.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the TC846. Typically, claims for overpayments must be submitted within a specific period following the end of the tax year. Missing these deadlines can result in the loss of the opportunity to recover funds. Always check the latest guidelines to ensure compliance with current regulations.

Quick guide on how to complete tc846

Effortlessly Prepare Tc846 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Tc846 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The Simplest Method to Modify and eSign Tc846 Effortlessly

- Obtain Tc846 and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign Tc846 and guarantee exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc846

Create this form in 5 minutes!

How to create an eSignature for the tc846

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the 2013 tc846 pdf document?

The 2013 tc846 pdf document is a standardized form used in various submissions and applications. It is crucial for individuals and businesses needing to report specific information accurately. By using the 2013 tc846 pdf, you ensure compliance and streamline your documentation process.

-

How can airSlate SignNow help with the 2013 tc846 pdf?

airSlate SignNow allows users to easily upload, sign, and send the 2013 tc846 pdf document securely. The platform simplifies the signing process while maintaining legal compliance and security, making it an essential tool for businesses dealing with important forms.

-

Is there a cost associated with using airSlate SignNow for the 2013 tc846 pdf?

Yes, airSlate SignNow offers various pricing plans tailored to your needs. Costs may vary based on the features you choose, but it remains a cost-effective solution for managing essential documents like the 2013 tc846 pdf.

-

What features does airSlate SignNow offer for managing the 2013 tc846 pdf?

airSlate SignNow offers a range of features for the 2013 tc846 pdf, including customizable templates, advanced eSignature capabilities, and secure document storage. These features enhance user experience while ensuring your documents remain confidential and accessible.

-

Can I integrate airSlate SignNow with other applications for the 2013 tc846 pdf?

Absolutely! airSlate SignNow supports integrations with various popular applications, allowing you to streamline your workflow when handling the 2013 tc846 pdf. This interoperability enhances efficiency and helps keep your business processes smooth.

-

What are the benefits of using airSlate SignNow for signatures on the 2013 tc846 pdf?

Using airSlate SignNow to sign the 2013 tc846 pdf provides numerous benefits, including faster turnaround times for agreements and improved document tracking. Additionally, it offers the peace of mind of legally binding eSignatures, ensuring authenticity and security.

-

Is airSlate SignNow compliant with legal regulations for the 2013 tc846 pdf?

Yes, airSlate SignNow is compliant with major eSignature laws, including the ESIGN Act and UETA, making it a reliable choice for signing the 2013 tc846 pdf. This compliance guarantees that your signed documents are legally enforceable.

Get more for Tc846

Find out other Tc846

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF