Form 575t 2012

What is the Form 575t

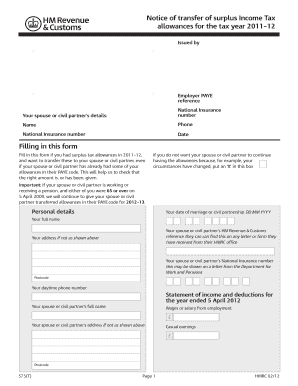

The HMRC Form 575t is a tax form used in the United Kingdom for tax transfers between spouses or civil partners. This form allows individuals to transfer their unused personal allowance or tax relief to their partner, thereby potentially reducing the overall tax liability for the household. The 575t tax form is particularly relevant for couples where one partner has a lower income and cannot fully utilize their tax-free allowance.

How to use the Form 575t

Using the HMRC Form 575t involves several steps to ensure that the transfer of tax allowances is executed correctly. First, both partners must agree on the transfer and ensure that the receiving partner meets the eligibility criteria. The form requires personal details from both individuals, including names, National Insurance numbers, and income details. Once completed, the form must be submitted to HMRC for processing. It is advisable to keep a copy of the form for personal records.

Steps to complete the Form 575t

Completing the HMRC Form 575t requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including both partners' personal details and income information.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the form to HMRC either online or via mail.

- Retain a copy of the submitted form for your records.

Legal use of the Form 575t

The HMRC Form 575t is legally binding when completed and submitted according to the guidelines set by HMRC. Both partners must provide accurate information, as any discrepancies could lead to penalties or delays in processing. The form must be filed within the tax year to be effective for that year's tax calculation. Compliance with all relevant tax laws is essential to ensure the validity of the transfer.

Filing Deadlines / Important Dates

Filing deadlines for the HMRC Form 575t are aligned with the UK tax year, which runs from April sixth to April fifth of the following year. To ensure that the transfer of allowances is considered for the current tax year, the form must be submitted by the deadline set by HMRC, typically by the end of the tax year. It is important to check for any updates or changes to these deadlines each year.

Who Issues the Form

The HMRC Form 575t is issued by Her Majesty's Revenue and Customs (HMRC), the UK government department responsible for tax collection and regulation. HMRC provides guidelines on how to complete the form and the eligibility criteria for transferring tax allowances. Individuals can access the form through the official HMRC website or by contacting HMRC directly for assistance.

Quick guide on how to complete form 575t

Effortlessly Prepare Form 575t on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the necessary tools to quickly create, edit, and eSign your documents without delays. Manage Form 575t across any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Edit and eSign Form 575t with Ease

- Obtain Form 575t and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with the specific tools that airSlate SignNow offers for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Form 575t and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 575t

Create this form in 5 minutes!

How to create an eSignature for the form 575t

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is HMRC Form 575 T for 2017-2018, and why do I need it?

HMRC Form 575 T for 2017-2018 is a tax form that provides information on tax deductions and reliefs for individuals in the UK. Completing this form accurately is crucial for ensuring you receive the appropriate tax benefits. With airSlate SignNow, you can easily eSign and send your HMRC Form 575 T for 2017-2018, reducing the time and effort required for this process.

-

How can airSlate SignNow help me with HMRC Form 575 T for 2017-2018?

airSlate SignNow streamlines the eSigning process for HMRC Form 575 T for 2017-2018, allowing you to prepare, sign, and send your documents efficiently. Our user-friendly interface and secure cloud storage make it easy to manage all your tax forms, including the HMRC Form 575 T for 2017-2018, ensuring compliance and peace of mind.

-

Is there a cost associated with using airSlate SignNow for HMRC Form 575 T for 2017-2018?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can choose a plan that allows you to efficiently handle documents like the HMRC Form 575 T for 2017-2018 without breaking your budget. Our cost-effective solution ensures you only pay for the features you need.

-

Can I integrate airSlate SignNow with other applications for HMRC Form 575 T for 2017-2018?

Absolutely! airSlate SignNow seamlessly integrates with a variety of business applications, enabling you to manage your HMRC Form 575 T for 2017-2018 alongside your other tools. Whether you're using accounting software or project management applications, our integrations help streamline your workflows.

-

What are the benefits of using airSlate SignNow for HMRC Form 575 T for 2017-2018?

Using airSlate SignNow for HMRC Form 575 T for 2017-2018 offers numerous benefits, including faster document turnaround times and a secure signing process. You can track the status of your forms in real-time and reduce the risk of errors, ensuring that your tax filings are completed accurately and on time.

-

Is airSlate SignNow secure for signing HMRC Form 575 T for 2017-2018?

Yes, security is a top priority at airSlate SignNow. Our platform uses advanced encryption and security measures to ensure that your HMRC Form 575 T for 2017-2018 and all related documents are safe from unauthorized access. You can confidently eSign and manage your forms knowing your data is protected.

-

How can I get started with airSlate SignNow for HMRC Form 575 T for 2017-2018?

Getting started with airSlate SignNow is quick and easy! Simply visit our website to sign up for an account, where you can start uploading and managing your HMRC Form 575 T for 2017-2018 documents right away. Our intuitive interface and helpful resources will guide you through the process, ensuring a smooth experience.

Get more for Form 575t

Find out other Form 575t

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template