Vat 3 Form PDF

What is the VAT 3 Form PDF

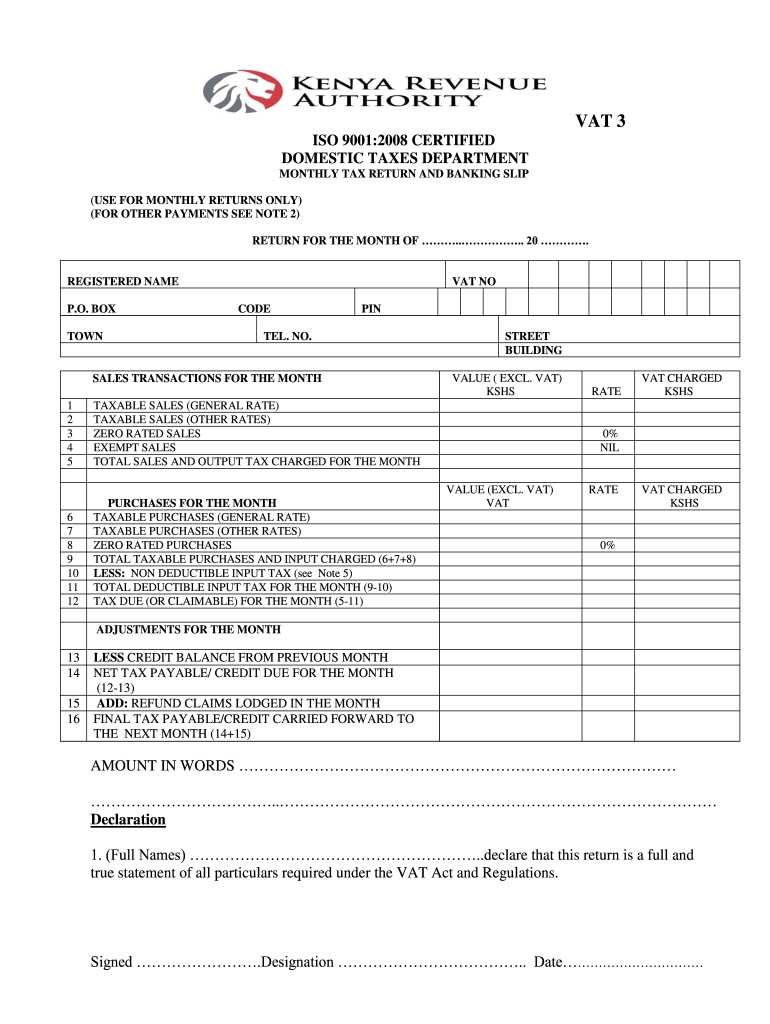

The VAT 3 Form PDF is a critical document used for reporting value-added tax (VAT) in various jurisdictions. This form is essential for businesses that are registered for VAT, allowing them to report their sales, purchases, and the VAT they have collected and paid. The form serves as a comprehensive record for tax authorities to assess compliance with VAT regulations. Understanding the purpose and structure of the VAT 3 Form can help ensure accurate reporting and timely submissions.

How to Obtain the VAT 3 Form PDF

To obtain the VAT 3 Form PDF, individuals and businesses can typically visit the official tax authority website of their respective state or jurisdiction. Many tax authorities provide downloadable versions of the form directly on their websites. Additionally, forms may be available at local tax offices or through authorized tax professionals. Ensuring that you have the most current version of the VAT 3 Form is crucial for compliance.

Steps to Complete the VAT 3 Form PDF

Completing the VAT 3 Form PDF involves several key steps. First, gather all necessary financial records, including sales invoices, purchase receipts, and previous VAT returns. Next, accurately fill out each section of the form, detailing your sales, purchases, and the VAT amounts involved. After completing the form, review it for accuracy to avoid errors that could lead to penalties. Finally, ensure that you sign and date the form before submission.

Legal Use of the VAT 3 Form PDF

The VAT 3 Form PDF is legally binding when completed and submitted in accordance with the relevant tax laws. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to audits or penalties. Many jurisdictions require electronic submission of the form, which is considered valid under eSignature laws, provided that the submission meets specific legal criteria.

Filing Deadlines / Important Dates

Filing deadlines for the VAT 3 Form PDF vary by jurisdiction. Typically, businesses must submit this form quarterly or annually, depending on their VAT registration status. It is essential to be aware of these deadlines to avoid late fees or penalties. Keeping a calendar of important tax dates can help ensure timely submissions and compliance with local tax regulations.

Form Submission Methods

The VAT 3 Form PDF can be submitted through various methods, including online, by mail, or in person at designated tax offices. Online submission is often the preferred method due to its convenience and speed. Businesses should check with their local tax authority for specific submission guidelines, as requirements may differ based on location.

Quick guide on how to complete vat 3 form pdf

Complete Vat 3 Form Pdf effortlessly on any device

Online document administration has become favored among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can acquire the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, alter, and eSign your documents quickly with no delays. Handle Vat 3 Form Pdf on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Vat 3 Form Pdf without hassle

- Locate Vat 3 Form Pdf and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Leave behind lost or misplaced files, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow fulfills all your document management needs in a few clicks from any device of your choosing. Alter and eSign Vat 3 Form Pdf and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 3 form pdf

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the process to download the VAT 3 returns form using airSlate SignNow?

To download the VAT 3 returns form using airSlate SignNow, simply log in to your account, navigate to the templates section, and select the VAT 3 returns form. After filling in the required information, you can easily download the completed form for your records or submission. Our user-friendly interface makes this process quick and efficient.

-

Is there a cost associated with downloading the VAT 3 returns form?

Downloading the VAT 3 returns form is included in your airSlate SignNow subscription at no additional cost. Our pricing is designed to be cost-effective, allowing businesses to handle their documentation needs without breaking the bank. You can explore our various pricing plans to find the one that suits your business best.

-

Can I edit the VAT 3 returns form before downloading it?

Yes, you can easily edit the VAT 3 returns form within airSlate SignNow before downloading. Our platform allows for real-time editing and adjustments so that you can ensure all necessary information is accurate. Once you're satisfied with the changes, you can download the VAT 3 returns form with just a click.

-

What features does airSlate SignNow offer for managing VAT 3 returns?

airSlate SignNow provides several features for managing VAT 3 returns, including secure eSignature capabilities, template storage, and easy downloads. You can track document status and ensure compliance effortlessly. Our all-in-one platform streamlines the eSigning process while allowing you to download VAT 3 returns form seamlessly.

-

What are the benefits of using airSlate SignNow for VAT 3 returns?

Using airSlate SignNow for your VAT 3 returns offers multiple benefits, such as reduced processing times and enhanced document security. Our platform helps eliminate paperwork hassles so you can focus on your core business activities. Plus, with the ability to download VAT 3 returns form efficiently, managing your tax documentation becomes a breeze.

-

Does airSlate SignNow integrate with other software for VAT 3 return management?

Absolutely! airSlate SignNow offers integration with various accounting and financial software, making VAT 3 return management more efficient. These integrations allow you to sync data seamlessly and automate workflows. This ensures that when you download VAT 3 returns form, all information is accurate and up-to-date.

-

Is there customer support available for help with the VAT 3 returns form?

Yes, airSlate SignNow provides exceptional customer support to assist you with any inquiries related to downloading the VAT 3 returns form. Our knowledgeable team is available to help you navigate the platform and resolve any issues you may encounter. We are here to ensure your experience is smooth and hassle-free.

Get more for Vat 3 Form Pdf

- Residential lease for single family home and duplex form

- Residential lease for unit in condominium or cooperative form

- Nefar mls 2012 form

- Exclusive agreement transaction broker form

- Floridas uniform complaint form re 2200 2

- Florida standard lease agreement form

- Consent to adoption form

- Rental application corental property management inc form

Find out other Vat 3 Form Pdf

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself