Summary

- U.S. law recognizes eSignatures as legally valid if you follow ESIGN and UETA principles, and obtain informed consumer consent where required.

- Align implementation with NIST digital identity guidance, especially the 2025 update (SP 800-63-4), to right-size identity proofing and authentication.

- In regulated use cases (real estate, finance, healthcare, tax), add domain-specific controls (e.g., FTC Safeguards Rule breach notification; HUD/FHA modernization; IRS permanent eSignature allowance for select forms).

- Standardize an audit-ready evidence trail (consent, signer intent, integrity, retention) and test it end-to-end before going live.

- For real estate teams, streamline templates, mobile signing, and broker oversight to accelerate closings without compromising compliance.

This case-study-style guide shows how a mid-market organization can roll out electronic signatures without friction. We’ll ground every step in current U.S. frameworks (ESIGN/UETA), identity assurance (NIST), and sector rules relevant to real estate, financial services, healthcare, and tax.

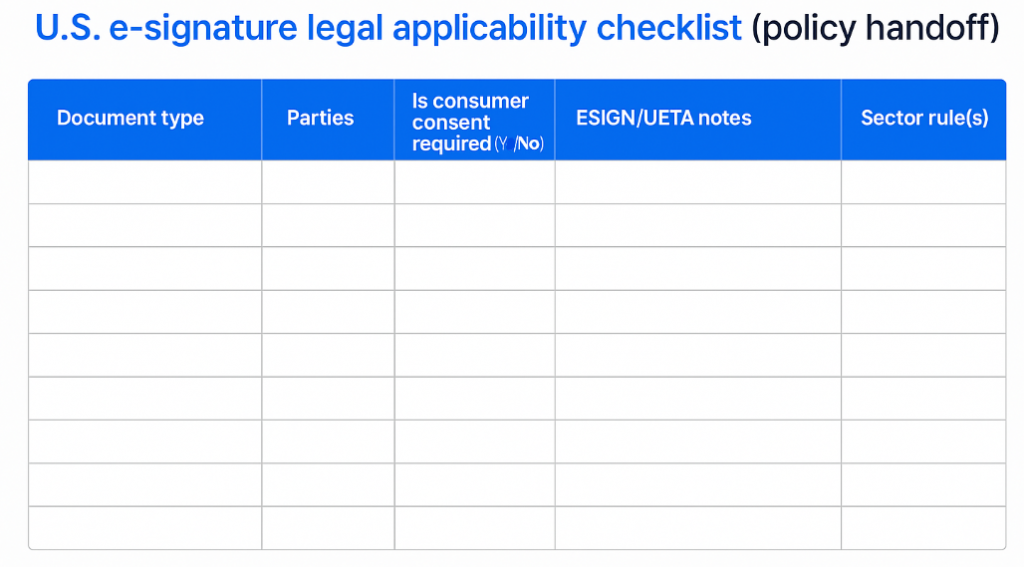

Best practice #1 — map your legal basis before you configure anything

Start with a simple matrix: what you are signing, who is signing, and which law applies.

- General validity: The ESIGN Act gives electronic signatures the same legal effect as wet ink when certain conditions are met (e.g., consent, record retention). UETA aligns state law with these principles in 49 states, DC, and U.S. territories that adopted it.

- Consumer disclosures & consent: If your transaction is consumer-facing, ensure you present ESIGN consumer disclosures and obtain affirmative consent before delivering required disclosures electronically. Financial regulators explicitly tie electronic disclosures to ESIGN consent.

- Carve-outs: Some documents (e.g., certain wills or court papers) may be excluded by statute. Confirm at policy level.

Deliverable: A one-page “applicability matrix” that lists each document type, the applicable rule (ESIGN/UETA plus any sector rule), and your consent path.

Sources: FDIC

Best practice #2 — design your consent and disclosures as a reusable pattern

Your ESIGN consumer consent pattern should be consistent and tested across web and mobile:

- Present disclosures covering hardware/software requirements, the right to withdraw consent, and how to obtain paper copies; capture affirmative consent; log the event with timestamp, IP, and user agent.

- For transactions involving mortgage/real estate disclosures, ensure your electronic delivery aligns with Reg X (which points back to ESIGN for consent and delivery).

Sources: FDIC

Best practice #3 — right-size identity proofing and authentication with NIST SP 800-63-4

Not every agreement needs the same identity rigor. Use NIST Digital Identity Guidelines to set assurance levels proportionate to risk:

- Identity proofing: Determine if remote identity proofing is needed; align with SP 800-63-4’s updated guidance (Aug 1, 2025) rather than legacy -63-3.

- Authentication: Step-up authentication (e.g., OTP, authenticator app) for higher-risk transactions; keep friction low for routine signings.

- Federation: Where staff are in SSO, leverage federation and avoid orphan accounts.

Sources: NIST

Best practice #4 — engineer integrity and retention from day one

Courts and regulators care about whether a signed record is reliably retained and reproducible:

- Record integrity: Ensure documents are tamper-evident and that any hash or audit trail travels with the record.

- Retention & reproducibility: ESIGN requires records to be accurately reproducible for later reference. Build export and archival tests into QA.

Sources: FDIC

Best practice #5 — layer sector-specific requirements (finance, housing, tax, healthcare)

Your baseline program should branch into sector modules:

- Financial services (GLBA): As of May 13, 2024, the FTC Safeguards Rule requires non-bank financial institutions to report certain security events (≥500 consumers) to the FTC within 30 days. Map your incident response to this threshold and timeline.

- Housing/mortgage: HUD/FHA (Aug 2, 2024 final rule; guidance Dec 2024) modernized engagement with delinquent borrowers, explicitly enabling electronic/remote engagement—use this to justify borrower-friendly digital flows.

- Tax: The IRS permanently allows digital/electronic signatures for specified forms and compliance interactions (Oct 17, 2023 Internal Revenue Manual update). Maintain a controlled list of eligible IRS forms.

- Healthcare (HIPAA): HHS proposed updates to the HIPAA Security Rule (Jan 2025 NPRM) that emphasize MFA, asset inventories, vendor oversight, and testing—plan now so your HIPAA-ready eSignature workflows inherit these controls if you handle ePHI.

Sector add-ons for U.S. eSignature compliance (2023–2025)

| Sector | Regulation | Effective / Status | What Changes for eSignature Operations | Evidence You Must Retain |

|---|---|---|---|---|

| GLBA Safeguards | FTC GLBA Safeguards Rule | May 13, 2024 | Implement breach notification workflows for digital transactions | Incident logs |

| HUD / FHA Default Servicing | HUD / FHA Default Engagement | Aug 2, 2024 | Allow digital borrower contact and electronic communication tracking | Retention of borrower outreach records |

| IRS E-Signature Program | IRS e-Signature Program | Oct 17, 2023 | Identify eligible forms for e-signature and maintain compliance attestation | Approved form list and attestation records |

| HIPAA Security | HIPAA Security NPRM | Jan 2025 (proposed) | Require MFA, digital inventories, and security controls for e-signed health data | Policy updates and proof of control |

Sources:

FTC Blog (May 14, 2024); HUD Mortgagee Letter (Dec 2024); PwC/IRM note on IRS (Oct 2023); Federal Register HIPAA NPRM (Jan 2025)

Best practice #6 — standardize templates, roles, and guardrails (with a real-estate lens)

Create role-based templates for your most-used agreements, plus broker/manager guardrails:

- Templates: Pre-place fields (signer, initial, date) and conditional logic for addenda to reduce errors.

- Broker oversight: Centralize clause libraries and approval rules for price-sensitive terms.

- Mobile signing: Real-estate deals move fast; ensure flows render well on phones without sacrificing consent UX.

- Digital closings context: Industry groups recognize eSignatures and digital authorizations as a way to avoid bottlenecks and speed the path to closing, provided parties can review and approve documents remotely.

Sources: National Association of REALTORS®

Best practice #7 — build an audit trail that tells the whole story

An audit trail should cover the who/what/when/where/how of every step, not just the final signature:

- Who: Authenticated identity or account, with any step-up events captured.

- What: Document hash values pre- and post-signature.

- When/where: Timestamps with timezone, IP, device.

- How: Consent path, delivery method, authentication method.

- Retention: Demonstrate that a record is accurately reproducible, per ESIGN.

Sources: FDIC

Best practice #8 — operationalize security & privacy (MFA, least privilege, vendor oversight)

Tie your eSignature program into your broader security and privacy governance:

- Identity & access: Enforce MFA for admins and sensitive signings; apply least-privilege and timely access revocation. HIPAA’s proposed updates and NIST’s framework both point to stronger authentication and access governance.

- Vendor/third-party risk: If your organization is subject to GLBA or handles ePHI, ensure business associate/third-party agreements and monitoring are in place.

- Incident response: Align thresholds and timelines with FTC Safeguards breach notification requirements where applicable.

Sources: Federal Register

Best practice #9 — train, test, and continuously improve

Successful rollouts hinge on change management:

- Role-specific training: Legal and compliance teams train on consent, retention, and audit evidence; sales/field teams train on mobile signing etiquette and avoiding off-platform signatures.

- Tabletop exercises: Simulate a consent dispute or a document integrity challenge; prove your logs and retention.

- Regulatory watch: Track updates such as NIST SP 800-63-4 (released Aug 2025) and sector-specific changes (e.g., HUD, FTC). Bake this into quarterly reviews.

Sources: NIST

Case studies

Case study A — multi-state real-estate brokerage accelerates agreements

Challenge: Agents needed same-day turnarounds on listing and purchase agreements across several states with different disclosure rules.

Approach: The brokerage standardized ESIGN consent screens, created state-specific templates with clause libraries, and mandated mobile-ready flows. Broker oversight was added for high-risk clauses.

Why it works: Industry guidance emphasizes that electronic authorization systems let buyers, sellers, lenders, and title agents review, revise, and approve documents remotely, reducing bottlenecks before closing.

Case study B — non-bank lender aligns eSign workflows to GLBA Safeguards

Challenge: The lender needed to demonstrate that its digital signing program aligned with Safeguards Rule updates (effective May 13, 2024).

Approach: It added security event classifications and automated alerts keyed to the FTC’s 500-consumer threshold; breach runbooks were updated to include eSignature audit artifacts.

Why it works: The FTC’s amendment requires timely notification to the FTC after qualifying events; designing your program around this threshold reduces scramble during incidents.

Case study C — healthcare provider anticipates HIPAA Security updates

Challenge: A provider wanted eSignature for consent forms involving ePHI and sought to get ahead of security expectations.

Approach: It implemented MFA for staff signers, inventoried systems/plugins that handle ePHI, and strengthened vendor oversight.

Why it works: The HIPAA Security Rule NPRM proposes explicit requirements for MFA, asset inventories, and vendor controls—preparing now eases future compliance.

Final thoughts

Rolling out eSignatures smoothly is less about picking features and more about operational discipline: clear applicability rules, robust consent and identity patterns, evidence-rich audit trails, and sector-specific controls. Anchor your program in ESIGN/UETA for legal effect, NIST SP 800-63-4 for identity assurance, and track updates across FTC/HUD/IRS/HHS for sector compliance. For real estate scenarios, invest in templates and mobile usability to keep deals moving while maintaining broker oversight. Over the next 12–24 months, expect more prescriptive identity and security expectations (from HIPAA and beyond); building adaptable processes today will keep your eSignature program compliant and resilient.

Ready to start implementing secure eSignature workflows? Try SignNow for free today.

Glossary

- NIST SP 800-63-4 (Digital Identity Guidelines)

This refers to the National Institute of Standards and Technology guidance used to determine the appropriate level of identity proofing and authentication for a transaction based on its risk. The article notes organizations should align with the 2025 update (SP 800-63-4). - Consumer consent (ESIGN)

This is a specific legal requirement when delivering required disclosures electronically to consumers. The process involves presenting disclosures about hardware/software needs and the right to obtain paper copies , and then capturing affirmative consent from the consumer before proceeding. - Audit trail

A standardized, evidence-ready record covering the “who/what/when/where/how” of the entire signing process. A complete trail captures the authenticated identity, document hash values, timestamps, IP address, and the specific consent path taken. - FTC safeguards rule

A regulation that, as of May 13, 2024, mandates that non-bank financial institutions (covered under GLBA) must report certain security events affecting 500 or more consumers to the FTC within 30 days. - Record integrity

A technical and legal requirement ensuring that signed records are tamper-evident and can be “accurately reproducible” for later reference, as required by ESIGN. This is often achieved by attaching a hash or audit trail to the document.

FAQ

- Are electronic signatures legal in all 50 states?

Yes. At the federal level, the ESIGN Act recognizes eSignatures; at the state level, UETA has been widely adopted to harmonize state law, with limited exceptions. Always check carve-outs. - Do I need explicit consumer consent every time?

If you are delivering required consumer disclosures electronically, ESIGN’s consumer-consent rules apply. Capture affirmative consent and maintain evidence. - How strong should signer authentication be?

Match authentication to risk using NIST SP 800-63-4; reserve stronger factors (e.g., OTP or app-based MFA) for higher-risk transactions. - What’s special about financial and mortgage documents?

Non-bank financial institutions face FTC Safeguards breach-notification duties (effective May 13, 2024). HUD/FHA has modernized borrower engagement rules to support electronic interactions. - Are eSignatures accepted by the IRS?

Yes—for certain forms and interactions. The IRS made acceptance of digital/electronic signatures for specified forms permanent in Oct 2023. Maintain a current list of eligible forms.

- Summary

- Best practice #1 — map your legal basis before you configure anything

- Best practice #2 — design your consent and disclosures as a reusable pattern

- Best practice #3 — right-size identity proofing and authentication with NIST SP 800-63-4

- Best practice #4 — engineer integrity and retention from day one

- Best practice #5 — layer sector-specific requirements (finance, housing, tax, healthcare)

- Best practice #6 — standardize templates, roles, and guardrails (with a real-estate lens)

- Best practice #7 — build an audit trail that tells the whole story

- Best practice #8 — operationalize security & privacy (MFA, least privilege, vendor oversight)

- Best practice #9 — train, test, and continuously improve

- Case studies

- Final thoughts

- Glossary

- FAQ