De542 Form 2017

What is the De542 Form

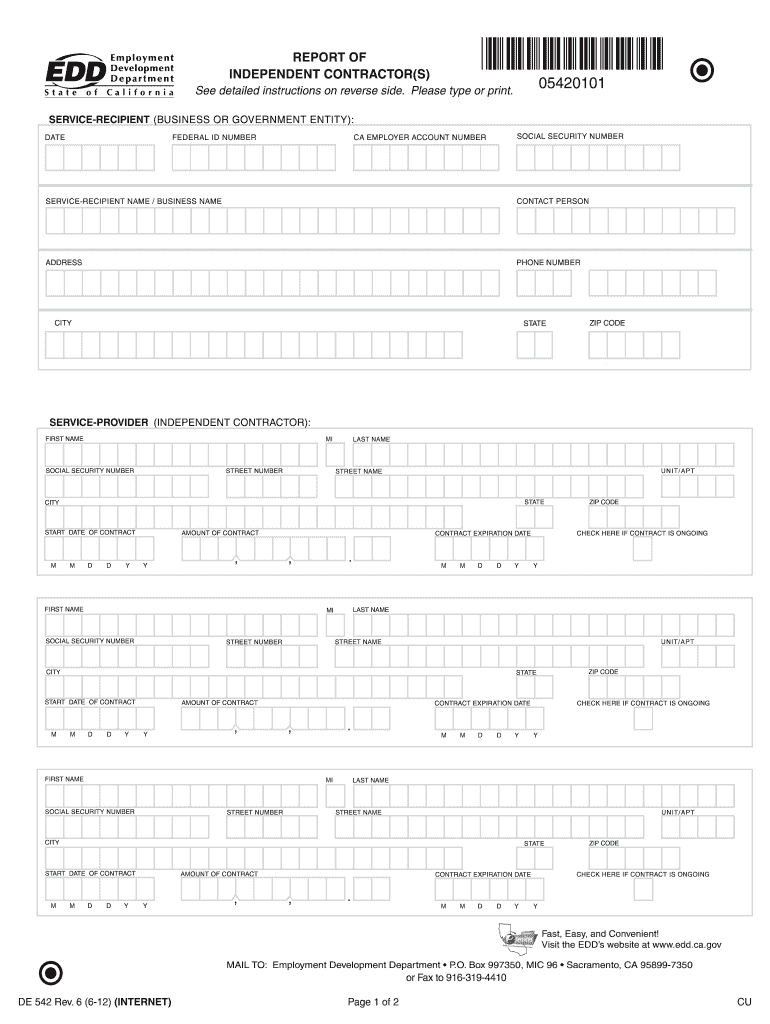

The De542 Form is a document used in the United States for reporting certain types of income and transactions to the Internal Revenue Service (IRS). This form is primarily utilized by businesses and individuals to disclose information related to payments made to non-employees, such as independent contractors and freelancers. It ensures that the IRS has accurate records of income reported by these individuals, which is essential for tax compliance.

How to use the De542 Form

Using the De542 Form involves several steps to ensure accurate reporting. First, gather all necessary information about the payee, including their legal name, address, and taxpayer identification number (TIN). Next, fill out the form with details about the payments made, including the amount and the nature of the services provided. Once completed, the form must be submitted to the IRS, along with any required supporting documentation, to ensure compliance with tax regulations.

Steps to complete the De542 Form

Completing the De542 Form requires careful attention to detail. Follow these steps:

- Collect the payee's information, including their name, address, and TIN.

- Document the total amount paid to the payee during the tax year.

- Specify the type of services provided by the payee.

- Review the form for accuracy and completeness.

- Submit the form to the IRS by the designated deadline.

Legal use of the De542 Form

The De542 Form is legally binding when filled out correctly and submitted on time. It is essential to adhere to IRS guidelines to avoid potential penalties. Accurate reporting helps maintain transparency and ensures that all income is accounted for, which is crucial for both the payer and the payee. Compliance with tax laws protects against audits and legal issues related to income reporting.

Required Documents

To complete the De542 Form, certain documents are necessary. These include:

- The payee's W-9 form, which provides their TIN and certification of their taxpayer status.

- Records of all payments made to the payee throughout the year.

- Any contracts or agreements outlining the services provided by the payee.

Form Submission Methods

The De542 Form can be submitted using various methods. Options include:

- Online submission through the IRS e-file system, which is secure and efficient.

- Mailing the completed form to the appropriate IRS address, ensuring it is postmarked by the filing deadline.

- In-person submission at designated IRS offices, if necessary.

Penalties for Non-Compliance

Failure to file the De542 Form on time or inaccuracies in reporting can result in penalties. The IRS may impose fines based on the severity of the non-compliance, which can include:

- Failure-to-file penalties for late submissions.

- Failure-to-pay penalties if taxes owed are not paid on time.

- Potential audits or additional scrutiny of financial records.

Quick guide on how to complete de542 2012 form

Complete De542 Form seamlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage De542 Form on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign De542 Form effortlessly

- Locate De542 Form and click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your requirements in document management in just a few clicks from any device you prefer. Modify and eSign De542 Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct de542 2012 form

Create this form in 5 minutes!

How to create an eSignature for the de542 2012 form

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the De542 Form?

The De542 Form is a document used in various business contexts, typically for disclosures related to specific transactions. airSlate SignNow simplifies the process of completing and signing the De542 Form electronically, ensuring that your documents are both accessible and securely managed.

-

How can airSlate SignNow help me with the De542 Form?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning the De542 Form. You can streamline your workflow, reduce paperwork, and have the assurance that your document is legally binding and stored securely.

-

What pricing options does airSlate SignNow offer for the De542 Form?

airSlate SignNow offers flexible pricing plans that cater to various business needs, allowing you to efficiently manage the De542 Form without breaking your budget. You can choose from monthly or annual subscriptions, each providing access to essential features for optimal document management.

-

Is the De542 Form secure with airSlate SignNow?

Yes, the De542 Form is secure with airSlate SignNow. The platform uses advanced encryption and security protocols to protect your data, ensuring that all your signed documents remain confidential and compliant with legal standards.

-

Can I integrate the De542 Form with other software using airSlate SignNow?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easy to manage the De542 Form alongside your existing tools. This integration capability enhances your workflow and allows for efficient document handling.

-

What features does airSlate SignNow provide for handling the De542 Form?

airSlate SignNow includes a myriad of features for the De542 Form, such as reusable templates, automated reminders, and real-time tracking of document status. These features help optimize the signing process and maintain a structured workflow.

-

Can I access the De542 Form from mobile devices?

Yes, you can access the De542 Form from mobile devices with airSlate SignNow. The mobile-friendly interface allows you to complete and eSign documents on-the-go, providing flexibility for busy professionals.

Get more for De542 Form

Find out other De542 Form

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy