Form Ac3262 S

What is the Form Ac3262 S

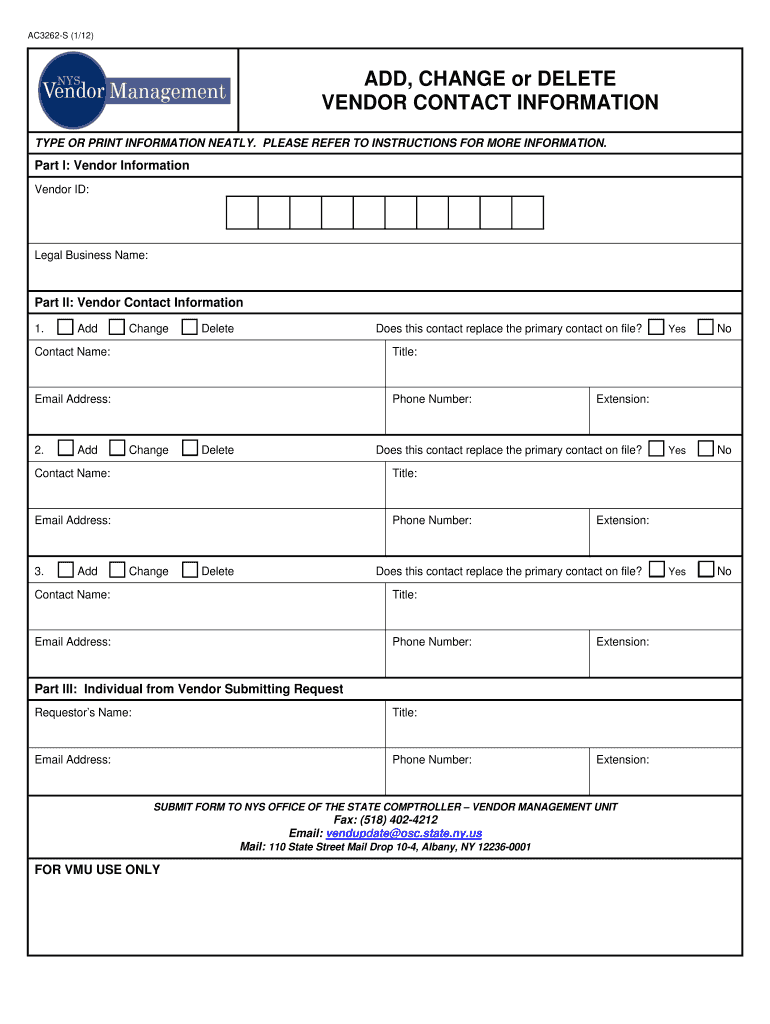

The Form Ac3262 S is a specific document used primarily in certain administrative processes. This form serves as a crucial tool for individuals and businesses to provide necessary information to relevant authorities. It is often required for compliance with specific regulations, ensuring that all parties involved have a clear understanding of the information being submitted. Understanding the purpose of this form is essential for proper completion and submission.

How to use the Form Ac3262 S

Using the Form Ac3262 S involves several steps to ensure that it is completed accurately. First, gather all necessary information that is required by the form. This may include personal identification details, financial information, or other relevant data. Next, fill out the form carefully, ensuring that all fields are completed as required. Once the form is filled out, review it for accuracy before submission. Utilizing a digital platform can simplify this process, allowing for easy corrections and secure submission.

Steps to complete the Form Ac3262 S

Completing the Form Ac3262 S involves a systematic approach:

- Start by downloading the form from a reliable source.

- Read the instructions carefully to understand what information is needed.

- Fill in your details in each section, ensuring accuracy.

- Double-check your entries for any errors or omissions.

- Sign the form digitally or manually as required.

- Submit the completed form through the designated method, whether online or by mail.

Legal use of the Form Ac3262 S

The legal use of the Form Ac3262 S is governed by specific regulations that ensure its validity. When completed correctly, this form can serve as a legally binding document. It is crucial to adhere to the guidelines set forth by governing bodies to avoid any issues related to compliance. Understanding the legal implications of the form is essential for both individuals and businesses to ensure that their submissions are recognized and accepted.

Who Issues the Form Ac3262 S

The Form Ac3262 S is typically issued by a governmental or regulatory agency responsible for overseeing the specific area of compliance it addresses. This agency provides the necessary guidelines and requirements for completing the form. Knowing the issuing authority can help individuals and businesses understand the context and importance of the form, as well as any specific instructions related to its use.

Form Submission Methods (Online / Mail / In-Person)

The Form Ac3262 S can be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online Submission: Many agencies allow for digital submission through their official websites, providing a quick and efficient way to submit the form.

- Mail Submission: The form can often be printed and mailed to the appropriate address, ensuring that it is delivered securely.

- In-Person Submission: Some situations may require individuals to submit the form in person at designated offices.

Quick guide on how to complete form ac3262 s

Complete Form Ac3262 S effortlessly on any device

Online document administration has gained traction with businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly and conveniently. Manage Form Ac3262 S on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centered process today.

The optimal method to alter and electronically sign Form Ac3262 S with ease

- Find Form Ac3262 S and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to store your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form Ac3262 S and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ac3262 s

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is Form Ac3262 S and how is it used?

Form Ac3262 S is a specific document required for various business transactions. It is often used for compliance and needs to be filled out accurately to avoid any legal issues. With airSlate SignNow, you can easily fill, sign, and send Form Ac3262 S electronically, streamlining your workflow.

-

How does airSlate SignNow help in managing Form Ac3262 S?

airSlate SignNow provides a user-friendly platform to manage Form Ac3262 S effectively. You can create templates, add fields for data entry, and share the document with stakeholders for quick eSigning. This signNowly reduces the time you spend on paperwork.

-

What are the key features of airSlate SignNow for Form Ac3262 S?

Key features of airSlate SignNow for handling Form Ac3262 S include customizable templates, secure cloud storage, real-time tracking, and mobile accessibility. These features ensure that you have a seamless experience while managing important documents.

-

Is there a cost associated with using airSlate SignNow for Form Ac3262 S?

Yes, there is a cost associated with using airSlate SignNow, but it is generally cost-effective compared to traditional methods. With various pricing plans available, you can choose one that suits your budget and business needs while efficiently managing Form Ac3262 S.

-

Can I integrate airSlate SignNow with other tools while using Form Ac3262 S?

Absolutely! AirSlate SignNow offers a wide range of integrations with popular tools such as Google Drive, Salesforce, and Dropbox. This means you can easily sync and access Form Ac3262 S alongside your other documents and applications.

-

What are the benefits of using airSlate SignNow for Form Ac3262 S?

Using airSlate SignNow for Form Ac3262 S allows you to save time, reduce errors, and enhance document security. The platform not only simplifies the signing process but also ensures that your documents are stored safely and are easily retrievable.

-

What types of users can benefit from Form Ac3262 S with airSlate SignNow?

Form Ac3262 S can benefit a variety of users, including small business owners, HR professionals, and legal teams. Regardless of your industry, airSlate SignNow helps you manage documents efficiently, making it suitable for anyone needing to handle such forms.

Get more for Form Ac3262 S

- Umhs authorization release of information 2012

- Evidence of insurability form

- Masm 5018 02 10 application for specified form

- Visco precert form aetna

- Med quest 6965535 form

- Breast imaging services mammography order form lake forest lfh

- Dermal filler consent pdf form

- Printable forms for pressure ulcer

Find out other Form Ac3262 S

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History