Income Verification Form 2020-2026

What is the Income Verification Form

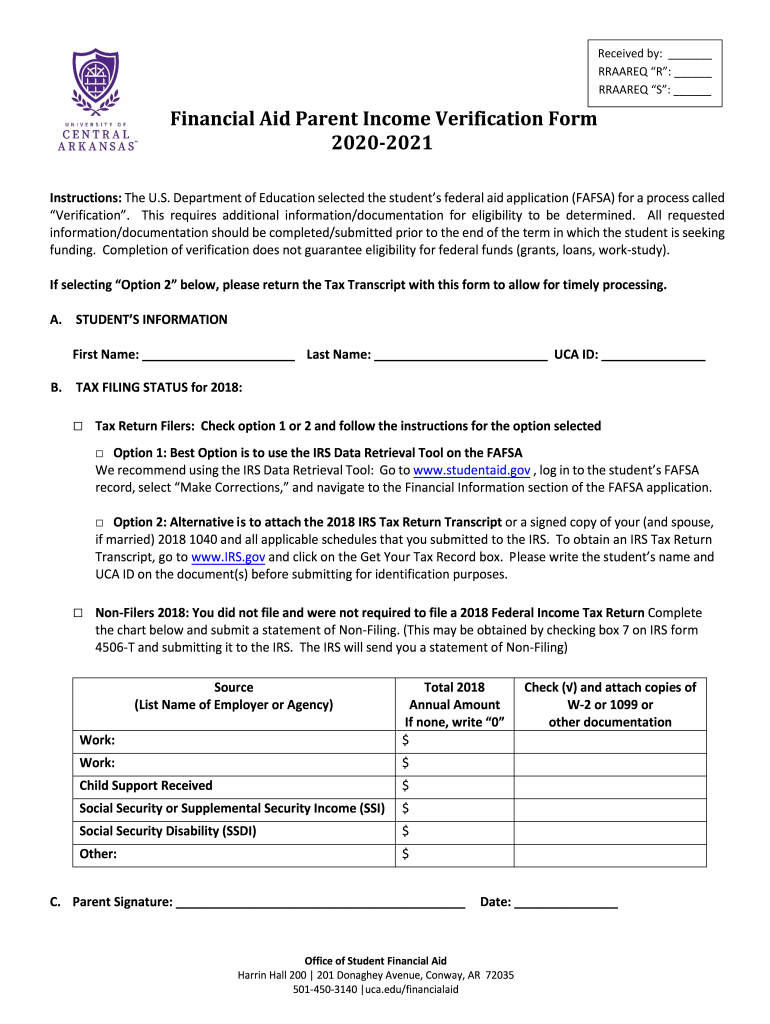

The income verification form is a document used to confirm an individual's or household's income. This form is often required by financial institutions, government agencies, and educational institutions to assess eligibility for loans, grants, or assistance programs. In the context of the 2020 income verification, it specifically refers to the income details for that year, which may include wages, benefits, or other sources of income. This form plays a crucial role in ensuring that the information provided is accurate and verifiable.

How to use the Income Verification Form

To effectively use the income verification form, individuals should gather all necessary documentation that reflects their income for the year in question. This may include pay stubs, tax returns, and any other relevant financial records. Once the required information is collected, it should be accurately entered into the form. After completing the form, it can be submitted to the requesting agency or institution, either electronically or through traditional mail, depending on their submission guidelines.

Steps to complete the Income Verification Form

Completing the income verification form involves several key steps:

- Gather all relevant income documentation, such as W-2s, 1099s, and pay stubs.

- Ensure that all personal information, including name, address, and Social Security number, is accurate.

- Fill in the income details for the year 2020, including all sources of income.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to the specified method, whether online or by mail.

Legal use of the Income Verification Form

The income verification form must be completed and submitted in compliance with applicable laws and regulations. In the United States, eSignature laws such as the ESIGN Act and UETA ensure that electronic signatures are legally binding, provided that certain criteria are met. This means that when using an electronic version of the income verification form, individuals should ensure that their signatures are properly authenticated and that the form is securely transmitted to maintain its legal validity.

Required Documents

When filling out the income verification form, it is essential to have the following documents on hand:

- W-2 forms from employers for the year 2020.

- 1099 forms for any freelance or contract work.

- Recent pay stubs that reflect current income.

- Tax returns filed for the year 2020.

- Any additional documentation that supports income claims, such as bank statements or benefit letters.

Form Submission Methods (Online / Mail / In-Person)

The submission methods for the income verification form can vary based on the requirements of the requesting agency. Common submission methods include:

- Online: Many institutions allow for electronic submission via secure portals, which can streamline the process.

- Mail: The form can be printed and sent via postal service, ensuring that it is sent to the correct address.

- In-Person: Some agencies may require or allow individuals to submit the form in person, providing an opportunity for immediate confirmation.

Quick guide on how to complete 2019 income verification form

Complete Income Verification Form seamlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Income Verification Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The easiest method to modify and eSign Income Verification Form effortlessly

- Find Income Verification Form and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Income Verification Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 income verification form

Create this form in 5 minutes!

How to create an eSignature for the 2019 income verification form

The way to create an eSignature for a PDF document in the online mode

The way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is 2020 income verification and why is it important?

2020 income verification is the process of confirming an individual's income for the year 2020, which is crucial for various financial and legal transactions. This verification helps lenders, landlords, and employers ensure that the reported income is accurate, facilitating better decision-making.

-

How can airSlate SignNow assist with 2020 income verification?

airSlate SignNow provides an efficient platform for sending and eSigning documents related to 2020 income verification. Our streamlined digital workflow makes it easy to collect and manage the necessary verification documents, ensuring compliance and reducing processing time.

-

What are the pricing options for airSlate SignNow when handling 2020 income verification?

Our pricing for airSlate SignNow is flexible and competitive, catering to various business needs, including those focusing on 2020 income verification. We offer different plans that include features essential for document management and eSigning, so you can choose one that fits your budget and requirements.

-

Does airSlate SignNow integrate with other tools for 2020 income verification?

Yes, airSlate SignNow offers seamless integrations with multiple platforms, enhancing the process of 2020 income verification. Whether you need to connect with your HR systems, accounting software, or CRM tools, our integrations ensure that your workflow is smooth and efficient.

-

What features does airSlate SignNow offer to support 2020 income verification?

airSlate SignNow includes features like customizable templates, secure eSigning, and automated reminders, all of which are advantageous for 2020 income verification. These tools not only save time but also increase the accuracy and security of the verification process.

-

How secure is my data when using airSlate SignNow for 2020 income verification?

Data security is a top priority at airSlate SignNow. Our platform uses advanced encryption and compliance with industry regulations, ensuring that all documents related to 2020 income verification are protected against unauthorized access.

-

Can I access airSlate SignNow from mobile devices for 2020 income verification?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to manage 2020 income verification documents from your smartphone or tablet. This flexibility ensures that you can send and eSign documents on the go, making the process more convenient for your business.

Get more for Income Verification Form

Find out other Income Verification Form

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now