Hawaii Form N 288c 2020

What is the Hawaii Form N 288c

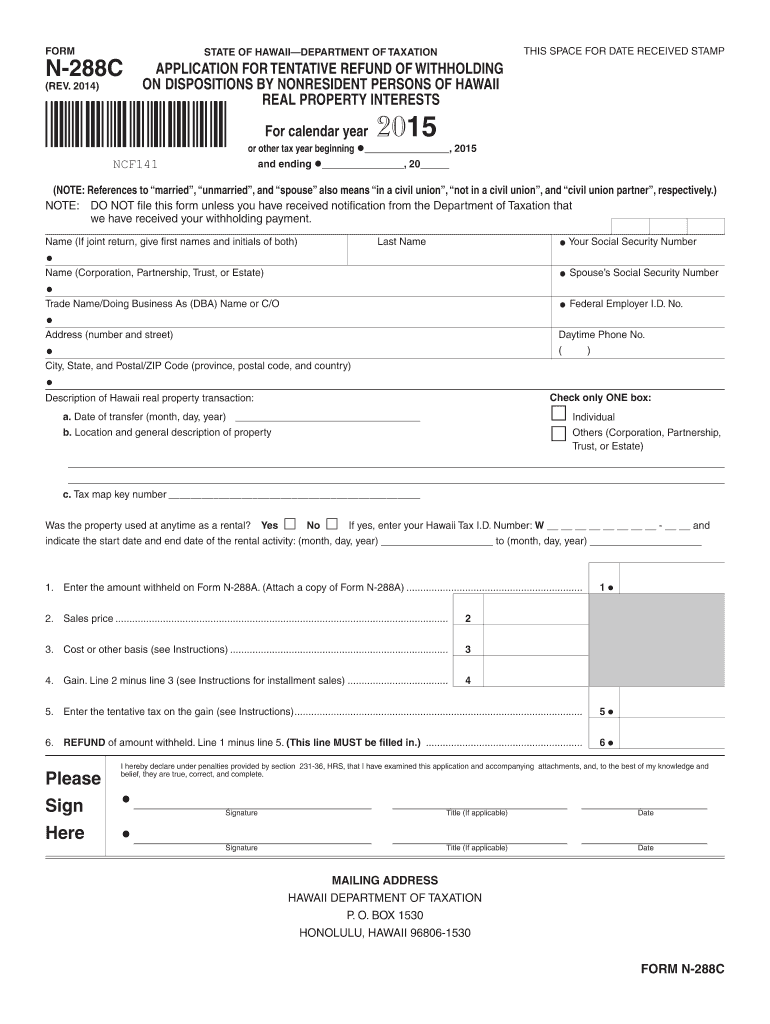

The Hawaii Form N 288c is a specific tax form used by individuals and businesses in Hawaii to report certain income and deductions. This form is crucial for ensuring compliance with state tax regulations and is typically associated with the reporting of income from Hawaii sources. Understanding the purpose of this form is essential for accurate tax filing and maintaining good standing with the state tax authority.

How to use the Hawaii Form N 288c

Using the Hawaii Form N 288c involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and deduction records. Next, fill out the form accurately, ensuring that all required fields are completed. After completing the form, review it for any errors before submission. It is also advisable to keep a copy for your records. The form can be submitted electronically or by mail, depending on your preference.

Steps to complete the Hawaii Form N 288c

Completing the Hawaii Form N 288c requires attention to detail. Follow these steps:

- Obtain the latest version of the form from the Hawaii Department of Taxation website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from Hawaii sources accurately.

- List any applicable deductions and credits.

- Calculate your total tax liability based on the information provided.

- Sign and date the form to certify its accuracy.

Legal use of the Hawaii Form N 288c

The Hawaii Form N 288c is legally binding when completed and submitted according to state regulations. It is essential to ensure that the information provided is truthful and accurate, as any discrepancies may lead to penalties or legal repercussions. The form must be submitted by the designated filing deadline to avoid late fees and interest charges.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii Form N 288c are typically aligned with the state tax calendar. It is important to be aware of these dates to ensure timely submission. Generally, the form must be filed by April fifteenth of the following tax year, but extensions may be available under certain circumstances. Always verify specific deadlines for the current tax year, as they may vary.

Form Submission Methods (Online / Mail / In-Person)

The Hawaii Form N 288c can be submitted through various methods, providing flexibility for taxpayers. The options include:

- Online Submission: Many taxpayers choose to file electronically through the Hawaii Department of Taxation’s online portal.

- Mail: Completed forms can be mailed to the appropriate tax office address provided on the form.

- In-Person: Taxpayers may also visit local tax offices to submit their forms directly.

Quick guide on how to complete hawaii form n 288c 2015

Complete Hawaii Form N 288c effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to generate, alter, and eSign your documents promptly without any delays. Manage Hawaii Form N 288c on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest method to alter and eSign Hawaii Form N 288c with ease

- Obtain Hawaii Form N 288c and then select Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then hit the Done button to save your modifications.

- Decide how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Hawaii Form N 288c and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hawaii form n 288c 2015

Create this form in 5 minutes!

How to create an eSignature for the hawaii form n 288c 2015

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is the Hawaii Form N 288c?

The Hawaii Form N 288c is a tax form used for claiming a refund on excess withholding and estimated payments for individual income taxes in Hawaii. Understanding this form is crucial for accurately filing your taxes and ensuring you receive the refunds you're entitled to.

-

How can airSlate SignNow help with the Hawaii Form N 288c?

airSlate SignNow provides an efficient platform for preparing, signing, and submitting your Hawaii Form N 288c. With a user-friendly interface, you can streamline document workflows, ensuring that your forms are completed and sent promptly.

-

What features does airSlate SignNow offer for eSigning the Hawaii Form N 288c?

AirSlate SignNow offers features such as secure eSignature capabilities, document tracking, and customizable templates for Hawaii Form N 288c. These features help simplify the signing process and enhance document security and compliance.

-

Is there a cost to use airSlate SignNow for the Hawaii Form N 288c?

AirSlate SignNow offers various pricing plans, including affordable options that can fit different business needs when managing the Hawaii Form N 288c. By choosing the right plan, you can maximize your document management efficiently and cost-effectively.

-

Can I integrate airSlate SignNow with other applications for the Hawaii Form N 288c?

Yes, airSlate SignNow offers integrations with various applications, enabling you to connect your workflow for the Hawaii Form N 288c with tools like CRMs and cloud storage services. This flexibility enhances productivity and streamlines your document management processes.

-

What are the benefits of using airSlate SignNow for managing Hawaii Form N 288c?

Using airSlate SignNow for managing your Hawaii Form N 288c offers numerous benefits, including ease of use, time savings, and enhanced document security. It allows businesses to submit forms efficiently while minimizing the risk of errors in the process.

-

How secure is airSlate SignNow when handling the Hawaii Form N 288c?

AirSlate SignNow prioritizes security, employing robust encryption and compliance measures to protect your data related to the Hawaii Form N 288c. This ensures that sensitive information remains confidential and secure throughout the signing process.

Get more for Hawaii Form N 288c

- Agent format

- New jersey autopsy reports form

- Porosity gizmo answer key form

- Essentia health release of information

- Bayada bucks catalog form

- Confidential financial statement as of texas capital bank form

- Direct deposit authorization thomaston savings bank form

- Anlage grundstck zur feststellungserklrung form

Find out other Hawaii Form N 288c

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document