Commercial Lease Application Eforms Com

What is the application taxes form?

The application taxes form is a crucial document that individuals and businesses use to report their income and calculate their tax obligations. This form is essential for ensuring compliance with federal and state tax regulations. It typically includes sections for personal information, income details, deductions, and credits. Understanding this form is vital for accurate tax filing and avoiding penalties.

Steps to complete the application taxes form

Completing the application taxes form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary documents, such as W-2s, 1099s, and records of any deductions. Next, fill out your personal information, including your name, address, and Social Security number. Proceed to report your income, ensuring that all figures are accurate. After entering your deductions and credits, review the completed form for any errors. Finally, sign and date the form before submission.

Filing deadlines / important dates

Timely filing of the application taxes form is crucial to avoid penalties. Generally, the deadline for individual tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It's essential to be aware of any state-specific deadlines as well. Marking these dates on your calendar can help ensure that you submit your form on time.

Required documents for application taxes

To complete the application taxes form accurately, you will need several key documents. These typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any additional income

- Documentation for deductions, such as mortgage interest statements

- Receipts for business expenses if applicable

Having these documents ready will streamline the process and help ensure that your form is filled out correctly.

Who issues the application taxes form?

The application taxes form is issued by the Internal Revenue Service (IRS) at the federal level. State tax authorities also provide their own versions of tax forms for state income tax purposes. It is important to use the correct form for your specific tax situation, as different forms may apply based on your filing status and income sources.

Penalties for non-compliance

Failure to file the application taxes form on time or inaccuracies in reporting can result in significant penalties. The IRS imposes fines for late filing, which can accumulate over time. Additionally, underreporting income can lead to interest charges and further penalties. Understanding these consequences emphasizes the importance of accurate and timely tax filing.

Eligibility criteria for application taxes

Eligibility to file the application taxes form typically depends on various factors, including your income level, filing status, and age. Generally, all U.S. citizens and residents who earn above a certain threshold must file a tax return. Specific criteria may vary based on whether you are self-employed, a student, or part of a business entity. Reviewing these criteria can help determine your filing obligations.

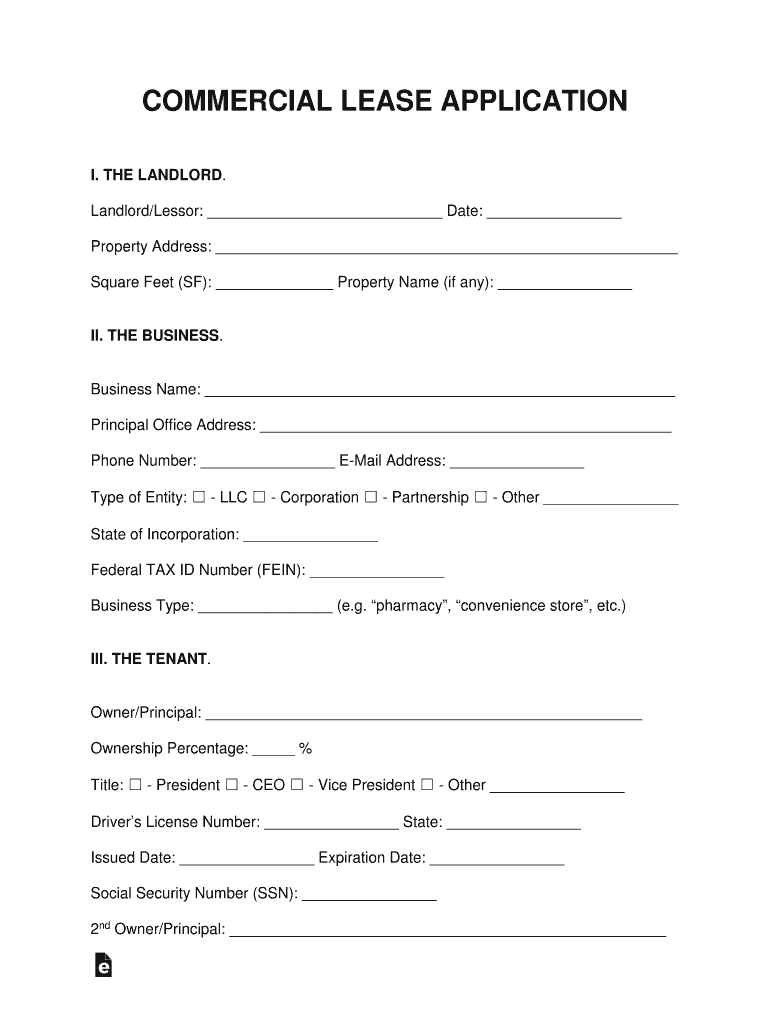

Quick guide on how to complete commercial lease application eformscom

Complete Commercial Lease Application Eforms com seamlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Commercial Lease Application Eforms com on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Commercial Lease Application Eforms com with ease

- Locate Commercial Lease Application Eforms com and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, cumbersome form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and eSign Commercial Lease Application Eforms com and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the commercial lease application eformscom

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What are application taxes in the context of eSigning documents?

Application taxes refer to the costs associated with using software solutions to manage and sign documents electronically. With airSlate SignNow, these application taxes are minimized due to our cost-effective setup, allowing businesses to streamline their document handling while staying compliant.

-

How does airSlate SignNow help with application taxes for businesses?

airSlate SignNow assists businesses in managing their application taxes by providing a user-friendly platform that simplifies document workflows. By reducing the time spent on document management, companies can focus on their core operations and reduce overhead costs, ultimately optimizing their application taxes.

-

What features does airSlate SignNow offer to address application taxes?

Our platform includes features like document templates, automated workflows, and secure eSignatures that directly impact application taxes. These tools enhance productivity and compliance while ensuring that your business incurs minimal costs associated with managing tax-related documents.

-

Does airSlate SignNow provide any support for understanding application taxes?

Yes, airSlate SignNow offers support and resources to help businesses understand application taxes as they relate to electronic signatures and document management. Our customer support team is available to answer questions and ensure you maximize the efficiency of your tax documentation.

-

What is the pricing structure for airSlate SignNow regarding application taxes?

airSlate SignNow provides transparent pricing options tailored to different business needs, making it a cost-effective choice for managing application taxes. Our plans are competitive, ensuring that the overall savings on document processing outweigh any associated application taxes.

-

Can I integrate airSlate SignNow with other applications for managing application taxes?

Yes, airSlate SignNow easily integrates with various accounting and tax software to streamline your application taxes. This ensures a seamless transfer of information between platforms, allowing for efficient management of tax-related documents.

-

How does airSlate SignNow enhance security concerning application taxes?

Security is critical when dealing with application taxes. airSlate SignNow implements robust encryption and authentication measures that protect your documents and sensitive information, ensuring compliance while minimizing risks associated with tax documentation.

Get more for Commercial Lease Application Eforms com

Find out other Commercial Lease Application Eforms com

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online