Non Residence Etc Use the SA109 Supplementary Pages to Declare Your Residence and Domicile Status and Claim Personal Allowances 2020

What is the Non residence Etc Use The SA109 Supplementary Pages?

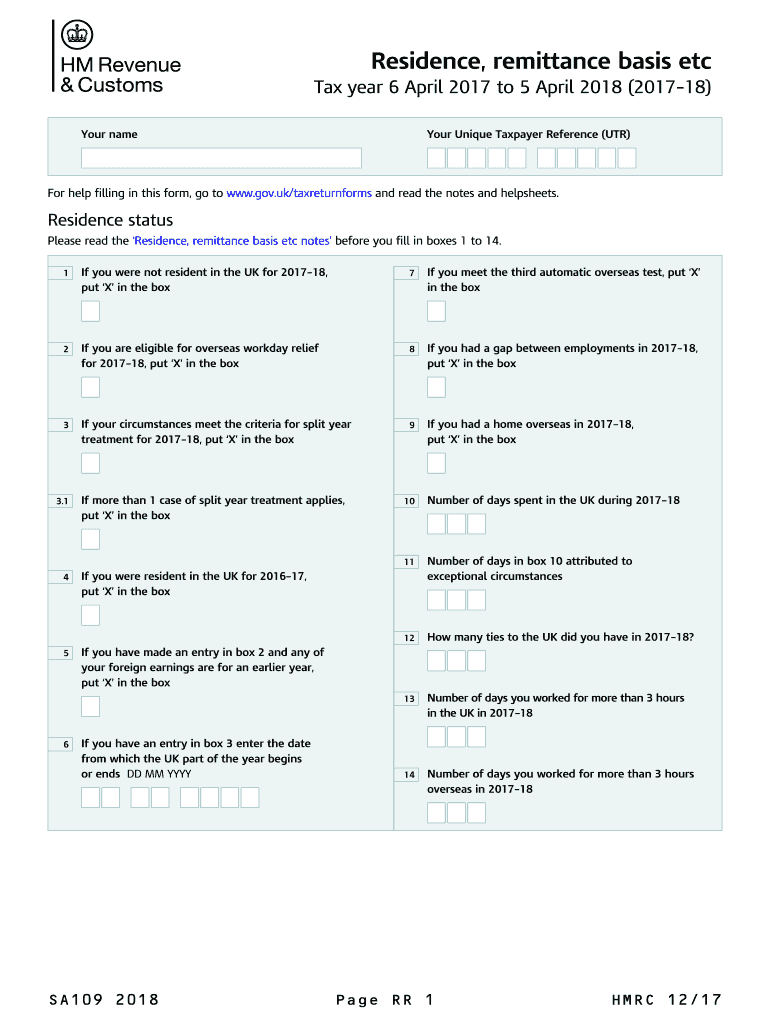

The Non residence Etc Use The SA109 Supplementary Pages is a crucial document for individuals who are non-UK residents. It allows them to declare their residence and domicile status while filing a tax return for the tax year ended 5 April. This form is essential for claiming personal allowances as a non-UK resident, ensuring compliance with tax regulations while maximizing potential benefits. Understanding this form is vital for anyone navigating the complexities of international tax obligations.

How to Use the Non residence Etc Use The SA109 Supplementary Pages

Using the Non residence Etc Use The SA109 Supplementary Pages involves several steps. First, gather all necessary personal information, including your residency status and details about your domicile. Next, accurately fill out the form, ensuring that all sections are completed to reflect your current status. It is important to review the information for accuracy before submission, as errors can lead to complications with your tax return. Finally, submit the completed form alongside your tax return to the appropriate tax authority.

Steps to Complete the Non residence Etc Use The SA109 Supplementary Pages

Completing the Non residence Etc Use The SA109 Supplementary Pages requires careful attention to detail. Follow these steps:

- Collect relevant documentation, including proof of your non-resident status.

- Fill out personal details accurately, including your name, address, and tax identification number.

- Declare your residence and domicile status clearly, providing any necessary explanations.

- Claim any personal allowances you are eligible for as a non-UK resident.

- Review the completed form for accuracy and completeness.

- Submit the form with your tax return by the specified deadline.

Legal Use of the Non residence Etc Use The SA109 Supplementary Pages

The Non residence Etc Use The SA109 Supplementary Pages is legally binding when completed correctly. It must adhere to the relevant tax laws and regulations governing non-resident tax obligations. Ensuring that the form is filled out accurately not only protects your rights as a taxpayer but also helps avoid potential penalties. It is advisable to keep a copy of the submitted form for your records and to consult a tax professional if you have questions about your specific situation.

Required Documents for the Non residence Etc Use The SA109 Supplementary Pages

To successfully complete the Non residence Etc Use The SA109 Supplementary Pages, certain documents are necessary. These may include:

- Proof of residency status, such as utility bills or lease agreements.

- Tax identification number or Social Security number.

- Any relevant correspondence from tax authorities regarding your residency status.

- Documentation supporting your claims for personal allowances.

Filing Deadlines for the Non residence Etc Use The SA109 Supplementary Pages

Filing deadlines for the Non residence Etc Use The SA109 Supplementary Pages align with the overall tax return deadlines. It is essential to submit this form by the deadline to ensure compliance and avoid penalties. Typically, tax returns in the UK must be filed by 31 January following the end of the tax year on 5 April. Marking these dates on your calendar can help you stay organized and ensure timely submission.

Quick guide on how to complete non residence etc 2018 use the sa109 2018 supplementary pages to declare your residence and domicile status and claim personal

Easy Preparation of Non residence Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Personal Allowances on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the required form and securely store it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and eSign your documents without any hassles. Manage Non residence Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Personal Allowances across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Simplest Method to Edit and eSign Non residence Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Personal Allowances Effortlessly

- Locate Non residence Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Personal Allowances and click Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize important parts of the documents or redact sensitive details with specialized tools offered by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Choose your preferred method of delivering the form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Non residence Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Personal Allowances to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct non residence etc 2018 use the sa109 2018 supplementary pages to declare your residence and domicile status and claim personal

Create this form in 5 minutes!

How to create an eSignature for the non residence etc 2018 use the sa109 2018 supplementary pages to declare your residence and domicile status and claim personal

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the purpose of the SA109 Supplementary Pages?

The SA109 Supplementary Pages allow individuals to declare their residence and domicile status for tax purposes. Non residence Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Personal Allowances As A Non UK Resident When Filing A Tax Return For The Tax Year Ended 5 April.

-

How do I determine if I need to fill out the SA109 form?

If you are a non-UK resident or unsure of your residency status, you may need to use the SA109 form. Non residence Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Personal Allowances As A Non UK Resident When Filing A Tax Return For The Tax Year Ended 5 April.

-

What personal allowances can I claim as a non-UK resident?

As a non-UK resident, you may still be eligible for certain personal allowances, provided you complete the SA109 form correctly. Non residence Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Personal Allowances As A Non UK Resident When Filing A Tax Return For The Tax Year Ended 5 April.

-

Is there a fee for using the SA109 Supplementary Pages?

There is no direct fee for using the SA109 Supplementary Pages; however, consider any costs associated with filing your tax return through a professional service. Non residence Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Personal Allowances As A Non UK Resident When Filing A Tax Return For The Tax Year Ended 5 April.

-

Can airSlate SignNow assist in completing the SA109 form?

While airSlate SignNow primarily focuses on eSigning and document management, it can streamline the process by allowing you to securely send and sign documents related to your tax filing. Non residence Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Personal Allowances As A Non UK Resident When Filing A Tax Return For The Tax Year Ended 5 April.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features like eSigning, document templates, and cloud storage, designed to simplify your paperwork. Non residence Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Personal Allowances As A Non UK Resident When Filing A Tax Return For The Tax Year Ended 5 April.

-

How can I integrate airSlate SignNow with my current workflow?

airSlate SignNow offers various integrations with popular business tools, allowing you to enhance your existing workflow. You can efficiently send, sign, and manage documents while ensuring you meet requirements, including Non residence Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Personal Allowances As A Non UK Resident When Filing A Tax Return For The Tax Year Ended 5 April.

Get more for Non residence Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Personal Allowances

- Pharmacy technology program information and application

- Ssm health kidney care begins serving patients in the st form

- Letter of medical necessity for lung transplant template form

- A guide for pain management after your form

- Request form for reconsideration

- Hyperlipidemia template form

- Mychart scott white form

- Print the membership application aota form

Find out other Non residence Etc Use The SA109 Supplementary Pages To Declare Your Residence And Domicile Status And Claim Personal Allowances

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online