Schedule CA 540 California Adjustments Residents Instructions Schedule CA 540 California Adjustments Residents Instructions 2018

What is the Schedule CA 540 California Adjustments Residents Instructions?

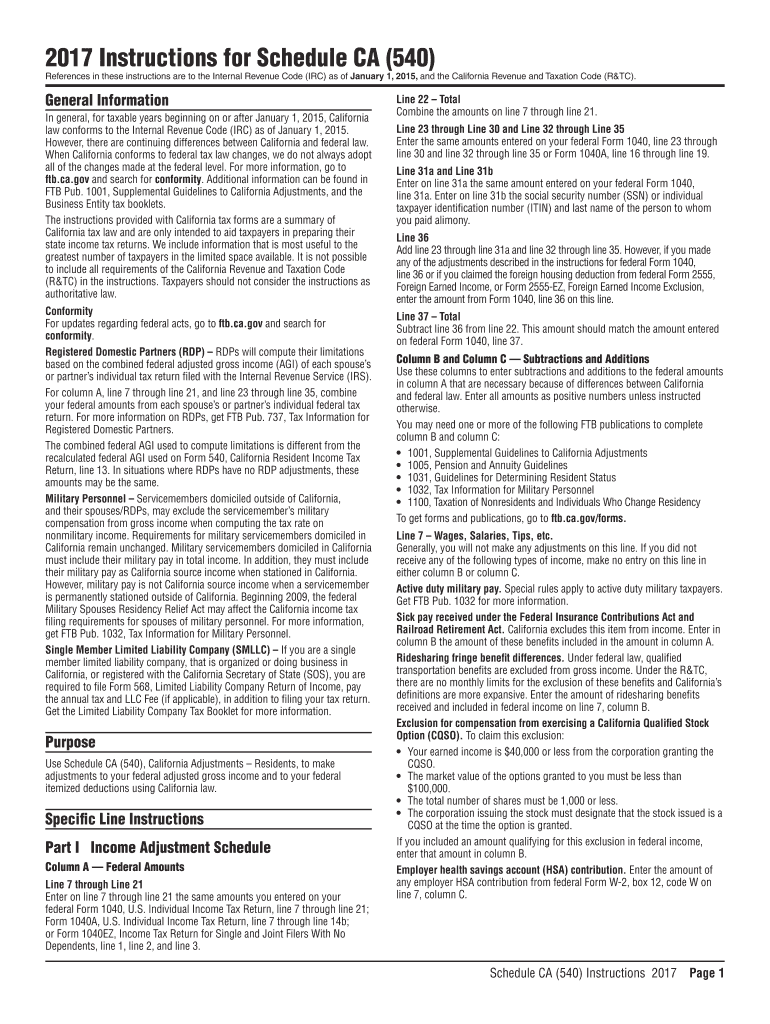

The Schedule CA 540 California Adjustments Residents Instructions is a form used by California residents to report adjustments to their income when filing state taxes. This form allows taxpayers to make necessary modifications to their federal adjusted gross income (AGI) to comply with California tax laws. It is essential for accurately calculating state tax liabilities and ensuring compliance with California's tax regulations. The adjustments may include various deductions, credits, and other tax-related items that differ from federal guidelines.

Steps to Complete the Schedule CA 540 California Adjustments Residents Instructions

Completing the Schedule CA 540 involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and previous tax returns. Next, carefully read the instructions provided with the form to understand what adjustments apply to your situation. Fill out the form by entering your federal AGI and making the required adjustments in the designated sections. Double-check your entries for accuracy before finalizing the form. Lastly, ensure that you sign and date the form before submission.

How to Obtain the Schedule CA 540 California Adjustments Residents Instructions

The Schedule CA 540 California Adjustments Residents Instructions can be obtained through the California Franchise Tax Board (FTB) website. The form is available for download in PDF format, which can be printed and filled out manually. Additionally, taxpayers may also request a physical copy by contacting the FTB directly. It is advisable to ensure you have the most current version of the form to avoid any issues during the filing process.

Key Elements of the Schedule CA 540 California Adjustments Residents Instructions

Key elements of the Schedule CA 540 include sections for reporting income adjustments, deductions, and credits. Taxpayers must provide their federal AGI, followed by adjustments that increase or decrease this amount based on California-specific tax rules. Important adjustments may include state tax refunds, student loan interest deductions, and contributions to retirement accounts. Each section of the form is clearly labeled to guide taxpayers in making the appropriate entries.

Legal Use of the Schedule CA 540 California Adjustments Residents Instructions

The Schedule CA 540 is legally binding when completed accurately and submitted to the California Franchise Tax Board. It is crucial for taxpayers to understand that providing false information or failing to report required adjustments can lead to penalties and interest on unpaid taxes. Therefore, it is essential to ensure that all entries are truthful and comply with California tax laws to avoid legal complications.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Schedule CA 540. Generally, the form is due on April 15 for most individuals, aligning with the federal tax deadline. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines or extensions that may be announced by the California Franchise Tax Board.

Quick guide on how to complete 2017 schedule ca 540 california adjustments residents instructions 2017 schedule ca 540 california adjustments residents

Complete Schedule CA 540 California Adjustments Residents Instructions Schedule CA 540 California Adjustments Residents Instructions effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any holdups. Manage Schedule CA 540 California Adjustments Residents Instructions Schedule CA 540 California Adjustments Residents Instructions on any platform with airSlate SignNow’s Android or iOS applications and improve any document-related task today.

The simplest method to alter and electronically sign Schedule CA 540 California Adjustments Residents Instructions Schedule CA 540 California Adjustments Residents Instructions without stress

- Locate Schedule CA 540 California Adjustments Residents Instructions Schedule CA 540 California Adjustments Residents Instructions and then click Get Form to begin.

- Utilize the resources we provide to complete your document.

- Mark important parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Modify and electronically sign Schedule CA 540 California Adjustments Residents Instructions Schedule CA 540 California Adjustments Residents Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 schedule ca 540 california adjustments residents instructions 2017 schedule ca 540 california adjustments residents

Create this form in 5 minutes!

How to create an eSignature for the 2017 schedule ca 540 california adjustments residents instructions 2017 schedule ca 540 california adjustments residents

The best way to generate an eSignature for your PDF file online

The best way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the Schedule CA 540 California Adjustments Residents Instructions?

The Schedule CA 540 California Adjustments Residents Instructions is a tax form that helps California residents make necessary adjustments to their income tax return. This form guides taxpayers in reporting income, deductions, and credits accurately, enhancing compliance with state tax laws.

-

How can I access the Schedule CA 540 California Adjustments Residents Instructions?

You can easily access the Schedule CA 540 California Adjustments Residents Instructions through the California Franchise Tax Board's website or by using tax preparation software that includes this schedule. Ensuring all instructions are followed accurately will streamline your filing process.

-

Are there any costs associated with using the Schedule CA 540 California Adjustments Residents Instructions?

Using the Schedule CA 540 California Adjustments Residents Instructions is generally free, as it is provided by the state. However, if you choose to use tax preparation software or professional services, there may be associated costs that vary based on the provider of those services.

-

What features does the Schedule CA 540 California Adjustments Residents Instructions offer?

The Schedule CA 540 California Adjustments Residents Instructions includes sections for reporting various adjustments to income, as well as deductions and credits specific to California. This ensures that taxpayers can navigate the complexities of California tax regulations effectively.

-

How does the Schedule CA 540 California Adjustments Residents Instructions benefit taxpayers?

The Schedule CA 540 California Adjustments Residents Instructions benefits taxpayers by simplifying the reporting of necessary income adjustments and ensuring compliance with California tax requirements. Properly completing this schedule helps prevent errors and reduces the risk of audits.

-

Can I eSign my Schedule CA 540 California Adjustments Residents Instructions?

Yes, you can use eSignature solutions like airSlate SignNow to securely eSign your Schedule CA 540 California Adjustments Residents Instructions and other tax documents. This expedites the filing process, making it easier to manage your documentation electronically.

-

How often do the Schedule CA 540 California Adjustments Residents Instructions change?

The Schedule CA 540 California Adjustments Residents Instructions may change annually based on amendments to California tax laws or regulations. It's important to review the latest instructions prior to filing to ensure compliance with current requirements.

Get more for Schedule CA 540 California Adjustments Residents Instructions Schedule CA 540 California Adjustments Residents Instructions

- Nursing equivalency form january 2016

- Nursing program medical record form

- Identifying best practices for and utilities of the form

- Y office of the registrar cnsuedu form

- University of iowa hospitals and clinics uihc form

- Consent to release of information university of iowa

- To be returned within 30 days form

- Pdf the role of next generation sequencing in precision form

Find out other Schedule CA 540 California Adjustments Residents Instructions Schedule CA 540 California Adjustments Residents Instructions

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now