California Instructions 540 Form Printable 2018

What is the California Instructions 540 Form Printable

The California Instructions 540 Form is a crucial document for individuals filing their state income tax returns. This form provides detailed guidelines on how to complete the California Resident Income Tax Return, known as Form 540. It is designed to assist taxpayers in understanding the necessary steps, calculations, and requirements specific to California tax laws. The instructions cover various aspects, including income reporting, deductions, credits, and any applicable adjustments that may affect the taxpayer's overall liability.

Steps to Complete the California Instructions 540 Form Printable

Completing the California Instructions 540 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, review the instructions to understand the sections of the form and what information is required. Fill out the form systematically, starting with personal information, followed by income, deductions, and credits. It is essential to double-check calculations and ensure that all entries are accurate. Finally, sign and date the form before submission.

Legal Use of the California Instructions 540 Form Printable

The California Instructions 540 Form is legally binding when completed correctly and submitted to the state tax authority. It is essential for taxpayers to follow the guidelines provided in the instructions to ensure compliance with California tax laws. Failure to adhere to these instructions may result in penalties, interest, or even legal repercussions. Utilizing a reliable platform for electronic submission, such as airSlate SignNow, can enhance the security and validity of the submission process, ensuring all legal requirements are met.

Key Elements of the California Instructions 540 Form Printable

Several key elements are essential to the California Instructions 540 Form. These include:

- Personal Information: Taxpayer's name, address, and Social Security number.

- Income Reporting: Detailed sections for reporting various types of income, including wages, interest, and dividends.

- Deductions and Credits: Information on available deductions and tax credits specific to California residents.

- Signature Section: A designated area for the taxpayer's signature, affirming the accuracy of the information provided.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the California Instructions 540 Form. The form can be filed electronically through various online platforms, which often provide a streamlined process for completion and submission. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate state tax office. For those who prefer in-person submission, visiting a local tax office is also an option. Each method has its own advantages, such as immediate confirmation of receipt for electronic submissions and the ability to ask questions during in-person visits.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the California Instructions 540 Form. Typically, the deadline for filing is April 15th of each year, aligning with the federal tax filing deadline. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions that may be available, which can provide additional time for filing but must be requested in advance.

Quick guide on how to complete california instructions 540 form printable

Effortlessly prepare California Instructions 540 Form Printable on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents promptly without delays. Oversee California Instructions 540 Form Printable on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to alter and electronically sign California Instructions 540 Form Printable effortlessly

- Obtain California Instructions 540 Form Printable and click on Get Form to commence.

- Utilize the tools we furnish to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form hunting, or mistakes that necessitate printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from any chosen device. Modify and electronically sign California Instructions 540 Form Printable and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california instructions 540 form printable

Create this form in 5 minutes!

How to create an eSignature for the california instructions 540 form printable

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

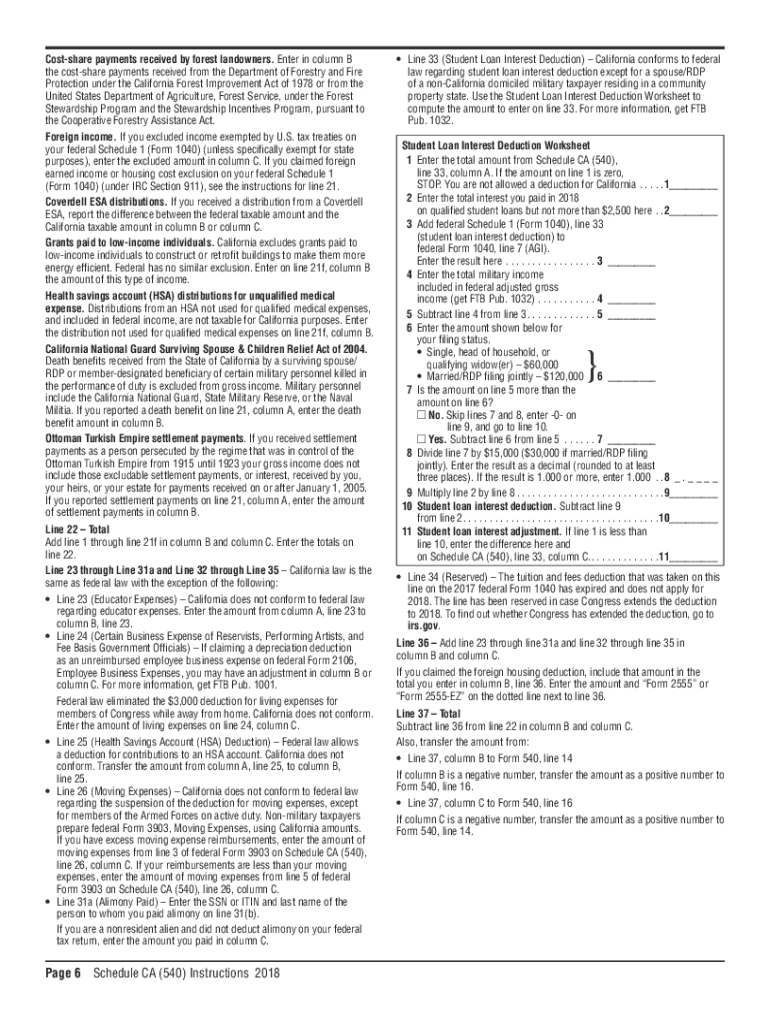

What is Schedule CA 540?

Schedule CA 540 is a tax form used by California residents to determine their California taxable income. It begins by adjusting your federal adjusted gross income based on state-specific income adjustments, leading to your final California taxable income. Understanding what is Schedule CA 540 is essential for accurate tax filing and compliance.

-

Why do I need to complete Schedule CA 540?

You need to complete Schedule CA 540 to report your income and calculate your California tax liability accurately. It helps ensure that you're complying with California state tax laws and allows you to take advantage of any deductions or credits available. Knowing what is Schedule CA 540 can save you money and prevent potential penalties.

-

What information do I need to fill out Schedule CA 540?

To fill out Schedule CA 540, you’ll need your federal tax return, including your adjusted gross income, details about your California income sources, and any eligible deductions or credits. Having this information ready will streamline the preparation of your Schedule CA 540. Familiarity with what is Schedule CA 540 is helpful for gathering the necessary documents.

-

What are the benefits of using airSlate SignNow for document signing related to Schedule CA 540?

Using airSlate SignNow for signing documents related to Schedule CA 540 makes the process efficient and secure. With features like multi-party signing and advanced tracking, you can ensure your tax documents are managed properly. By utilizing airSlate SignNow, you simplify your workflow while staying compliant with tax regulations.

-

How does airSlate SignNow integrate with tax preparation software for Schedule CA 540?

airSlate SignNow seamlessly integrates with popular tax preparation software, allowing you to eSign and send your Schedule CA 540 documents directly from the platform. This integration simplifies the process, ensuring all your information is in one place and easily accessible. Knowing how to use airSlate SignNow with these tools can enhance your tax filing experience.

-

Is airSlate SignNow cost-effective for individual users filing Schedule CA 540?

Yes, airSlate SignNow is a cost-effective solution for individual users who need to sign and send their Schedule CA 540 documents securely. With various pricing plans available, it caters to everyone from casual users to businesses, ensuring that you get value for your investment. Understanding how airSlate SignNow can fit into your budget is key for efficient tax processes.

-

What features does airSlate SignNow offer that assist with tax document management, including Schedule CA 540?

airSlate SignNow offers features like customizable templates, audit trails, and remote signing, all of which assist in managing tax documents like Schedule CA 540. These tools help you organize your documents, track their status, and ensure compliance. Learning what is Schedule CA 540 and utilizing airSlate SignNow’s features can streamline your filing process.

Get more for California Instructions 540 Form Printable

Find out other California Instructions 540 Form Printable

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer