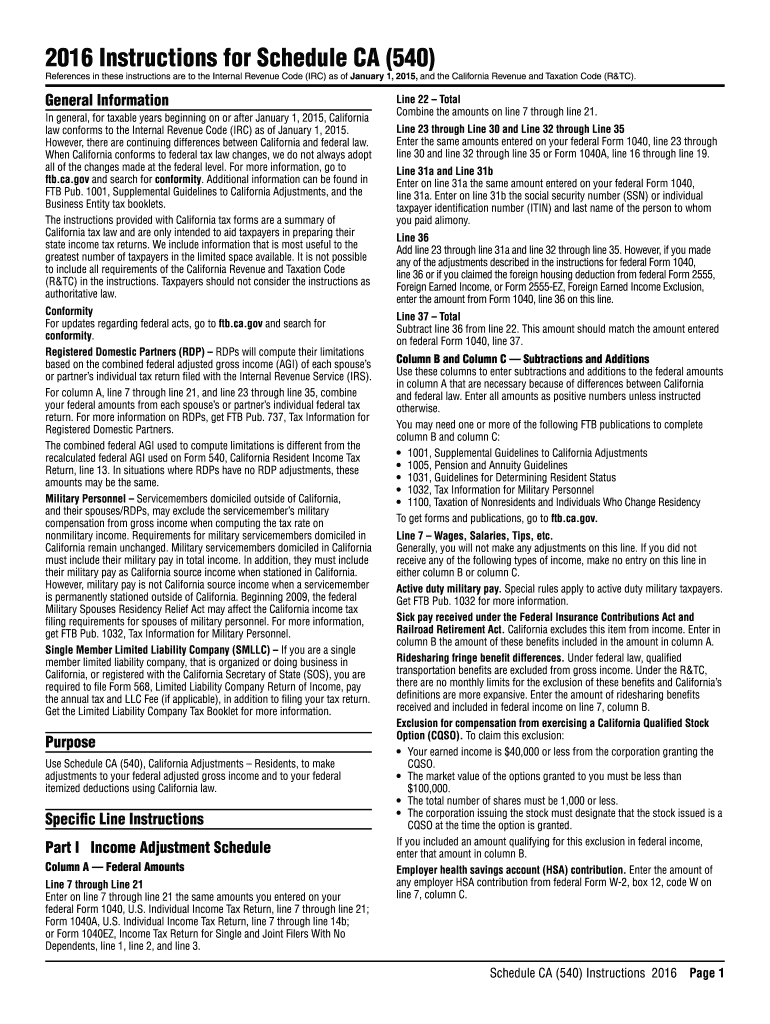

Instructions for Schedule CA 540 California Adjustments Residents Instructions for Schedule CA 540 Calif 2016

Overview of Instructions For Schedule CA 540 California Adjustments Residents

The Instructions For Schedule CA 540 California Adjustments Residents provide detailed guidance for California residents who need to report adjustments to their income on their state tax returns. This form is essential for ensuring that all necessary adjustments are accurately reflected, allowing taxpayers to comply with California tax laws. The instructions cover various adjustments that may apply, including modifications for federal tax deductions and credits that differ from state regulations.

How to Use the Instructions For Schedule CA 540 California Adjustments Residents

To effectively use the Instructions For Schedule CA 540, begin by reviewing the entire document to understand the specific adjustments applicable to your situation. Identify the sections that correspond to your income sources and deductions. Each adjustment has specific criteria and calculations, so ensure you follow the step-by-step guidance provided. This will help you accurately complete your Schedule CA 540 and avoid potential errors that could lead to delays or penalties.

Steps to Complete the Instructions For Schedule CA 540 California Adjustments Residents

Completing the Instructions For Schedule CA 540 involves several key steps:

- Gather all necessary financial documents, including your federal tax return and any relevant income statements.

- Review the instructions for specific adjustments that apply to your income and deductions.

- Follow the outlined calculations for each adjustment, ensuring accuracy in your figures.

- Complete the Schedule CA 540 form based on the adjustments calculated.

- Double-check your entries for accuracy before submission.

Key Elements of the Instructions For Schedule CA 540 California Adjustments Residents

Key elements of the Instructions For Schedule CA 540 include:

- Definitions of various income types and adjustments.

- Guidelines for calculating adjustments based on federal tax laws.

- Examples of common adjustments that California residents may encounter.

- Important notes on deadlines and submission methods for the completed form.

State-Specific Rules for the Instructions For Schedule CA 540 California Adjustments Residents

California has specific rules that differ from federal tax regulations, which are crucial to understand when completing the Instructions For Schedule CA 540. These rules may include unique deductions, credits, and modifications that apply only to California residents. Familiarizing yourself with these state-specific provisions ensures compliance and maximizes your potential tax benefits.

Legal Use of the Instructions For Schedule CA 540 California Adjustments Residents

The Instructions For Schedule CA 540 are legally binding when completed accurately and submitted to the California tax authorities. It is essential to adhere to all guidelines and requirements outlined in the instructions to ensure that your adjustments are recognized. Using a reliable digital tool for eSigning and submitting the form can enhance the security and validity of your submission, aligning with state compliance standards.

Quick guide on how to complete 2016 instructions for schedule ca 540 california adjustments residents 2016 instructions for schedule ca 540 california

Effortlessly prepare Instructions For Schedule CA 540 California Adjustments Residents Instructions For Schedule CA 540 Calif on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed files, allowing you to locate the appropriate form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Instructions For Schedule CA 540 California Adjustments Residents Instructions For Schedule CA 540 Calif on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to alter and electronically sign Instructions For Schedule CA 540 California Adjustments Residents Instructions For Schedule CA 540 Calif with ease

- Find Instructions For Schedule CA 540 California Adjustments Residents Instructions For Schedule CA 540 Calif and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Decide how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Instructions For Schedule CA 540 California Adjustments Residents Instructions For Schedule CA 540 Calif to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 instructions for schedule ca 540 california adjustments residents 2016 instructions for schedule ca 540 california

Create this form in 5 minutes!

How to create an eSignature for the 2016 instructions for schedule ca 540 california adjustments residents 2016 instructions for schedule ca 540 california

How to make an eSignature for your 2016 Instructions For Schedule Ca 540 California Adjustments Residents 2016 Instructions For Schedule Ca 540 California online

How to make an electronic signature for the 2016 Instructions For Schedule Ca 540 California Adjustments Residents 2016 Instructions For Schedule Ca 540 California in Chrome

How to generate an eSignature for signing the 2016 Instructions For Schedule Ca 540 California Adjustments Residents 2016 Instructions For Schedule Ca 540 California in Gmail

How to create an electronic signature for the 2016 Instructions For Schedule Ca 540 California Adjustments Residents 2016 Instructions For Schedule Ca 540 California from your smartphone

How to generate an eSignature for the 2016 Instructions For Schedule Ca 540 California Adjustments Residents 2016 Instructions For Schedule Ca 540 California on iOS

How to generate an eSignature for the 2016 Instructions For Schedule Ca 540 California Adjustments Residents 2016 Instructions For Schedule Ca 540 California on Android devices

People also ask

-

What are the main features of the Instructions For Schedule CA 540 California Adjustments Residents?

The Instructions For Schedule CA 540 California Adjustments Residents include detailed guidelines on how to report state-specific income adjustments. It helps taxpayers understand which deductions, credits, and reporting methodologies apply specifically to California residents. With this knowledge, you can ensure your tax return is accurate and compliant with state regulations.

-

How can I access the Instructions For Schedule CA 540 California Adjustments Residents?

You can easily access the Instructions For Schedule CA 540 California Adjustments Residents online through the California Department of Tax and Fee Administration (CDTFA) website. Additionally, various tax preparation software packages also provide direct access to these instructions as part of their services. This allows taxpayers to find all the necessary information conveniently.

-

Are there any costs associated with obtaining the Instructions For Schedule CA 540 California Adjustments Residents?

The Instructions For Schedule CA 540 California Adjustments Residents are available to the public free of charge. However, if you choose to use professional tax services or software for preparation, those may incur costs. It's advisable to compare options to find a solution that fits your budget.

-

Can the Instructions For Schedule CA 540 California Adjustments Residents be used for electronic filing?

Yes, the Instructions For Schedule CA 540 California Adjustments Residents are compatible with electronic filing systems. Most e-filing platforms integrate these instructions directly, making it user-friendly for taxpayers. This allows for a smooth filing process while ensuring compliance with California's tax guidelines.

-

What benefits does following the Instructions For Schedule CA 540 California Adjustments Residents provide?

Following the Instructions For Schedule CA 540 California Adjustments Residents helps ensure that you maximize your deductions while minimizing the chance of an audit. By understanding and applying state-specific adjustments accurately, you can improve your tax outcomes. This guidance is crucial for making informed financial decisions for California residents.

-

Do the Instructions For Schedule CA 540 California Adjustments Residents cover non-resident taxpayers?

The Instructions For Schedule CA 540 California Adjustments Residents are specifically tailored for California residents and may not apply to non-resident taxpayers. Non-residents have different forms and instructions they must follow. Always consult the appropriate resources to ensure compliance based on your residency status.

-

Is there any support available for understanding the Instructions For Schedule CA 540 California Adjustments Residents?

Yes, various resources are available to help you understand the Instructions For Schedule CA 540 California Adjustments Residents. Many tax professionals, online forums, and customer support services from software providers offer assistance. These resources can clarify complex points and ensure you're making the right moves in your tax filing process.

Get more for Instructions For Schedule CA 540 California Adjustments Residents Instructions For Schedule CA 540 Calif

- Does quest do titers form

- Application for readmission university of kentucky form

- Hot work permit osha form

- Nps complete fill up format form for syndicate bank

- Bankers life independent caregivers form

- What is ppsp insurance form

- Cna healthpro medical practitioners application claims made coverage form

- Form 51 101f3 29309473

Find out other Instructions For Schedule CA 540 California Adjustments Residents Instructions For Schedule CA 540 Calif

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will