Instructions for Schedule CA 540FTB Ca Gov California 2021-2026

What is the Instructions for Schedule CA 540

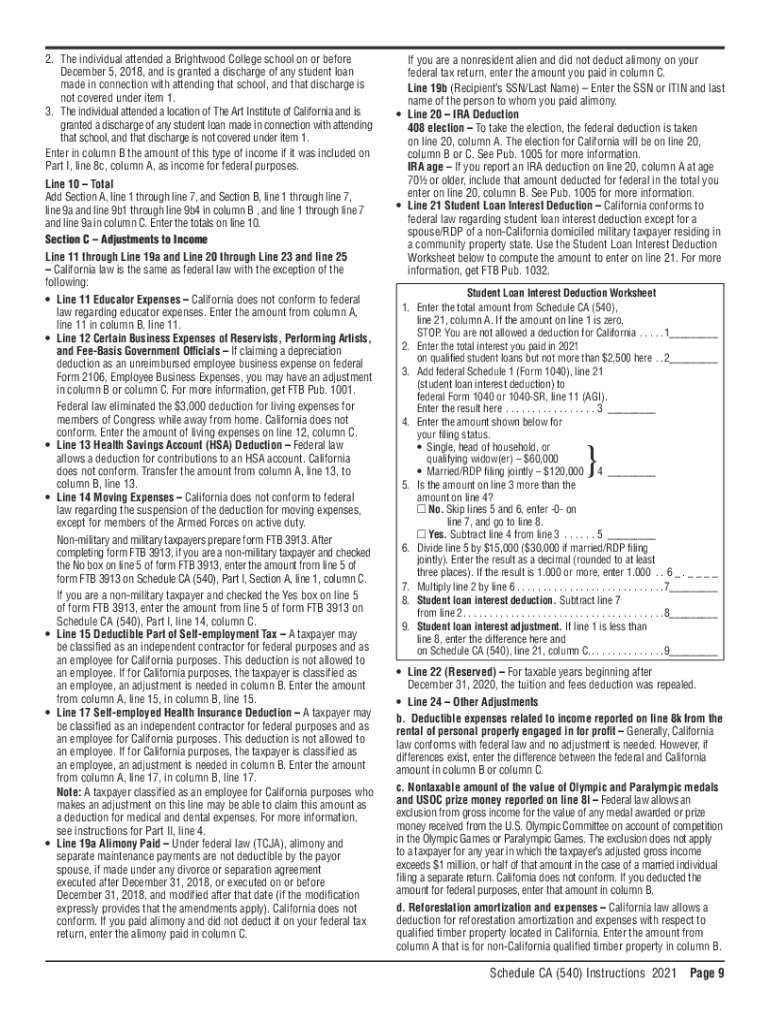

The Instructions for Schedule CA 540 provide essential guidance for California taxpayers who need to report their income and calculate their tax liabilities. This form is specifically designed for individuals filing their California income tax returns. It outlines the necessary steps and requirements to ensure compliance with state tax laws. Understanding these instructions is crucial for accurate and timely filing, as they detail how to report various types of income, deductions, and credits applicable to California residents.

Steps to Complete the Instructions for Schedule CA 540

Completing the Instructions for Schedule CA 540 involves several key steps:

- Gather all necessary documents, including W-2 forms, 1099s, and any other income statements.

- Review the instructions carefully to understand the specific requirements for your tax situation.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Double-check your calculations to avoid errors that could lead to penalties.

- Submit your completed Schedule CA 540 along with your California tax return by the designated deadline.

Legal Use of the Instructions for Schedule CA 540

The legal use of the Instructions for Schedule CA 540 is essential for ensuring that taxpayers comply with California tax laws. These instructions are recognized by the California Franchise Tax Board (FTB) as the official guidance for completing the form. Adhering to these instructions helps prevent issues such as audits, fines, or legal repercussions. It is important to follow the guidelines closely to maintain compliance with state regulations.

Required Documents for Schedule CA 540

When preparing to complete the Schedule CA 540, certain documents are required to ensure accurate reporting:

- W-2 forms from employers, detailing wages and taxes withheld.

- 1099 forms for any freelance or contract income received.

- Documentation for any deductions or credits claimed, such as mortgage interest statements or medical expense receipts.

- Previous year’s tax return for reference and consistency in reporting.

Filing Deadlines for Schedule CA 540

Filing deadlines for Schedule CA 540 are crucial for taxpayers to keep in mind. Typically, the deadline to file your California tax return, including Schedule CA 540, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, allowing for additional time to file without incurring penalties.

Form Submission Methods for Schedule CA 540

Taxpayers have several options for submitting their Schedule CA 540:

- Online submission through the California Franchise Tax Board's e-file system, which is the fastest and most efficient method.

- Mailing a paper form to the appropriate address provided in the instructions, which may take longer to process.

- In-person submission at designated tax offices, which can provide immediate assistance if needed.

Examples of Using the Instructions for Schedule CA 540

Examples of using the Instructions for Schedule CA 540 can help clarify how to apply the guidelines effectively. For instance, if a taxpayer is self-employed, they would refer to specific sections of the instructions that address reporting business income and expenses. Similarly, a taxpayer claiming deductions for education expenses would find relevant guidance on how to report those amounts accurately. These examples illustrate the versatility of the instructions in accommodating various taxpayer scenarios.

Quick guide on how to complete 2021 instructions for schedule ca 540ftbcagov california

Complete Instructions For Schedule CA 540FTB ca gov California effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your papers quickly without delays. Manage Instructions For Schedule CA 540FTB ca gov California on any device using airSlate SignNow's Android or iOS apps and ease any document-related tasks today.

How to modify and eSign Instructions For Schedule CA 540FTB ca gov California with ease

- Obtain Instructions For Schedule CA 540FTB ca gov California and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Instructions For Schedule CA 540FTB ca gov California and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 instructions for schedule ca 540ftbcagov california

Create this form in 5 minutes!

People also ask

-

What are the 'ca adjustments instructions 2023' in airSlate SignNow?

The 'ca adjustments instructions 2023' refer to the guidelines provided by airSlate SignNow for California-specific adjustments to eSigning processes. These instructions ensure compliance with state regulations and help users manage their documents effectively. Familiarizing yourself with these guidelines is essential for a seamless signing experience.

-

How can I find the latest 'ca adjustments instructions 2023'?

You can find the latest 'ca adjustments instructions 2023' directly on the airSlate SignNow support page or within the help center. We continuously update these instructions based on regulatory changes and user feedback, ensuring you have access to the most current information. Check back regularly to stay informed about any updates.

-

Are there costs associated with following the 'ca adjustments instructions 2023'?

There are no additional costs to follow the 'ca adjustments instructions 2023' when using airSlate SignNow. Our platform provides free access to updates and guidelines, ensuring that all users can benefit from compliant eSigning. This helps businesses save money while adhering to California regulations.

-

What features does airSlate SignNow offer for compliance with 'ca adjustments instructions 2023'?

airSlate SignNow offers a variety of features designed to ensure compliance with the 'ca adjustments instructions 2023'. These include customizable templates, audit trails, and legally binding signatures. These tools empower businesses to manage their document workflows confidently and in accordance with state laws.

-

How do the 'ca adjustments instructions 2023' benefit businesses?

The 'ca adjustments instructions 2023' help businesses streamline their document signing processes while maintaining compliance with state regulations. By implementing these instructions, companies reduce the risk of legal issues and foster confidence among customers. This ultimately leads to faster transactions and improved customer satisfaction.

-

Can airSlate SignNow integrate with other tools while using the 'ca adjustments instructions 2023'?

Yes, airSlate SignNow seamlessly integrates with various business applications, even when adhering to the 'ca adjustments instructions 2023'. This integration capability allows businesses to automate workflows and enhance productivity. Utilizing these features helps users manage their documents efficiently while staying compliant.

-

What support does airSlate SignNow provide for 'ca adjustments instructions 2023'?

airSlate SignNow provides dedicated support to help users navigate the 'ca adjustments instructions 2023'. Our support team is available to answer questions and provide assistance with document compliance. Customers can access various resources, including tutorials and FAQs, to ensure they understand and implement these instructions correctly.

Get more for Instructions For Schedule CA 540FTB ca gov California

- New york contract sample form

- Renovation contract for contractor new york form

- Concrete mason contract for contractor new york form

- Demolition contract for contractor new york form

- Framing contract for contractor new york form

- New york contract form

- New york contract ny form

- Paving contract for contractor new york form

Find out other Instructions For Schedule CA 540FTB ca gov California

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word