P11D Expenses and Benefits 14 Use Form P11D at the End of the Tax Year to Report Expenses and Benefits Youve Provided to Company 2014

What is the P11D Expenses and Benefits Form?

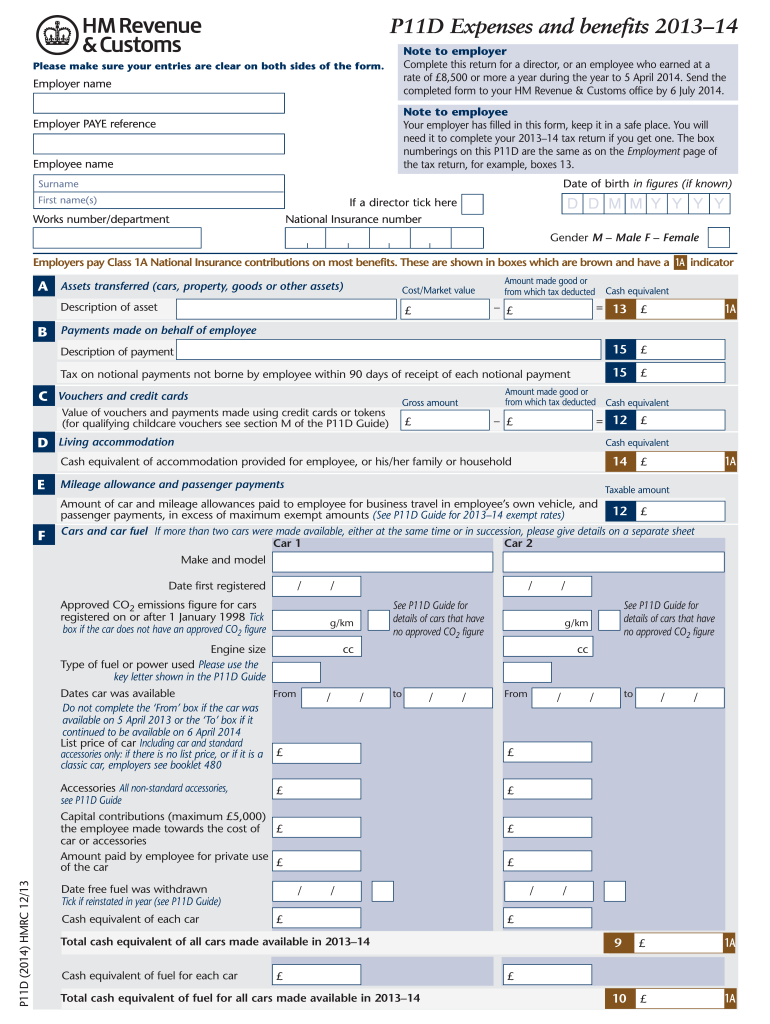

The P11D Expenses and Benefits form is a document used at the end of the tax year to report expenses and benefits provided to company directors or to employees earning at least $8,500 annually. This form is essential for ensuring compliance with tax regulations, as it helps the Internal Revenue Service (IRS) track non-cash benefits that may affect an employee's taxable income. The information reported on the P11D can include items such as company cars, health insurance, and other perks that contribute to an employee's overall compensation package.

Steps to Complete the P11D Expenses and Benefits Form

Completing the P11D form involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the expenses and benefits provided to employees. This includes identifying the types of benefits offered and their monetary value. Next, fill out the form with the relevant details, ensuring that all information is accurate and complete. After filling out the form, review it for any errors or omissions before submission. Finally, submit the completed P11D to the appropriate tax authority by the specified deadline.

Legal Use of the P11D Expenses and Benefits Form

The P11D form is legally binding and must be completed in accordance with IRS guidelines. It is crucial for employers to accurately report all benefits provided to employees, as failure to do so can result in penalties or audits. The form serves as an official record of non-cash benefits, and it is important to maintain compliance with tax laws to avoid legal repercussions. Employers should ensure that they are familiar with the relevant regulations governing the use of this form.

Filing Deadlines for the P11D Expenses and Benefits Form

Filing deadlines for the P11D form are critical to avoid late penalties. Typically, the form must be submitted by July 6 following the end of the tax year. It is essential for employers to keep track of these deadlines to ensure timely submission. Additionally, employers should be aware of any changes to deadlines that may occur due to new tax regulations or updates from the IRS.

Examples of Using the P11D Expenses and Benefits Form

Employers may use the P11D form to report various types of benefits provided to employees. For instance, if a company provides a vehicle for personal use, the value of that benefit must be reported on the form. Similarly, if an employee receives health insurance coverage, the cost of that coverage should also be included. These examples illustrate the importance of accurately reporting all benefits to ensure compliance with tax laws.

Required Documents for the P11D Expenses and Benefits Form

To complete the P11D form, employers should gather several key documents. These may include records of all expenses and benefits provided to employees, such as invoices, receipts, and payroll records. Additionally, any agreements or contracts related to employee benefits should be reviewed to ensure accurate reporting. Having these documents on hand will facilitate the completion of the form and help ensure compliance with legal requirements.

Digital vs. Paper Version of the P11D Expenses and Benefits Form

Employers have the option to complete the P11D form either digitally or on paper. The digital version offers advantages such as ease of use, faster submission, and reduced risk of errors. Digital forms can be filled out and submitted electronically, which streamlines the process significantly. On the other hand, some employers may prefer the traditional paper method. Regardless of the format chosen, it is important to ensure that all information is accurately reported and submitted by the deadline.

Quick guide on how to complete p11d 2014 expenses and benefits 2013 14 use form p11d at the end of the tax year to report expenses and benefits youve provided

Effortlessly Prepare P11D Expenses And Benefits 14 Use Form P11D At The End Of The Tax Year To Report Expenses And Benefits Youve Provided To Company on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly and without interruptions. Manage P11D Expenses And Benefits 14 Use Form P11D At The End Of The Tax Year To Report Expenses And Benefits Youve Provided To Company on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign P11D Expenses And Benefits 14 Use Form P11D At The End Of The Tax Year To Report Expenses And Benefits Youve Provided To Company Seamlessly

- Obtain P11D Expenses And Benefits 14 Use Form P11D At The End Of The Tax Year To Report Expenses And Benefits Youve Provided To Company and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click the Done button to save your progress.

- Choose how you wish to deliver your form, either via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign P11D Expenses And Benefits 14 Use Form P11D At The End Of The Tax Year To Report Expenses And Benefits Youve Provided To Company and ensure outstanding communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct p11d 2014 expenses and benefits 2013 14 use form p11d at the end of the tax year to report expenses and benefits youve provided

Create this form in 5 minutes!

How to create an eSignature for the p11d 2014 expenses and benefits 2013 14 use form p11d at the end of the tax year to report expenses and benefits youve provided

The way to generate an eSignature for your PDF file online

The way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What are P11D Expenses and Benefits?

P11D Expenses And Benefits 14 Use Form P11D At The End Of The Tax Year To Report Expenses And Benefits You've Provided To Company Directors Or To Employees Earning At A Rate Of 8500 Or More A Year Sussexpayrollservices Co. This form allows employers to detail the taxable benefits given to their employees, ensuring compliance with tax regulations.

-

Who needs to fill out a P11D form?

Any employer who provides benefits to directors or employees earning £8,500 or more annually must submit Form P11D. P11D Expenses And Benefits 14 Use Form P11D At The End Of The Tax Year To Report Expenses And Benefits You’ve Provided To Company Directors Or To Employees Earning At A Rate Of 8500 Or More A Year Sussexpayrollservices Co. It's essential for proper tax reporting and compliance.

-

What types of benefits must be reported on the P11D form?

The P11D form covers a variety of benefits including company cars, health insurance, and travel expenses. Employers must use P11D Expenses And Benefits 14 Use Form P11D At The End Of The Tax Year To Report Expenses And Benefits You've Provided To Company Directors Or To Employees Earning At A Rate Of 8500 Or More A Year Sussexpayrollservices Co. All relevant benefits should be reported to avoid penalties.

-

How does airSlate SignNow simplify the P11D reporting process?

airSlate SignNow provides a streamlined solution for managing and reporting P11D information. With features tailored for efficiency, you can easily eSign and send necessary documents. P11D Expenses And Benefits 14 Use Form P11D At The End Of The Tax Year To Report Expenses And Benefits You've Provided To Company Directors Or To Employees Earning At A Rate Of 8500 Or More A Year Sussexpayrollservices Co. This reduces administrative burdens and enhances compliance.

-

Is there a cost associated with using airSlate SignNow for P11D forms?

Yes, airSlate SignNow offers pricing plans that cater to various business needs, providing tools to manage P11D submissions effectively. P11D Expenses And Benefits 14 Use Form P11D At The End Of The Tax Year To Report Expenses And Benefits You've Provided To Company Directors Or To Employees Earning At A Rate Of 8500 Or More A Year Sussexpayrollservices Co. These plans are designed to be cost-effective while ensuring compliance and ease of use.

-

Can I integrate airSlate SignNow with my existing payroll systems?

Absolutely! airSlate SignNow offers integrations with many popular payroll systems, making it easier to manage P11D reporting. P11D Expenses And Benefits 14 Use Form P11D At The End Of The Tax Year To Report Expenses And Benefits You've Provided To Company Directors Or To Employees Earning At A Rate Of 8500 Or More A Year Sussexpayrollservices Co. This ensures consistency and accuracy across your financial reporting.

-

What are the deadlines for submitting the P11D form?

Employers must submit the P11D form by July 6 following the end of the tax year. P11D Expenses And Benefits 14 Use Form P11D At The End Of The Tax Year To Report Expenses And Benefits You've Provided To Company Directors Or To Employees Earning At A Rate Of 8500 Or More A Year Sussexpayrollservices Co. It’s vital to adhere to these deadlines to avoid penalties and ensure compliance.

Get more for P11D Expenses And Benefits 14 Use Form P11D At The End Of The Tax Year To Report Expenses And Benefits Youve Provided To Company

- Ds 3179 sandiego form

- Ds 3179 form

- Mch 12 form

- Ihaveconfirmedthattheinstallationcertificatesfortheconstructioninstallationidentifiedonthisformhasbeencompletedandis energy ca

- Mech 3a constant volume single zone unitary ac and heat energy ca form

- Mech 3a form

- 41 nc form

- Chsi how to obtain certified copies of marriage records 2016 form

Find out other P11D Expenses And Benefits 14 Use Form P11D At The End Of The Tax Year To Report Expenses And Benefits Youve Provided To Company

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document