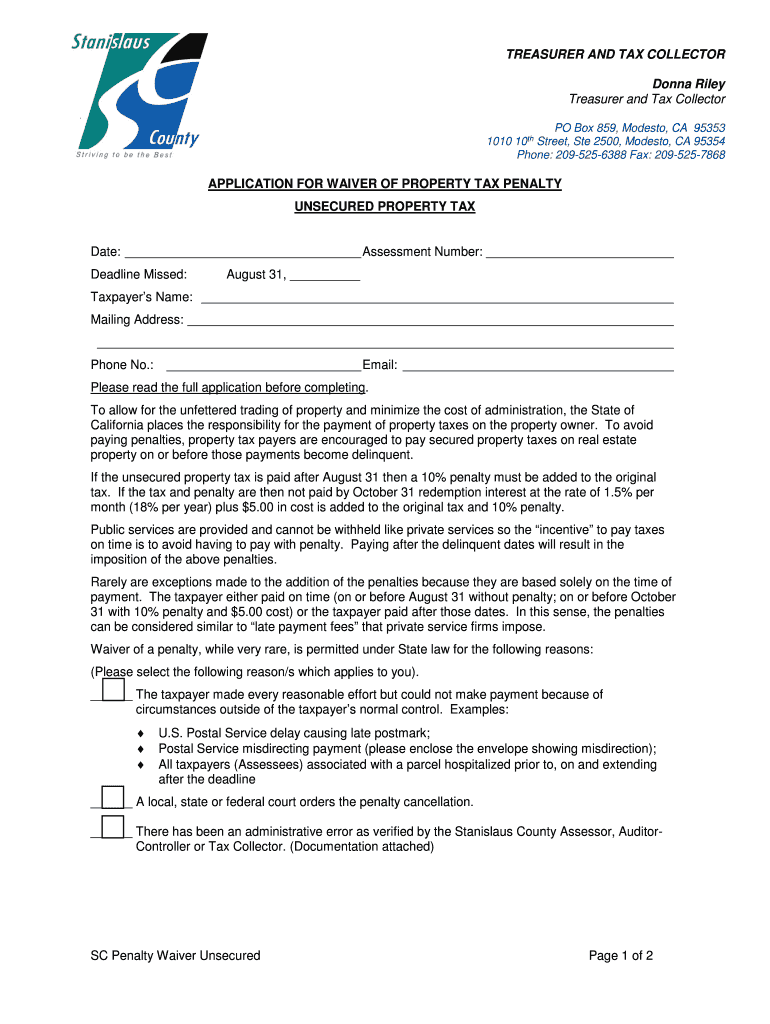

APPLICATION for WAIVER of PROPERTY TAX PENALTY UNSECURED PROPERTY TAX APPLICATION for WAIVER of PROPERTY TAX PENALTY UNSECURED P Form

Understanding the application for waiver of penalty

The application for waiver of penalty is a formal request submitted to a governing body, typically related to property tax, seeking relief from penalties imposed for late payment or non-compliance. This application is crucial for individuals and businesses who may have faced financial hardships or unforeseen circumstances that prevented timely payments. By filing this application, taxpayers can potentially reduce or eliminate penalties, allowing them to manage their financial obligations more effectively.

Steps to complete the application for waiver of penalty

Completing the application for waiver of penalty involves several key steps to ensure accuracy and compliance. Begin by gathering necessary documentation, such as proof of income, tax statements, and any relevant correspondence from tax authorities. Next, fill out the application form carefully, providing all required information, including your personal details and reasons for requesting the waiver. After completing the form, review it for any errors or omissions before submitting it to the appropriate tax authority. Ensure that you keep a copy of the application for your records.

Required documents for the application for waiver of penalty

When submitting the application for waiver of penalty, certain documents may be required to support your request. Commonly required documents include:

- Proof of income, such as recent pay stubs or tax returns

- Documentation of any financial hardships, such as medical bills or job loss letters

- Previous correspondence with the tax authority regarding your account

- Any additional forms or statements as specified by the tax authority

Providing comprehensive documentation can strengthen your case for a waiver and facilitate a smoother review process.

Eligibility criteria for the application for waiver of penalty

Eligibility for a waiver of penalty typically depends on specific criteria set by the tax authority. Common factors include:

- Demonstrating a valid reason for late payment, such as illness or financial crisis

- Maintaining a history of timely payments prior to the incident

- Providing evidence of efforts made to resolve the outstanding tax obligations

Understanding these criteria can help you prepare a more compelling application and increase your chances of approval.

Form submission methods for the application for waiver of penalty

The application for waiver of penalty can usually be submitted through various methods, depending on the policies of the tax authority. Common submission methods include:

- Online submission via the tax authority's official website

- Mailing a physical copy of the application to the designated office

- In-person submission at local tax offices during business hours

Choosing the appropriate method can ensure that your application is received promptly and processed without delays.

Approval time for the application for waiver of penalty

The approval time for the application for waiver of penalty can vary based on the tax authority's workload and the complexity of your case. Generally, applicants can expect a response within a few weeks to several months. It is advisable to check the tax authority's website or contact them directly for specific timelines related to your application. Keeping track of your submission and following up can help ensure that your request is processed in a timely manner.

Quick guide on how to complete application for waiver of property tax penalty unsecured property tax application for waiver of property tax penalty unsecured

Easily Prepare APPLICATION FOR WAIVER OF PROPERTY TAX PENALTY UNSECURED PROPERTY TAX APPLICATION FOR WAIVER OF PROPERTY TAX PENALTY UNSECURED P on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle APPLICATION FOR WAIVER OF PROPERTY TAX PENALTY UNSECURED PROPERTY TAX APPLICATION FOR WAIVER OF PROPERTY TAX PENALTY UNSECURED P on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Simplest Way to Modify and eSign APPLICATION FOR WAIVER OF PROPERTY TAX PENALTY UNSECURED PROPERTY TAX APPLICATION FOR WAIVER OF PROPERTY TAX PENALTY UNSECURED P Effortlessly

- Locate APPLICATION FOR WAIVER OF PROPERTY TAX PENALTY UNSECURED PROPERTY TAX APPLICATION FOR WAIVER OF PROPERTY TAX PENALTY UNSECURED P and select Get Form to begin.

- Utilize the tools we provide to send your document.

- Mark pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate creating new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign APPLICATION FOR WAIVER OF PROPERTY TAX PENALTY UNSECURED PROPERTY TAX APPLICATION FOR WAIVER OF PROPERTY TAX PENALTY UNSECURED P while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for waiver of property tax penalty unsecured property tax application for waiver of property tax penalty unsecured

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the application for waiver of penalty?

The application for waiver of penalty is a formal request submitted to an authority to reduce or eliminate penalties incurred due to late submissions or non-compliance. This document is essential for individuals and businesses looking to resolve outstanding penalties efficiently. Utilizing eSignature solutions like airSlate SignNow can streamline this process.

-

How does airSlate SignNow help with the application for waiver of penalty?

airSlate SignNow simplifies the process of submitting your application for waiver of penalty by allowing you to create, send, and eSign documents quickly. Our platform ensures that your application is completed accurately, reducing the chances of rejection. This efficiency can save you time and help avoid further penalties.

-

What are the pricing options for using airSlate SignNow for my application for waiver of penalty?

airSlate SignNow offers various pricing tiers designed to fit different business needs, making it cost-effective for handling documentation like the application for waiver of penalty. Each plan provides varying features, enabling you to choose the best fit for your budget. You can check our website for detailed pricing information and promotions.

-

Are there any features specifically beneficial for creating an application for waiver of penalty?

Yes, airSlate SignNow includes features like customizable templates, robust eSigning capabilities, and document tracking, all of which are beneficial for creating an application for waiver of penalty. These tools ensure that your application is professional, compliant, and easily accessible. Additionally, you can track status and reminders for follow-up.

-

Can I integrate airSlate SignNow with other applications for my application for waiver of penalty?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, enhancing your workflow for processes like the application for waiver of penalty. This includes CRM systems, cloud storage solutions, and more. These integrations can help centralize your document management and reduce manual errors.

-

Is airSlate SignNow secure when dealing with the application for waiver of penalty?

Yes, airSlate SignNow prioritizes security for all documents, including the application for waiver of penalty. Our platform employs advanced encryption and compliance measures to ensure that all data remains confidential and protected. You can trust that your sensitive information is in safe hands when using our services.

-

How can I ensure my application for waiver of penalty is approved?

To increase the likelihood of approving your application for waiver of penalty, ensure that all information is accurate and complete before submission. Utilizing airSlate SignNow’s templates can help you avoid common mistakes. Additionally, consider including supporting documentation that clearly outlines your circumstances.

Get more for APPLICATION FOR WAIVER OF PROPERTY TAX PENALTY UNSECURED PROPERTY TAX APPLICATION FOR WAIVER OF PROPERTY TAX PENALTY UNSECURED P

- History of illinois dui laws illinois secretary of state form

- Waiver of fees for disaster victims illinois secretary of state form

- Il governmental form

- Letter consignment form

- Illinois disclosure living form

- Illinois veterans history project veteranamp39s fact sheet form

- Il capacitar form

- Irp summary for registration year cyberdrive illinois form

Find out other APPLICATION FOR WAIVER OF PROPERTY TAX PENALTY UNSECURED PROPERTY TAX APPLICATION FOR WAIVER OF PROPERTY TAX PENALTY UNSECURED P

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile